PAN Form 49AA: As everybody knows that PAN means Permanent Account Number [PAN]. It is a type of a government legal document that is used in all income tax department or government subsidies. It is also known as an income-earning medium for all individuals and non-individuals. It has become an important document for all people of India as it was announced by the government of India. So, this PAN Card Form 49AA is a type of an application form for all people inside or outside India. Anyone who knows the internet medium very accurately, they can download Pan Form 49AA through online by just sitting at their homes. NSDL or UTIITSL is the government websites from where you can download, apply, or submit your application forms online. Let us tell you all that this form requires KYC which was done with the help of a Qualified Overseas Investor, Overseas Institutional Investor as per the government rules & regulations. These rules are covered under the SEBI [Securities and Exchange Board Of India].

Along with this, let us tell you all that every overseas applicant is also eligible for making a PAN Card by using PAN Form 49AA online. This form is a type of an application form that was provided for making a PAN Card. It is denoted as a Permanent Account Number for overseas citizens. It is important for every applicant to just have to fill this form along with all important documents as asked in the form. Everyone can download their PAN Card Application Form 49AA from NSDL or UTIITL online website. So, Here in this article, we will provide you all information related to the PAN Card Form 49AA, its framework, the process of filling, and different modules related to PAN Form 49AA.

| Topic Name | PAN Card Application Form 49AA: Modules & Framework |

| Article Category | The Framework of Form 49AA Different Modules of Form 49AA Process of filling PAN Card Form 49AA Submit Online Printed PAN Card Form 49AA Frequently Asked Questions |

| Download PAN Form 49AA | Click Here |

The Framework of Form 49AA

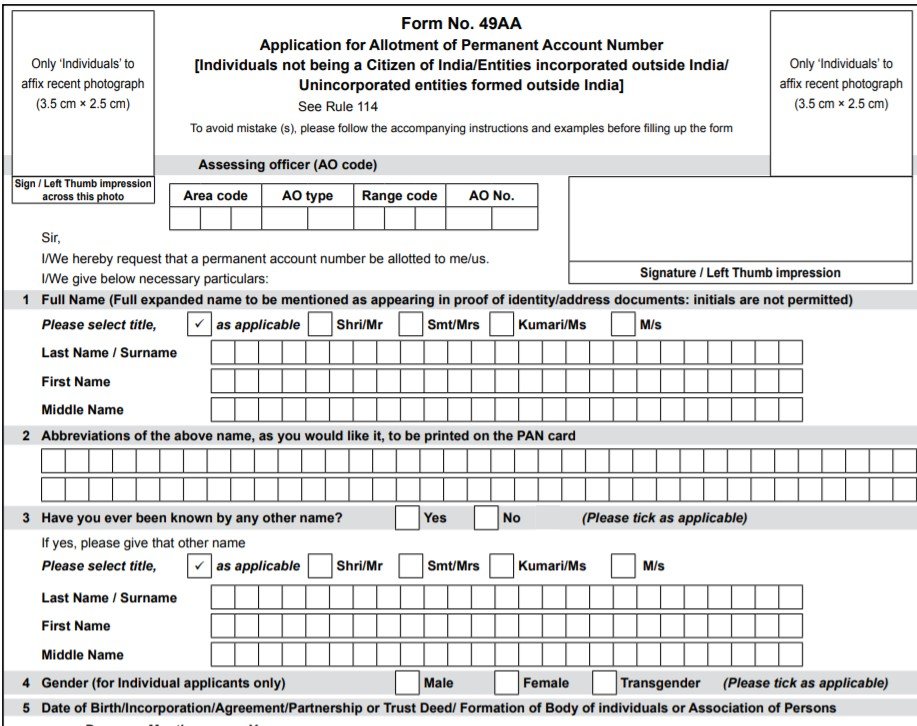

Here we discuss the various framework of form 49AA. As you already know that this Form 49AA has broadly part into various types of sections along with a number of subsections. Due to these subsections, it will make an easier for all to easily fill an application form. In this form, there will be provided a space for all asked queries. Let us tell you that this form has divided into around 17 parts, with every part has given a particular unique meaning.

Also, Get to Know More about Other Form

Different Modules of Form 49AA

Here we will discuss the different types of modules that should exist in a PAN Card Form 49AA. Modules of form 49AA are given as follows:

- Code of Assessing Officer: In this module of the form, all applicants need to fill the code of their area, Range code, Type of Account Office, and Number of Account Office.

- Name Abbreviation: It is important for every applicant to mention or include their abbreviated name as it is shown in your PAN Card.

- Full Name: In this section, every applicant can include a particular person’s first name, last name, marital status, and Surname.

- Gender: In this section, it includes the information of an applicant related to their gender.

- Other Name: In this section, If an applicant has to call by their other name then it is a mandatory task for them to mention another name in your PAN Card. Again, you have to fill all other details such as First name, Middle name, Last name, and Surname.

- Name of Father: In this section, every applicant has to fill his or her name of a father such as First name, Middle Name, Last Name, and surname of the father. It is appropriate for every individual candidate including all wedded women.

- Birth Date: In this section, if any applicant belongs to an individual, they have to fill or include the birth date. But, If an applicant belongs to particular organizations or company then they have to fill all the details of their company partnership, incorporation, Trust Deed, and Agreement.

- Address: In this section, every applicant needs to enter their permanent home address as well as their office address also. It always should be very correct.

- Email ID and Telephone Number: In this section, every applicant has to include all details of their country code, state telephone/ mobile number, or Email ID.

- Status of Application: In this section, it is important for every applicant to provide details of their category such as HUF member, Partnership, Firm, Individual, and Company.

- Communication Adress: In this section, it is important for every applicant has to select a communication address from both the Office and residence addresses.

- Registration Number: In this section, it includes information related to the company or organization registration number.

- Required Documents: In this, all applicants should have to submit his or her important document as asked in the form.

- Information of KYC: In this section of the form, includes information like marital status, citizenship, details of occupation, and many more. Along with this, let us tell you all that these details should be submitted by the respective Overseas Investor as per the provided rules & regulations of our government.

- Citizenship: In this section, every applicant has to mention all details related to the overseas citizenship & ISD code of a particular country.

- Citizen of India: In this section, every applicant has to mention all details related to the representative agent that includes their name and address.

Process of filling PAN Card Form 49AA

Here we will discuss the process of filling a PAN Card Form 49AA. As we know that there are many rules & regulations that should follow during form 49AA filling. It only seems that it has to be done very accurately, but not like that. If you done any mistake while filing, then your application form would get rejected. Follow all given below steps while applying for a PAN Card. Steps are:

- Basic Guidelines & Language: It is important for every applicant to get fill their form in English Language only, As It is mandatory. If anybody can use another language, then their filled form should get rejected or cannot be filled. Write all details in the given form in block letters and use only black ink. There is provided a box in which you have to fill a single letter over there and after every one letter leaves one box empty. It is for all applicants to just avoid using liquid ink pens as it looks so splotchy. For good writing, use only ballpoint pens.

- Photograph: It is important for every applicant to paste their latest photograph on the given space. Let us tell you all that photographs should not be stapled or clipped. Because it must be shown exactly the same as it looks on the PAN Card. Along with this, it is also important to paste a photograph with full clarity. So, it is mandatory to paste a good quality photograph.

- Signature on the Photograph: In this, when you will paste your photograph then you must do sign on it or left-hand thumb impression on it. Every applicant should paste a photograph on the given box in the form, as well as put a signature on the given box.

- Contact Information: In this, every applicant has to fill their all contact information in the given form. While filling a residence address, it is mandatory for all to fill all details such as city, town, district, state, and Pin code. Along with this, it is also a mandatory task for you all to fill STD code, Zip code, ISD code for a given phone number.

- Proper Information: In this, every applicant has to fill all information very accurate. It is a mandatory task for everyone to get fill his or her form very accurately. Incorrect information results in a rejection of an application form.

- Full information of AO code: In this, every applicant has to fill all information related to their areas such as code of the area, Range code, number of AO, and type of AO. Every applicant has got these details from the desired Income Tax Office or any available PAN Centers.

Submit Online Printed PAN Card Form 49AA

Here you will get to know the details of a PAN Card form from where it will be submitted. When you fill a form properly, then you have to submit it to the particular PAN Card office for further proceedings. This procedure can be done with all the important documents. Everyone has to visit NSDL or UTIITSL office for the submission of a PAN Card. If you want to acknowledge your application form at NSDL Office, then send it to the below address:

PAN Card Income Tax Services Unit,

NSDL e-Governance Infrastructure Limited,

Fifth Floor, Mantri Sterling,

Plot Number 341, Survey Number 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune: 411016

If anyone candidate wants to acknowledge his or her PAN [Permanent Account Number] from the UTIITSL website, then they have to send their application form to the given below address. The address was given as:

PAN Incharge PDC of Mumbai Locality

- UTI Infrastructure Tech. & Services Ltd, Plot Number 3, Sector 11, CBD Belapur, Navi Mumbai, 400614

PAN Incharge PDC of Kolkata Locality

- UTI Infrastructure Tech. & Services Ltd, 29, N. S. Road, Ground Floor, Opposite Gilander House & Standard Chartered Bank, Kolkata, 700001

PAN Incharge PDC of Chennai Locality

- UTI Infrastructure Tech. & Services Ltd, D-1, 1st Floor, Thiru-Vi-Ka Industrial Estate, Guindy, Chennai, 600032

PAN Incharge PDC of New Delhi Locality

- UTI Infrastructure Tech. & Services Ltd, 1/28 Sunlight Building, Asaf Ali Road, New Delhi, 110002

Important Documents for filing Form 49AA

Here we will discuss all the important documents while applying for a PAN Card 49AA. Let us tell you all that every resident who is living outside India or you say overseas have a need to submit all important papers with Form 49AA as proof of their identity and address. All important documents are given below:

Identity Proof Documents:

- Applicant Passport

- Applicant Driving license

- Arm’s license of an applicant

- Applicant Aadhaar card

- Applicant Bank Details

- Applicant Identity proof photo that governed by the government of India

- Applicant Pension Card along with a photo

Resident Proof Documents:

- Applicant residence Electricity bill

- Applicant Aadhaar Card

- Landline Bill

- Water Bill

- Applicant Passport

- Broadband Connection Bill

- Consumer Gas Connection Bill

- Applicant Bank Account Statement

- Depository Bank Account detail

- Domicile Certificate governed by the government

- Post Office Passbook

I hope you will understand this article very well and are ready to take benefit from it. If you are facing any problems related to the meaning of a PAN Card Form, Different modules of Form 49AA, and Process of filling a PAN Card Form 49AA then you may ask your queries in the given comment box.

Frequently Asked Questions

What do you understand by the term PAN Card Form 49AA?

It is a type of PAN Card Application Form that is used for applying for a PAN Card. This form is used by all Indian and Overseas citizens. This form can be used to update or edit all details of a citizen.

In which language could I fill this PAN Card Application Form 49AA?

While filling the PAN Card Application Form 49AA, every applicant has to use only the English language. It is a mandatory language. If an applicant uses another language, then his or her application form would get rejected.

Name all payment options that would be available for payment while applying for a PAN Card?

Every applicant needs to do payment with the help of the following payment options as Credit Card, UPI, Internet Banking, and Debit Card.