When it comes to investing your hard-earned money, the options can be overwhelming. You may hear advice like maxing out your employer’s 401(k), taking advantage of high-interest bonds, or diving into real estate for generational wealth. While there are numerous investment avenues, it’s crucial to follow a well-structured plan to set yourself up for financial success. In this guide, we’ll outline the perfect order for how to invest money to ensure a secure and prosperous future.

Step 1: Build Your Rainy Day Fund

Before you even think about investing, it’s imperative to establish a solid financial foundation. Start by creating an emergency fund that covers at least six months’ worth of living expenses. The amount you need will vary depending on your cost of living. Some may require $1,000, while others may need $10,000 or more, To Save Money easily You can Take a Challenge for 10k In 100 Days

Store this fund in a checking or high-yield savings account for quick and easy access. Having a rainy day fund serves several purposes:

Emotional Stability: It reduces anxiety and fear associated with investment volatility. Knowing you have a safety net allows you to make rational decisions during market downturns.

Protection During Recessions: In times of economic turmoil and layoffs, your emergency fund will help cover bills and living expenses while you search for new job opportunities.

Step 2: Pay Off High-Interest Debt

High-interest debt can be a significant roadblock to financial growth. With the average credit card interest rate hovering around 19.44%, it’s essential to prioritize debt reduction before investing. Here’s why:

Higher Interest Rates: You’re likely paying more in interest on your debt than you could earn from investments. For instance, if you’re paying a 20% interest rate on your debt, any investment returns may be negated.

Psychological Freedom: Paying off debt brings peace of mind and emotional relief. It enables you to focus on investing without the stress of looming financial obligations.

Improved Credit Score: Reducing debt positively impacts your credit score, helping fix a bad credit score and opening doors to better-borrowing terms and investment opportunities.

Consider two debt reduction strategies: tackling the highest-interest debt first or using the snowball method, starting with the smallest balance and gaining momentum as you pay off debts.

Step 3: Leverage Your Employer’s 401(k) Match

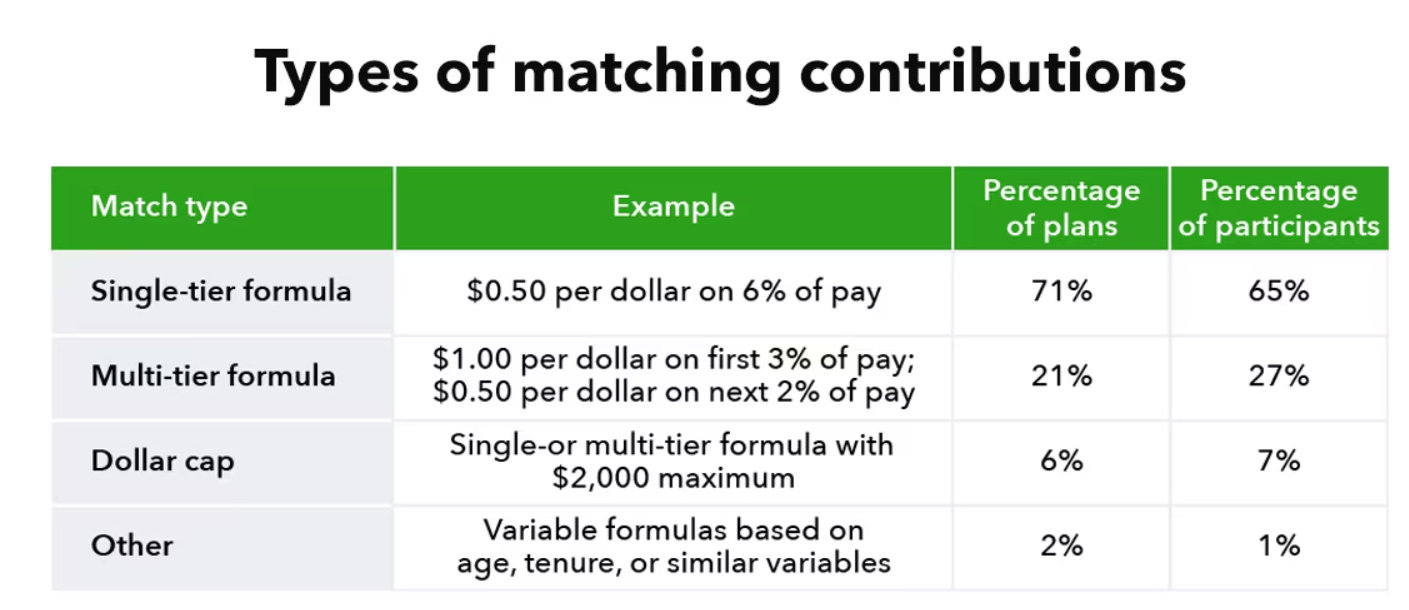

If your employer offers a 401(k) plan with a matching contribution, seize this opportunity. A 401(k) match is like free money. For example, if you earn $60,000 per year, and your employer matches 3% of your annual income, that’s an extra $1,800 per year contributed to your retirement account. Even if there are specific terms or vesting periods, it’s a valuable benefit worth exploring.

Step 4: Embrace the Roth IRA

Roth IRAs are powerful tax-efficient investment accounts that often go underutilized. Contributions are made with after-tax dollars, but all growth is tax-free. This makes them ideal for those expecting higher income in retirement.

For 2023, the maximum annual contribution is $6,500 (or $7,500 if you’re 50 or older). Roth IRAs come with some withdrawal requirements, but they offer tax advantages and flexibility in retirement planning.

Step 5: Explore Tax-Efficient Investment Accounts

Before jumping into regular taxable investment accounts, ensure you’ve maximized tax-advantaged options like 401(k)s and Roth IRAs. These accounts provide significant tax benefits, and your investments can grow more efficiently within them.

Once you’ve exhausted these options, consider a diverse range of investments such as stocks, bonds, ETFs, indexes, or cryptocurrencies based on your risk tolerance and financial goals. Remember that market downturns can provide opportunities for dollar-cost averaging.

Step 6: Realize Your Real Estate Aspirations

Real estate can be a cornerstone of generational wealth. It offers predictable cash flow, appreciation, tax benefits, and portfolio diversification. Whether you invest directly in properties or through publicly traded REITs (Real Estate Investment Trusts), real estate can be a vital component of your portfolio.

Conclusion

By following this perfect order for investing your money, you’ll be positioning yourself for financial success and a secure future. Building a solid financial foundation, eliminating high-interest debt, taking advantage of employer benefits, utilizing tax-efficient accounts, and exploring various investments can pave the way to financial freedom. Take control of your financial destiny and start building your wealth today.

Frequently Asked Questions

What is the first step to start investing money?

The first step is to assess your financial goals and risk tolerance. Determine why you want to invest, how much you can invest, and how comfortable you are with potential investment risks.

Where can I invest my money?

You can invest your money in various assets, including stocks, bonds, real estate, mutual funds, exchange-traded funds (ETFs), retirement accounts like 401(k)s and IRAs, and even alternative investments like cryptocurrencies or commodities.

How do I choose the right investment for me?

Your choice of investment should align with your financial goals and risk tolerance. Consider factors such as your investment horizon, income, and how much risk you can tolerate. Diversifying your investments can also help manage risk.

What are the key differences between stocks and bonds?

Stocks represent ownership in a company and offer the potential for capital appreciation and dividends. Bonds are debt securities issued by entities and provide regular interest payments and the return of the principal amount at maturity. Stocks tend to be riskier but offer higher potential returns, while bonds are generally considered safer.

Is it better to invest in individual stocks or mutual funds/ETFs?

It depends on your preferences and risk tolerance. Investing in individual stocks requires more research and carries higher risks, but it can offer potentially higher returns. Mutual funds and ETFs provide diversification and are suitable for those seeking a more hands-off approach to investing.