If you’re considering buying a home and have an annual income of fifty thousand dollars, you might be wondering just how much home you can afford. Interest rates play a significant role in determining your monthly mortgage payment, and they can fluctuate. You might also be concerned about how your credit score, down payment, and debt-to-income ratio affect your eligibility for a mortgage. In this comprehensive guide, we will explore FHA loan requirements and calculate different payment scenarios using various interest rates. By the end of this article, you’ll have a better understanding of how FHA loans work and how much home you can afford under different circumstances.

Understanding FHA Loans

FHA, or the Federal Housing Administration, offers loans that are known for their flexibility when it comes to credit scores, down payments, and debt-to-income ratios. If you’re considering FHA loan requirements, it’s important to know that while they are more lenient in some areas, meeting the basic guidelines doesn’t guarantee approval. FHA has additional requirements related to work history and other factors.

Credit Score and Down Payment

FHA allows borrowers with credit scores as low as 500 to qualify for a mortgage. However, if your score falls between 500 and 579, you’ll need to make a down payment of at least 10%. For scores above 579, you can put down as little as 3.5% when purchasing a home. For example, on a $100,000 home, a 3.5% down payment would amount to $3,500. But if your credit score is not good first you can fix your bad credit score.

Debt-to-Income Ratio

FHA permits a higher debt-to-income ratio of 57%, which is significantly more generous than conventional financing. This means you can potentially get approved for a larger loan amount with FHA compared to other loan programs, even with lower credit scores and a smaller down payment.

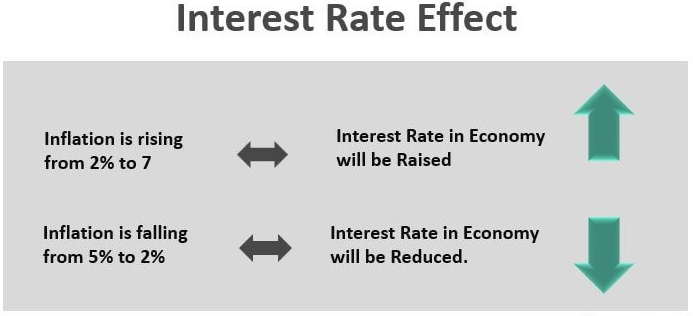

The Impact of Interest Rates

Interest rates have a substantial impact on your monthly mortgage payment and how much home you can afford. In this article, we will explore different payment scenarios using an FHA loan, based on three interest rate options: 6.75%, 5%, and 8%. Keep in mind that these calculations are for illustrative purposes only, and actual rates may vary based on your individual financial situation.

Calculating Your Debt-to-Income Ratio

To determine how much home you can afford, we’ll start by calculating your debt-to-income ratio (DTI). Lenders typically use your gross monthly income before taxes. If you earn fifty thousand dollars annually, your gross monthly income is approximately $4,167.

Front-End Ratio

The front-end ratio considers only your housing expenses. With FHA Loan Requirements, you can have a front-end ratio of up to 47% of your gross monthly income. This includes your mortgage payment, property taxes, homeowner’s insurance, mortgage insurance, and any HOA fees. In this example, it cannot exceed $1,958 per month.

Back-End Ratio

The back-end ratio includes all of your monthly debts in addition to your housing expenses. For FHA loans, the maximum back-end ratio is also 47%, provided that your front-end ratio is not exceeded. This means your total monthly debts, including car payments, credit card bills, and student loans, cannot surpass approximately $416.

For the purposes of this article, we’ll focus on scenarios where you have minimal to no other debts, so your calculations align with the front-end ratio.

Scenario 1: Current Interest Rate – 6.75%

Let’s start by examining how much home you can afford with today’s interest rates at 6.75%. We’ll use a purchase price of $250,000 as an example, which would require a down payment of $8,750 (3.5% of the purchase price). After accounting for FHA’s upfront mortgage insurance premium (1.75% of the loan amount), your base loan amount would be $244,084.

Here’s a breakdown of your monthly payment:

- Mortgage Payment: $1,583

- Property Taxes (at 1.1%): $229

- Monthly Mortgage Insurance (0.55%): $114

- Property Insurance (0.35%): $70

Total Monthly Payment: $1,997

With an annual income of $50,000, you would qualify for a $250,000 home with today’s interest rates at 6.75%.

Scenario 2: Higher Interest Rate – 8%

Now, let’s consider a scenario where interest rates have risen to 8%. Using the same purchase price of $250,000 and a down payment of $8,750, your base loan amount remains at $244,084. However, with the higher interest rate, your monthly mortgage payment increases to $1,791.

With this interest rate, your total monthly payment, including taxes, insurance, and mortgage insurance, would be $2,205. At this rate, you may need to consider a home priced closer to $200,000 to maintain a manageable debt-to-income ratio.

Scenario 3: Lower Interest Rate – 5%

Conversely, let’s explore a scenario where interest rates decrease to 5%. With the same purchase price and down payment, your base loan amount of $244,084 remains unchanged. At this lower interest rate, your monthly mortgage payment decreases to $1,310.

The total monthly payment, including taxes, insurance, and mortgage insurance, would be $1,597. With this lower interest rate, you could potentially afford a home closer to $300,000.

The Impact of Interest Rate Changes

As demonstrated in these scenarios, interest rates play a pivotal role in determining how much home you can afford. A difference of just a few percentage points can significantly affect your monthly payment and, consequently, your home-buying budget. Also, check the VA home loan to get higher loan limits.

It’s important to note that while waiting for interest rates to drop may seem tempting, it’s not without risks. Predicting market changes can be challenging, and there’s no guarantee that rates will decrease. Moreover, lower rates may also drive up home prices due to increased buyer demand, potentially offsetting any savings on your monthly payment.

Conclusion

When considering how much home you can afford, it’s essential to take into account various factors, including your income, credit score, down payment, and interest rates. FHA loans offer flexibility, making homeownership more accessible to individuals with lower credit scores and smaller down payments.

However, interest rates can significantly impact your purchasing power. As rates rise, you may need to consider more affordable homes, while lower rates could enable you to explore higher-priced properties.

Frequently Asked Questions (FAQs)

What Is an FHA Loan, and How Does It Differ From Conventional Loans?

An FHA loan is a mortgage insured by the Federal Housing Administration, a government agency. It differs from conventional loans in that it typically requires a lower down payment, allows for lower credit scores, and has more flexible debt-to-income ratio requirements. Conventional loans, on the other hand, are not government-insured and often require higher down payments and better credit scores.

What Credit Score Do I Need to Qualify for an FHA Loan?

FHA loans are known for their flexibility with credit scores. You can potentially qualify with a credit score as low as 500, but a score between 500 and 579 may require a higher down payment (usually 10%). A credit score of 580 or higher typically allows for a down payment as low as 3.5%.

How Much Down Payment Do I Need for an FHA Loan?

The minimum down payment for an FHA loan is 3.5% of the purchase price. However, if your credit score falls between 500 and 579, you may need to make a down payment of at least 10%. It’s essential to calculate your down payment based on the home’s purchase price.

What Is Mortgage Insurance, and Do I Need It with an FHA Loan?

Mortgage insurance is a fee that protects the lender in case the borrower defaults on the loan. With FHA loans, borrowers are required to pay an upfront mortgage insurance premium (UFMIP), which is 1.75% of the loan amount, and an annual mortgage insurance premium (MIP), which varies based on the loan amount and down payment. Unlike conventional loans, FHA loans typically require mortgage insurance for the life of the loan unless you refinance.

How Do Interest Rates Affect My Loan Eligibility?

Interest rates have a significant impact on your monthly mortgage payment and, consequently, how much home you can afford. Lower interest rates can increase your purchasing power, allowing you to afford a more expensive home. Conversely, higher interest rates may require you to consider more affordable options. It’s crucial to monitor interest rate trends and consider locking in a rate when it’s favorable.