When it comes to financial security and freedom, making informed decisions about loans and credit can play a pivotal role in achieving your goals. In this comprehensive guide, we will delve into the world of Discover Personal Loans, exploring their myriad benefits, eligibility criteria, and the step-by-step application process. By the end of this extensive exploration, you’ll be equipped with the knowledge needed to make informed decisions about your financial future, using Discover Personal Loans as a powerful tool on your journey to fiscal stability and freedom.

The Benefits of Discover Personal Loans

- Easy Application Process: Applying for a Discover Personal Loan is a breeze. You can easily check your pre-qualification status without impacting your credit score. It’s a no-brainer, right?

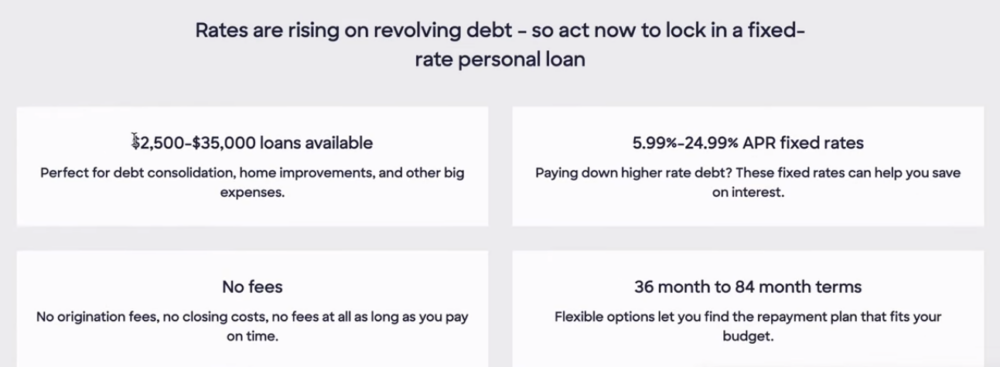

- Low Fixed Rates: With fixed rates ranging from 5.99% to 24.99%, Discover Personal Loans provide an excellent opportunity to pay down high-interest debt and save on interest expenses.

- No Origination Fees: Unlike many other personal loans, Discover Personal Loans have no origination fees or closing costs. That means more money in your pocket to achieve your financial goals.

- Flexible Repayment Options: Discover Personal Loans offer flexible repayment terms, ranging from 36 to 84 months. However, it’s advisable to choose a shorter term to avoid excessive interest payments.

- Fast Funding: Once you accept an offer, Discover Personal Loans can deposit the funds directly into your bank account within 24 to 48 hours. That means you can quickly access the cash you need.

Eligibility Requirements for Discover Personal Loans

Discover Personal Loans are an attractive option, but to take advantage of these benefits, you must meet certain eligibility criteria:

Credit Score

A strong credit history plays a pivotal role in securing a Discover Personal Loan. It is generally recommended to have a credit score of at least 690 or higher to improve your chances of approval. A higher credit score can also lead to more favorable terms and a higher loan amount. Therefore, it’s essential to check your credit score before applying and take steps to improve it if necessary. If you have bad credit score, take a look on guide: how to fix bad credit score.

Income Verification

You will be required to provide details about your income during the application process. Whether you’re employed, self-employed, or have other sources of income, this step is critical in determining your eligibility and the loan amount for which you qualify. Be prepared to provide accurate and up-to-date income documentation to support your application.

A Step-by-Step Guide to Applying for Discover Personal Loans

Now that we’ve discussed the benefits and eligibility requirements, let’s take a closer look at how to apply for Discover Personal Loans:

Step 1: Visit the website for Discover Personal Loans.

To begin your application journey, visit the official Discover Personal Loans website. This is the starting point for accessing the loan application process.

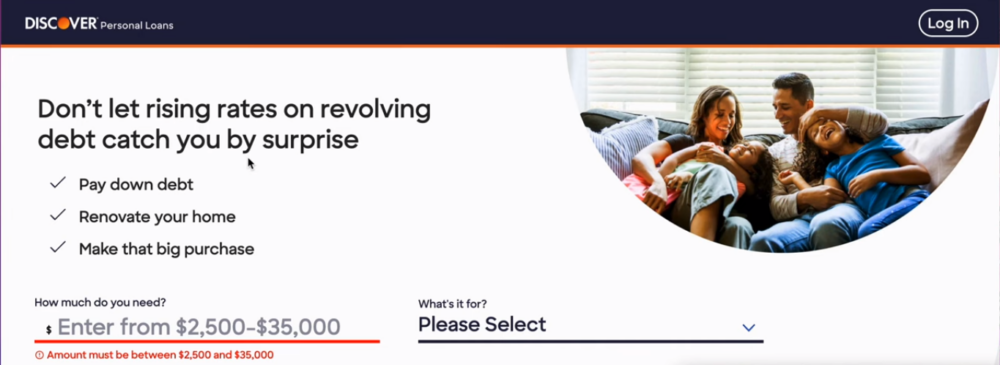

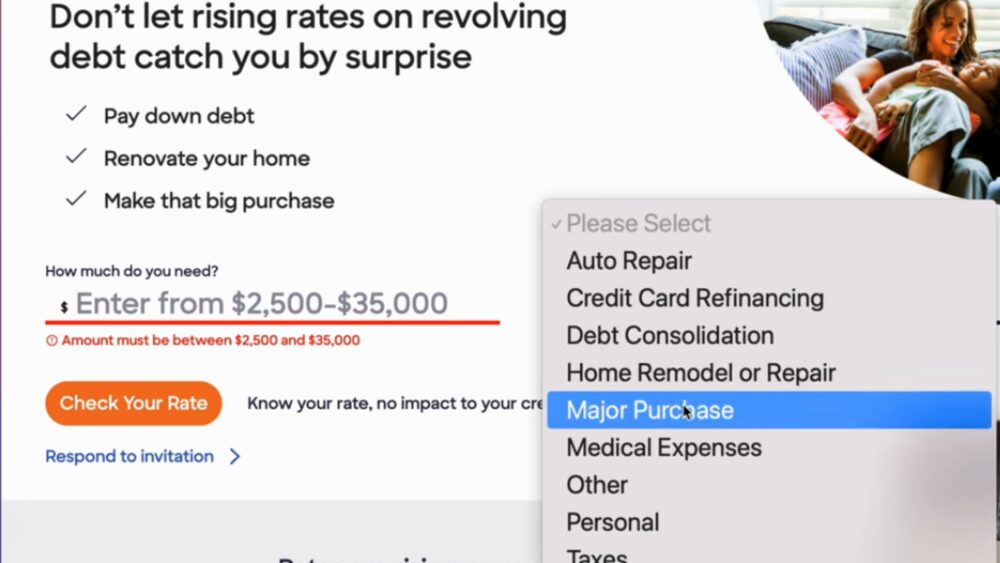

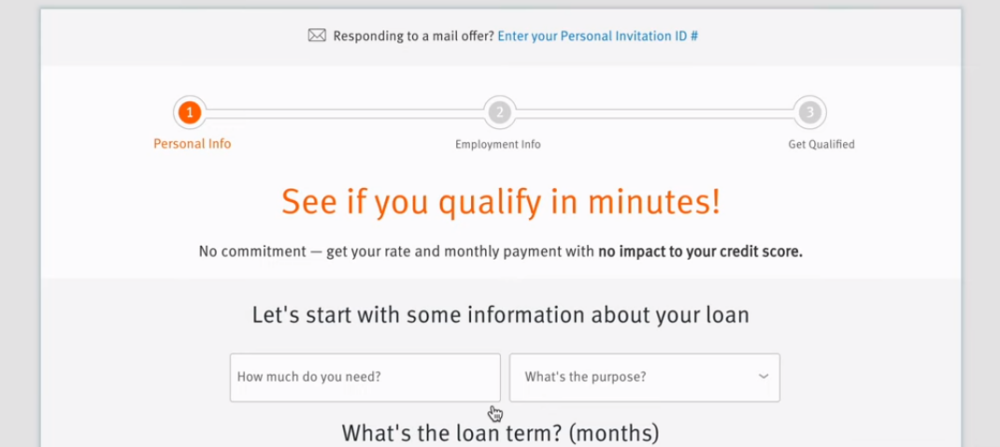

Step 2: Check Your Pre-Qualification

The first step in the application process is to determine your pre-qualification status. You’ll need to enter the loan amount you require and specify the purpose of the loan. “Major Purchase” is a recommended option, as it often leads to more favorable terms. Checking your pre-qualification status allows you to explore loan options without impacting your credit score, making it a risk-free step.

Step 3: Choose Your Loan Term

Select a loan term that aligns with your financial goals and budget. Keep in mind that shorter terms typically result in lower overall interest payments, which can help you save money over the life of the loan.

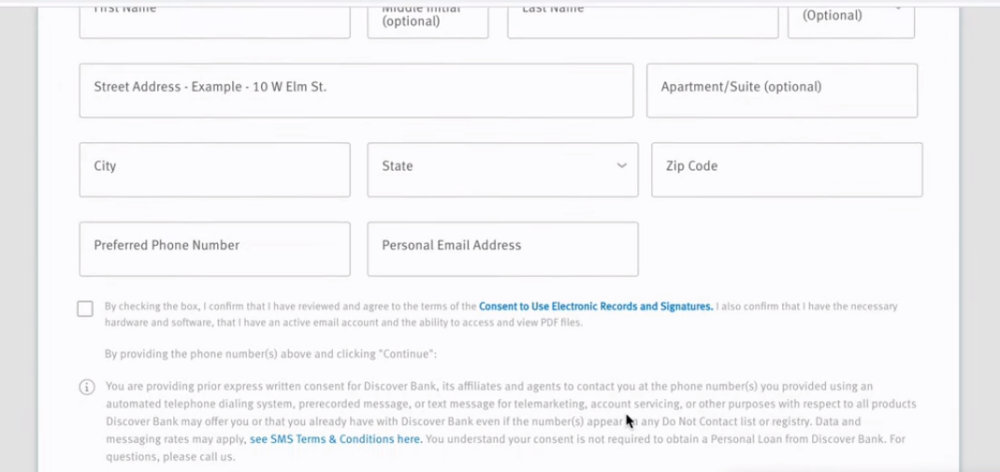

Step 4: Provide Personal Information

To complete your application, you’ll need to provide personal information. This contains important details such as your entire name, home address, phone number, and email address. Ensuring the accuracy of this information is crucial for a smooth application process.

Step 5: Verify Your Income

On the second page of the application, you will be required to verify your income. Whether you are employed or self-employed, providing accurate income details is essential for determining your eligibility and the loan amount you qualify for. To give boost to your income take a look on passive income apps.

Step 6: Review and Accept the Offer

After you’ve completed the application process, Discover will assess your information and provide you with a pre-qualification offer. Take the time to carefully review the terms, including the interest rate and monthly payment amount. You will have the opportunity to select the interest rate that suits your financial goals. If the offer aligns with your objectives, proceed to accept it.

Step 7: Access Your Funds

Once you’ve accepted the offer, Discover Personal Loans will initiate the funding process. Within 24 to 48 hours, the money should be directly paid into your bank account. This swift disbursement ensures that you can promptly address your financial needs or take advantage of opportunities as they arise. Also have a look on how to deposit funds to robinhood app.

Conclusion

Discover Personal Loans provide a straightforward and convenient way to secure the funds you need for a wide range of financial purposes. With competitive fixed rates, no origination fees, and flexible repayment options, Discover Personal Loans offer numerous advantages to borrowers. However, it’s essential to approach borrowing responsibly, considering your financial goals, budget, and ability to repay the loan.

Frequently Asked Questions (FAQs)

What is the minimum credit score required to qualify for a Discover Personal Loan?

While there is no strict minimum credit score requirement, it is generally recommended to have a credit score of at least 690 or higher to improve your chances of approval and secure more favorable loan terms.

Are there any origination fees or closing costs associated with Discover Personal Loans?

No, Discover Personal Loans do not have origination fees or closing costs. When you secure a Discover Personal Loan, you receive the full loan amount without any upfront charges.

How quickly can I access the funds once I accept a Discover Personal Loan offer?

Discover Personal Loans aim to deposit the funds directly into your bank account within 24 to 48 hours after you accept the loan offer. This rapid disbursement ensures quick access to the funds you need.

Can I choose my loan term with Discover Personal Loans?

Yes, Discover Personal Loans offer flexibility in loan terms. Borrowers can select a loan term that ranges from 36 to 84 months. However, it’s essential to consider the trade-offs between shorter and longer terms when choosing the most suitable option for your financial goals.

Does checking my pre-qualification status impact my credit score?

No, checking your pre-qualification status with Discover Personal Loans does not affect your credit score. It’s a risk-free way to explore your loan options and determine eligibility without any negative impact on your credit profile.