The Discover credit card—once hailed as the go-to choice for beginners—has long been celebrated for its no annual fee and impressive cash-back rewards. In 2023, it’s time to revisit this financial companion to determine if it still holds its crown. Does the promise of 5% cash back in rotating categories, coupled with an unlimited cash back match in the first year, stand up to its competition? As new cards and credit builder products emerge, is the Discover it card still a worthy option for beginners? Let’s delve into the details and find out.

Discover Cash Back Credit Card Overview

Alright, so the Discover it Cash Back credit card official website has some enticing features:

- No Annual Fee: You won’t be burdened with annual fees.

- 5% Cash Back in Rotating Categories: Enjoy 5% cash back in everyday categories that change each quarter, including popular choices like Amazon.com, grocery stores, restaurants, gas stations, and more.

- 1% Cash Back on All Other Purchases: A steady 1% cash back on all other purchases.

- Unlimited Cash Back Match in the First Year: The standout feature that puts this card on the map – Discover will double your cash back earnings at the end of your first year. If you earn $150 in cash back, it becomes $300, effectively giving you 10% cash back in the rolling categories and 2% on other purchases for your first year.

Now, you might be wondering, with several new competing products on the market, is the Discover credit card still the best option for beginners in 2023?

Competing Options

To answer that question, let’s look at some of the notable competitors:

- American Express Blue Cash Everyday Card: Offers 3% cash back on groceries, online retail purchases, and gas, with no annual fee.

- Citi Custom Cash Card: Provides 5% cash back on your highest eligible spending category, which automatically changes each month.

- Sofi Credit Card and Wells Fargo Active Cash Card: These offer a straightforward 2% cash back on all purchases, without any rotating categories.

These are just a few examples, and there are more options to consider. Additionally, credit builder products are gaining popularity, offering a safe way to build credit without accruing debt, which might be attractive for those new to credit cards.

What Lies Beneath

Digging deeper into the Discover card, there are both pros and cons:

Pros:

- Excellent Customer Support: Discover offers unparalleled 24/7 US-based customer service, often rivaling that of premium cards.

- Additional Features: The card provides robust online privacy protection, Social Security number monitoring, a $0 fraud liability guarantee, and convenient card management features.

- Widely Accepted: As of 2022, Discover claims acceptance in over 200 countries, with a 99% acceptance rate in the US.

Cons:

- Rotating Categories Cap: The 5% cash back is limited to $1500 in spending each quarter.

- Category Activation: You need to remember to activate the rotating categories in the Discover app.

- Intro APR: While there’s a 0% intro APR for the first 15 months, it’s best to avoid interest charges entirely.

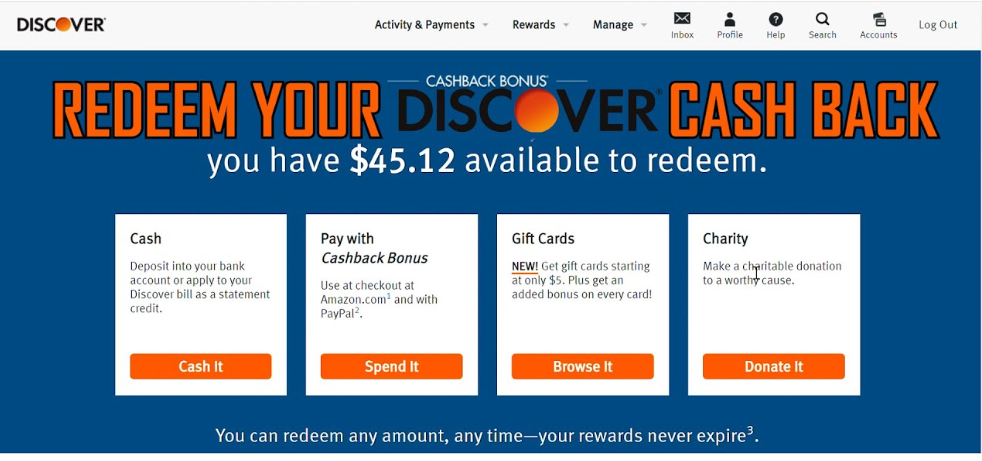

Redeeming Rewards

Redeeming your cash back rewards with Discover is straightforward, with no need to deal with complex points systems. You can deposit cash directly into your bank account, apply it as a statement credit, or use it with partners like Amazon and PayPal. If you want to know how to PayPal app setup on your Phone.

Card Customization and Options

Discover offers over 160 different card designs, which may not be a primary benefit but is a unique feature. Beyond the cash-back version, Discover provides a student version, a travel card, and more.

Is the Discover Credit Card Still Worth It?

In my opinion, the Discover it credit card is still worth considering in 2023, especially for those with no credit history. It remains an excellent choice for beginners. However, the market has evolved, and new competitors offer appealing benefits and rewards. Your choice should align with your specific spending habits and preferences.

Ultimately, it’s essential to evaluate what you want from your credit card and explore the available options. You can also check out my list of favorite beginner credit cards using the link below.

Conclusion

The Discover credit card remains a solid choice, particularly for newcomers to the world of credit cards. With its attractive cash-back rewards, customer-friendly features, and widespread acceptance, it continues to offer value. However, as the credit card landscape evolves, other cards have entered the arena, each with its unique set of advantages. The best choice ultimately depends on your specific preferences and spending habits. While the Discover it card still holds its own in 2023, it’s worth exploring the full spectrum of options available to ensure you make the best decision for your financial needs.

Frequently Asked Questions (FAQs)

What are the key benefits of the Discover credit card?

The Discover credit card offers no annual fee, 5% cash back in rotating categories, 1% cash back on all other purchases, and an enticing feature: unlimited cash back match in the first year.

Are there any limitations to the 5% cash back in rotating categories?

Yes, there is a spending cap of $1500 in those categories each quarter, which means the maximum cashback you can earn in these categories is $75 per quarter or $300 per year.

How does Discover’s customer support compare to other credit card companies?

Discover is known for its top-notch customer support, offering 24/7 US-based service that rivals premium cards like American Express.

Is the Discover credit card widely accepted?

Yes, as of 2022, Discover claims acceptance in over 200 countries and maintains a 99% acceptance rate within the United States.

How can I redeem my cash-back rewards with the Discover credit card?

Redeeming your cash-back rewards is simple. You can deposit the cash directly into your bank account, use it as a statement credit to reduce your balance or spend it with partner merchants like Amazon and PayPal.