We’ve all been there. You’re confidently coasting along, managing your finances, and then bam! You’re hit with a credit score drop for no reason. This can be frustrating. Why did it happen? And more importantly, what can you do about it?

You’re not alone in this quest for answers. Many people find themselves grappling with sudden credit score changes, even when they think they’ve done everything right. This comprehensive guide will shed light on the common culprits behind these unexpected dips and arm you with the knowledge to navigate and improve your credit landscape.

The Importance of Monitoring Your Credit

Before delving into the specific instances why credit score drop for no reason, it’s crucial to emphasize the importance of regularly monitoring your credit. Monitoring allows you to stay informed about any changes to your credit profile and can help you identify issues promptly. While there are various credit monitoring services available, it’s essential to choose one that provides comprehensive information from all three major credit bureaus.

Credit Score Drop for No Reason: Why is it Happening?

Let’s dive into the most common reasons why you might be facing a credit score drop for no reason:

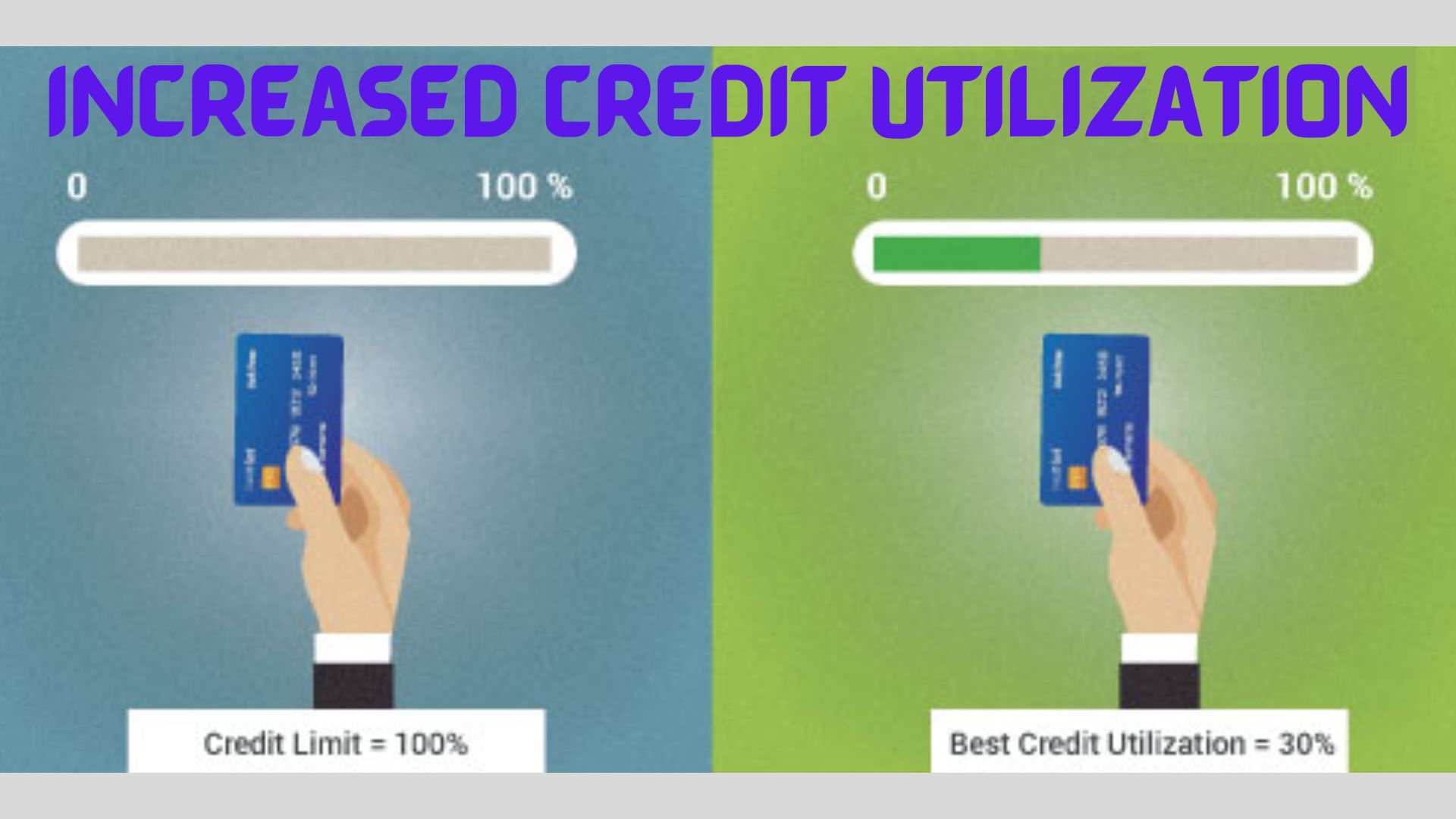

1. Increased Credit Utilization

One of the frequent culprits behind a sudden credit score drop for no reason is an increase in credit card utilization. If you’ve used your credit card for purchases, especially on cards with lower credit limits, you might inadvertently raise your credit utilization ratio. This ratio measures the amount of credit you’ve used compared to your total available credit. A high utilization ratio can have a significant negative impact on your credit score.

To mitigate this issue, be mindful of your credit card usage and aim to keep your credit card balances low relative to your credit limits. By doing so, you can prevent a sudden credit score drop due to increased utilization.

2. Paying Off Loans

Surprisingly, paying off loans, such as personal loans or car loans, VA Home Loan, can result in a temporary credit score drop. This drop occurs because the closed account no longer contributes positively to your credit mix and payment history. However, it’s crucial to understand that while your score may dip initially, it should recover over time as long as you continue to manage your credit responsibly.

To avoid unnecessary surprises, monitor your credit closely after paying off loans to track any score fluctuations.

3. Account Closures

Sometimes, your credit score may drop due to the unexpected closure of an account that was previously reported as open. This situation can arise from various factors, including errors on your credit report or updates made by creditors. An old account that was incorrectly marked as open may suddenly be reported as closed, negatively impacting your credit score.

To address this issue, review your credit reports regularly and dispute any inaccuracies with the credit bureaus. Timely correction of errors can prevent unnecessary drops in your credit score.

4. Late Payments and Collections

While late payments and collections are more obvious credit score influencers, they can still catch you off guard if you’re not vigilant. A late payment, even if it’s reported slightly later than the due date, can lead to a significant credit score drop. Additionally, collections from unpaid bills, especially medical bills, can negatively impact your credit when they unexpectedly appear on your credit report.

To avoid these issues, stay proactive in monitoring your accounts and payments. If you receive any unexpected collection notices, address them promptly to prevent further damage to your credit.

5. Past Due Amounts

Another factor to be aware of is the appearance of past due amounts on your credit report, even if you’re not yet 30 days late on a payment. Once your payment due date passes, a past due amount may be reported on your credit report, causing a temporary dip in your credit score. This drop is not as severe as a 30-day late payment, and it will reverse once you settle the past due amount.

To maintain a healthy credit score, ensure that you pay your bills on time and monitor your accounts for past due amounts.

6. Credit Limits Decreased

A reduction in your credit limit may seem inconsequential, but it can significantly impact your credit score. Credit utilization, the ratio of your credit card balances to your total credit limit, plays a pivotal role in your credit score. When a credit limit shrinks, it reduces your available credit. If your existing balance remains the same or increases, your credit utilization ratio rises, potentially leading to a credit score drop. To avoid surprises, monitor your credit limits and manage your balances wisely, ensuring your credit utilization stays low and your credit score remains healthy.

7. Closed a Credit Card

Closing a credit card may seem like a simple action, but it can have significant repercussions on your credit score. When you closing a credit card account, you reduce your total available credit, which can increase your credit utilization ratio—the balance compared to the credit limit. A higher utilization ratio can lead to a lower credit score. Additionally, closing an older credit card may shorten your credit history, another crucial factor in your credit score calculation. To minimize the negative impact, carefully consider the consequences before closing a credit card. If it’s necessary, focus on paying down balances and keeping other credit card accounts open to maintain a healthy credit profile.

What Is a Good or Bad Credit Score?

Understanding the significance of your credit score is essential for financial well-being. A credit score typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

A good credit score usually falls within the range of 700 to 850. It demonstrates responsible credit management, making it easier to qualify for loans, credit cards, and favorable interest rates.

On the other hand, a bad credit score typically ranges from 300 to 600. Low credit scores may result from missed payments, high credit card balances, or derogatory marks on your credit report. They can hinder your ability to access credit and often come with higher interest rates when approved.

Knowing your credit score and actively working to improve it can lead to better financial opportunities and more favorable lending terms. Monitoring your credit regularly allows you to track your progress and make informed decisions to maintain or boost your creditworthiness.

Ways to Improve Your Credit Scores

Maintaining a healthy credit score is crucial for financial stability and securing favorable lending terms. If your credit score needs improvement, don’t worry; there are several effective strategies to enhance your creditworthiness.

-

Pay Your Bills on Time: Consistently paying bills by their due dates is the most crucial factor in building good credit. Payment delays can have a substantial negative impact on your credit score.

- Reduce Credit Card Balances: Aim to keep your credit card balances low, ideally below 30% of your credit limit. High credit card utilization can negatively impact your score.

- Steer clear of closing long-standing accounts: The length of your credit history holds significance. Closing old credit card accounts can shorten your credit history, potentially lowering your score. Keep older accounts open and use them occasionally to maintain a positive credit history.

- Diversify Your Credit Mix: Having a mix of credit types, like credit cards, installment loans, and mortgages, can positively influence your credit score. A diverse credit portfolio demonstrates responsible credit management.

- Check Your Credit Reports: Regularly review your credit reports for errors or inaccuracies that could be dragging down your score. Dispute any discrepancies with the credit bureaus.

- Limit New Credit Applications: Applying for multiple new credit accounts within a short timeframe can hurt your score. Each application generates a hard inquiry, which can lower your score temporarily.

- Set Up Payment Reminders: Missing payments is a common reason for credit score drops. Set up reminders or automatic payments to ensure bills are paid on time.

- Work with a Credit Counselor: If you’re struggling with managing debt, consider seeking help from a credit counseling agency. They can provide guidance on debt repayment strategies.

- Negotiate with Creditors: If you have past-due accounts or collections, consider negotiating with creditors for a pay-for-delete agreement, where they remove the negative item in exchange for payment.

- Be Patient: Improving your credit score takes time. Consistently practicing good credit habits will gradually raise your score and open doors to better financial opportunities.

By implementing these strategies, you can take control of your credit health and work towards achieving a better credit score, providing you with increased financial flexibility and peace of mind.

Frequently Asked Questions

Q1. What is a credit score, and why is it important?

A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850 in most cases. It’s crucial because lenders use it to evaluate your ability to repay loans and determine the interest rates and credit limits they offer you. A higher credit score usually leads to better financial opportunities and lower borrowing costs.

Q2. How can I check my credit score and credit report?

You can check your credit score and obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com. Additionally, many financial institutions and credit monitoring services offer credit score access and credit reports as part of their services.

Q3. What are the factors that affect my credit score?

Several factors influence your credit score, including payment history, credit utilization (the amount of credit you’re using compared to your credit limits), length of credit history, types of credit accounts, and recent credit inquiries. Timely payments and responsible credit management play significant roles in maintaining a good credit score.

Q4. How can I improve a low credit score?

To improve a low credit score, focus on paying bills on time, reducing credit card balances, avoiding unnecessary credit applications, keeping old credit accounts open, and diversifying your credit mix. It’s also essential to dispute any errors on your credit report and work with a credit counselor if you’re facing financial challenges.

Q5. How long does it take to raise my credit score?

The time it takes to improve your credit score depends on several factors, including the severity of past credit issues and your commitment to good credit habits. Generally, it may take several months to a few years to see significant improvements. However, practicing responsible credit management consistently will gradually lead to a healthier credit profile.

Conclusion

Understanding the factors behind credit score drop for no reason is crucial for financial stability. Regular credit monitoring and informed decision-making are key practices. Whether due to high credit utilization, loan payoffs, account closures, or late payments, awareness of potential causes helps maintain or improve credit scores. Knowing the significance of good and bad credit scores is vital for financial access and interest rates. Implementing strategies like timely bill payments, balanced credit card usage, and diverse credit types is essential. Patience and diligence are key to achieving a healthier credit score and securing a more stable financial future.