Are you in search of a credit card that not only provides fantastic rewards but also offers the flexibility you desire, all without the burden of an annual fee? Your search ends with the Chase Freedom Flex Credit Card. This comprehensive guide is your key to unlocking the full potential of this remarkable card. We will delve into the intricate details, advantages, and features that make the Chase Freedom Flex credit card stand out in the crowded world of credit cards. Whether you’re just beginning your journey into the world of credit cards or consider yourself a seasoned pro, this card has something to offer everyone, making it a versatile and valuable addition to your financial toolbox.

Why Choose the Chase Freedom Flex Credit Card?

The Chase Freedom Flex is a powerhouse of a credit card that caters to both beginners and experienced users. Here’s why you should consider adding it to your wallet:

High-Value Rewards

This card stands out in the crowd due to its generous rewards program. With the Chase Freedom Flex Credit Card, you can enjoy:

- 5% Cash Back on Travel: Booking your travel through the Chase Ultimate Rewards portal can earn you a whopping 5% cash back.

- 3X on Dining: Enjoy 3X cash back at restaurants, takeouts, and delivery services.

- 3X on Drugstore Purchases: Stocking up on essentials? You’ll earn 3X cash back at drugstores.

- 1X on Everything Else: For all other purchases, you’ll still get a respectable 1% cash back.

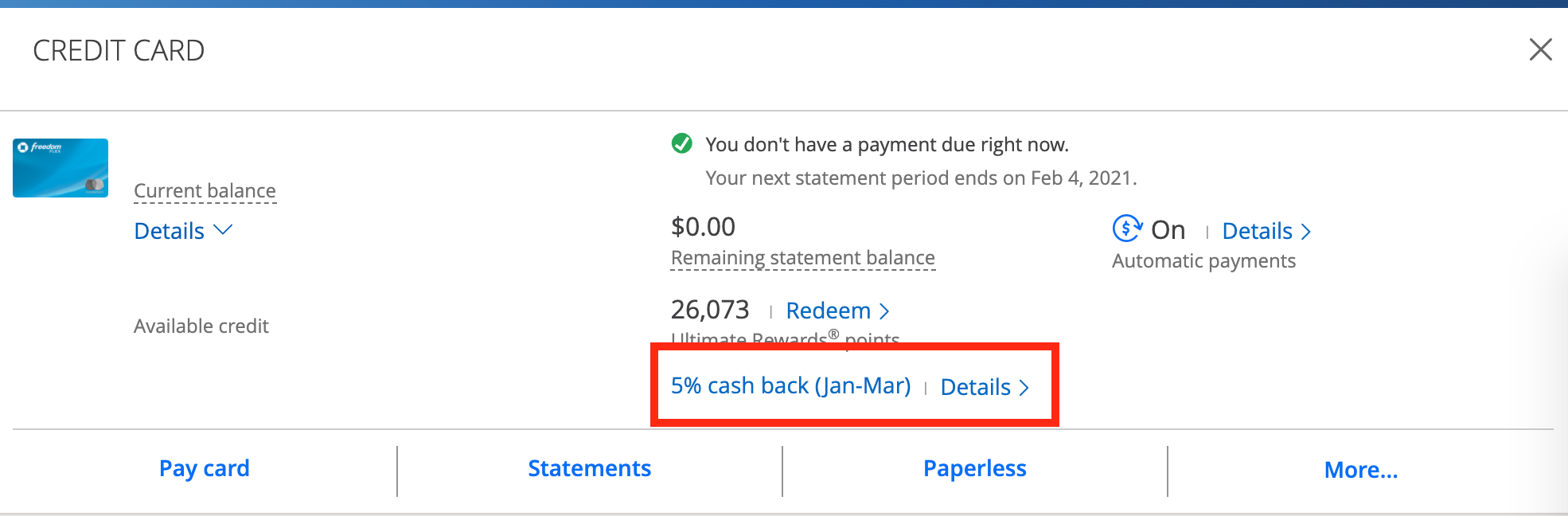

But where this card truly shines is in its rotating quarterly categories, which can earn you even more rewards. You need to activate these categories manually, but it’s well worth it. For instance, as of July, you can earn 5% cash back on gas stations, EV chargings, and select live entertainment. These categories change every quarter, and in the past, they have included popular options like Amazon, Lowe’s, Target, and gym memberships. It’s essential to remember that the 5% cash back applies only to the first $1,500 in quarterly spending in these categories, but it still adds up to approximately $300 in value per year.

0% APR Introductory Offer

The Chase Freedom Flex Credit card offers a fantastic 0% APR introductory offer on purchases and balance transfers for the first 15 months. This feature can help you save hundreds, if not thousands, of dollars in interest, making it an ideal choice if you have some existing credit card debt. While carrying a balance is generally not recommended in the world of rewards cards, this card provides a safety net in case you need it, but you should always keep maintain your good APR for a credit card.

Generous Welcome Bonus

By spending $500 within the first three months of account opening, you’ll receive a $200 bonus cash back. This means that you’re essentially getting 40% off everything you purchase with your card during that period. Combine this with the cash back from rotating categories, dining, food delivery, and drugstore purchases, and you can quickly accumulate a significant amount of savings.

No Annual Fee

One of the best features of the Chase Freedom Flex is that it comes with no annual fee. You can hold multiple Chase Freedom Flex cards without incurring any additional costs. It’s a great way to maximize your rewards.

Comparing Chase Freedom Flex with Other Cards

The Chase Freedom Flex Credit Card is undoubtedly a strong contender in the credit card market, but how does it stack up against other cards? Let’s take a look at a few comparisons:

- Capital One SavorOne: While the Capital One SavorOne offers similar dining and entertainment rewards, Chase’s Ultimate Rewards program provides more versatile redemption options, making the Freedom Flex a better choice for many.

-

US Bank Cash Plus: The US Bank Cash Plus card allows you to choose your 5% cash back categories, giving you more control. However, the Chase Freedom Flex is easier to get approved for, has a lower spending requirement for its welcome bonus, and often offers better introductory offers. The two cards can complement each other well if you’re looking for more options in your rewards strategy.

Getting Approved for the Chase Freedom Flex

If you’re interested in the Chase Freedom Flex Credit Card, it’s essential to understand the approval process. Here are some key factors to consider:

Credit Score Requirement

To increase your chances of approval, you should aim for a credit score of at least 670. This card is designed with beginners in mind, so even if your credit score isn’t perfect, you still have a good chance of being approved and you can fix your bad credit score.

Chase 5/24 Rule

Chase has a rule known as the “5/24 rule,” which means you can’t get a new Chase card if you’ve opened five or more credit cards in the last 24 months. To maximize your chances of approval for the Chase Freedom Flex, prioritize applying for Chase cards first.

Chase 2/30 Rule

Another rule to keep in mind is the “2/30 rule.” If you’ve applied for two Chase cards within the last 30 days, you’ll automatically be denied for the next one. It’s worth being patient to avoid the risk of denial.

Maximizing the Value of Your Chase Freedom Flex

Now that you have the Chase Freedom Flex credit Card, here are five tips to maximize its value:

- Maximize Quarterly Categories: Make sure to spend up to the $1,500 limit in the quarterly 5% cash back categories. Plan your purchases to align with these categories to earn more rewards.

- Meet the Welcome Bonus: Don’t miss out on the welcome bonus. Spend $500 within the first three months to get $200 cash back.

- Use Ultimate Rewards Points Wisely: The cash back you earn with the Freedom Flex is in the form of Chase Ultimate Rewards Points. Consider building a “Chase Trifecta” by pairing this card with the Chase Sapphire Preferred or Chase Sapphire Reserve. This allows you to maximize the value of your points by redeeming them for travel.

- Activate Cell Phone Protection: Pay your phone bill with your Freedom Flex to activate cell phone protection. If your phone breaks, you can get it replaced with just a $50 deductible.

-

Keep an Eye on Promotions: Stay updated with credit card offers and promotions. These can help you earn extra rewards and bonuses, maximizing the value of your card.

Conclusion

The Chase Freedom Flex Credit Card is an excellent credit card choice, especially for those who are new to the credit card game. Its combination of high-value rewards, a 0% APR introductory offer, a generous welcome bonus, and no annual fee make it a versatile and cost-effective option. By following these tips and guidelines, you can make the most out of your Chase Freedom Flex and enjoy the perks it offers.

Frequently Asked Questions (FAQs)

What is the Chase Freedom Flex Credit card?

The Chase Freedom Flex card is a credit card offered by Chase that provides users with cash back rewards and various benefits. It is known for its rotating 5% cash back categories, 0% APR introductory offer, and no annual fee.

How can I earn cash back with the Chase Freedom Flex?

You can earn cash back with the Chase Freedom Flex by using the card for purchases. It offers 5% cash back on rotating quarterly categories, 3% cash back on dining, and 3% cash back on drugstore purchases. All other purchases earn 1% cash back.

What are the rotating quarterly categories, and how do they work?

The rotating quarterly categories are specific spending categories that change every three months. Examples of categories include gas stations, EV charging, and select live entertainment. To earn 5% cash back in these categories, you need to manually activate them. The 5% cash back applies to the first $1,500 in spending within the category.

Is the Chase Freedom Flex a good card for beginners?

Yes, the Chase Freedom Flex is an excellent card for beginners. It has a relatively low credit score requirement, no annual fee, and a manageable spending requirement to earn the welcome bonus. Additionally, it provides valuable cash back rewards that can benefit users of all experience levels.

How can I maximize the value of the Chase Freedom Flex?

To maximize the value of your Chase Freedom Flex card, you can:

- Make sure to meet the spending requirement for the welcome bonus.

- Maximize your spending in the rotating quarterly categories.

- Consider pairing the card with other Chase cards like the Chase Sapphire Preferred or Chase Sapphire Reserve for enhanced rewards.

- Activate cell phone protection by paying your phone bill with the card.

- Stay updated with promotions and offers to earn extra rewards.