In this comprehensive guide, we will delve into the world of Care Credit, discussing what it is, its benefits, potential drawbacks, and how it compares to other credit cards. Care Credit is a financial solution designed to cater to your medical needs, particularly for elective procedures that may not be covered by your health insurance. Whether you’re considering a cosmetic surgery, dental work, LASIK eye surgery, or even veterinary services for your beloved pet, Care Credit steps in to help you manage those unexpected, substantial bills. In this article, we’ll explore the key features and advantages of Care Credit, offering valuable insights for making informed decisions.

What Is Care Credit?

Care Credit is a credit card issued by Synchrony Bank, a financial institution known for providing retail store credit cards, including well-known brands like Sam’s Club, Dick’s Sporting Goods, Old Navy, JCPenney, and many others. While Care Credit functions as a credit card, it serves a specific purpose: to finance medical expenses, particularly elective procedures and treatments that may not be covered by health insurance. This could include services like Lasik eye surgery, cosmetic dentistry, weight loss surgery, and various other medical interventions aimed at improving your quality of life.

You may also find Care Credit to be a valuable resource for unexpected veterinary bills. When your furry companion requires unplanned surgery or medical care, and you’re faced with a substantial bill, Care Credit offers a way to finance the expenses over time, rather than paying the entire amount upfront.

How to Access Care Credit

Obtaining Care Credit is relatively straightforward. Most people are introduced to it while visiting their healthcare provider. When faced with a medical procedure that their health insurance won’t cover, patients are often presented with the option of financing through Care Credit. Many medical professionals have established partnerships with Care Credit, making it readily available to patients on website. However, it is also possible to apply for Care Credit independently, outside of a healthcare provider’s office.

The Benefits of Care Credit

Care Credit offers a range of benefits, making it an attractive option for many individuals:

1. Zero Percent Financing

One of the most appealing aspects of Care Credit is the opportunity for zero percent financing. The terms of zero percent financing can vary depending on the healthcare provider, but it typically applies to purchases or bills of $200 or more. You may find offers ranging from six months to 24 months of zero percent financing. If you pay off the entire balance within the agreed-upon period, you won’t incur any interest charges. This feature allows you to spread your payments over time without the burden of added costs.

However, it’s crucial to understand the concept of deferred financing. If you fail to pay off the balance within the specified period, you will be subject to retroactive interest charges from the date of your purchase. The interest rate can be quite high, often reaching 26.99%. This means that even a small remaining balance can lead to substantial interest charges.

2. Lower Credit Score Requirements

Another advantage of Care Credit is its relatively lenient credit score requirements. Synchrony Bank, the issuer of Care Credit, is known for working with individuals who have lower credit scores. If you find yourself with a credit score in the range of 620 to 650, and you’re struggling to secure traditional credit cards with reasonable interest rates, Care Credit may be a viable solution. It offers a path to financing your medical needs, even when other credit options are limited.

3. Usable at Select Retailers

While Care Credit is primarily designed for medical expenses, it can also be used at select retailers, making it a versatile financial tool. Notable retailers where Care Credit is accepted include Walmart, Walgreens, and Sam’s Club. However, it’s important to note that the interest rate on everyday purchases remains high at 26.99%, and the card doesn’t offer any rewards. Consequently, it may not be the most attractive credit card for general retail use unless you have a limited choice due to bad credit score.

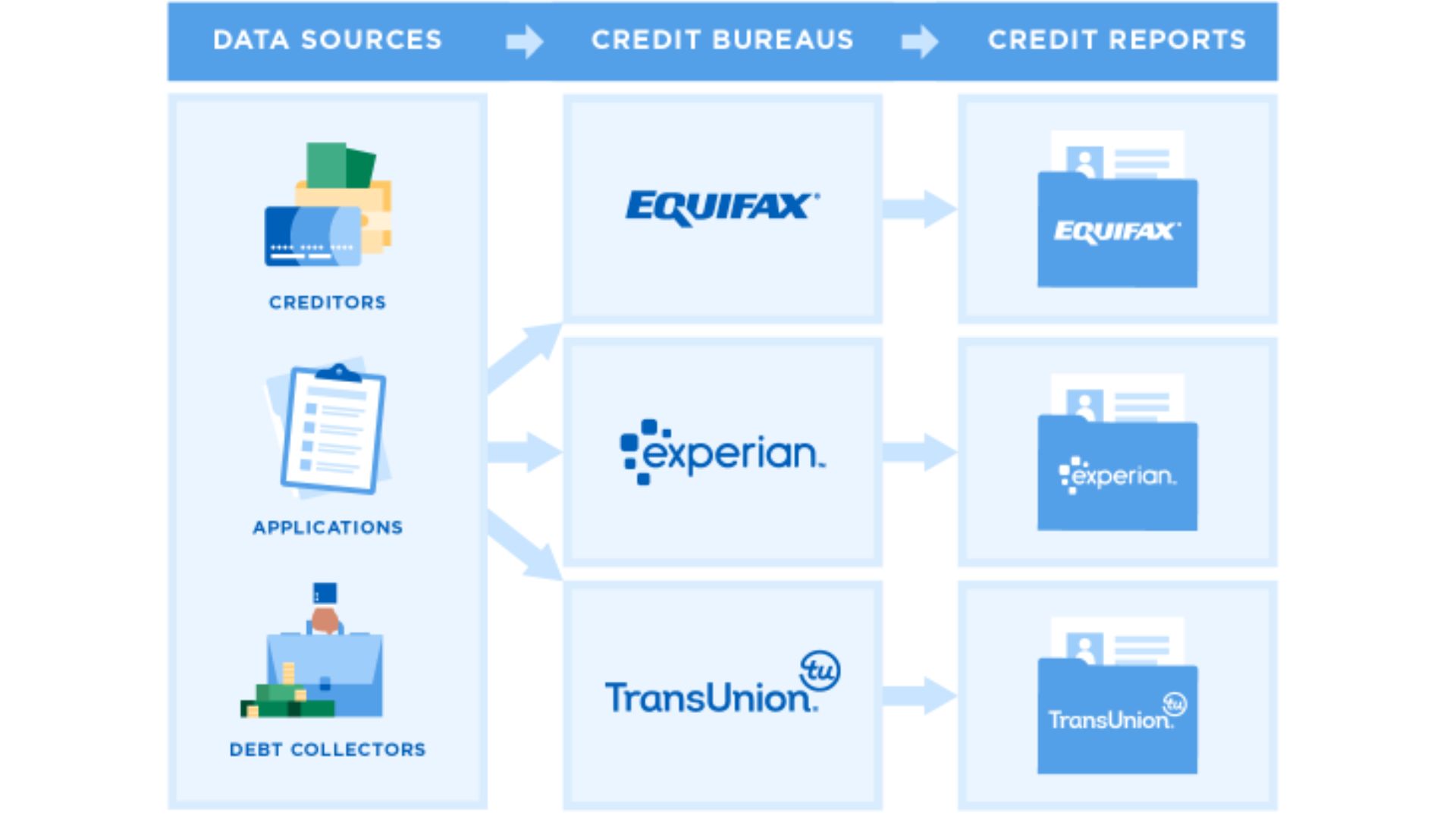

4. Reporting to Credit Bureaus

Care Credit is reported to credit bureaus as revolving credit, similar to regular credit cards. This means that it contributes to your credit history and can impact your credit score. Maintaining a positive payment history with Care Credit can potentially improve your credit standing over time.

Is Care Credit Right for You?

Whether Care Credit is the right choice for you depends on your unique circumstances and financial situation. Here are some key considerations:

1. Lower Credit Score

If you have a lower credit score and struggle to qualify for traditional credit cards with favorable terms, Care Credit could be a lifeline. Its lenient credit score requirements may enable you to access essential medical procedures with zero percent financing, provided you can manage the payments within the designated timeframe.

2. Consider Your Credit Card Alternatives

If you have a credit score that allows you to qualify for traditional credit cards, you may want to explore those options. Many credit cards offer zero percent financing on new purchases for extended periods, often ranging from 15 to 18 months. With these cards, you only accrue interest on the remaining balance if you don’t pay off the full amount within the specified time frame, which can be a more flexible and cost-effective solution.

3. Beware of Emotional Decisions

One potential drawback of Care Credit is that it is often presented to individuals in vulnerable situations. You may be facing a medical procedure that you strongly desire or need to improve your quality of life. In these emotional moments, it’s essential to consider your financial capability and ensure you can commit to the payment terms. Signing up for Care Credit without careful consideration may lead to unexpected interest charges and financial stress.

Conclusion

Care Credit can be a valuable financial tool for individuals with lower credit scores and those seeking medical procedures that require financing. Its zero percent financing offers flexibility and affordability when used responsibly. However, individuals with good credit may find more attractive options with traditional credit cards that offer extended zero percent financing periods. Ultimately, the decision to use Care Credit should be based on your unique financial situation and a thorough understanding of the terms and conditions.

Frequently Asked Questions

What Is Care Credit, and How Does It Work?

Care Credit is a specialized credit card designed for medical financing. It helps individuals manage the costs of elective medical procedures and unexpected healthcare expenses. It functions like a regular credit card and is issued by Synchrony Bank. Care Credit offers various financing options, including zero percent financing for specific periods, allowing you to pay off your medical bills without incurring interest if paid within the agreed-upon timeframe.

Is Care Credit Only for Medical Expenses, or Can I Use It for Other Purchases?

Care Credit is primarily intended for medical expenses, but it can also be used at select retailers like Walmart, Walgreens, and Sam’s Club. However, it’s important to note that it may not be the most favorable choice for everyday purchases due to its relatively high interest rate (26.99%) and the absence of rewards for non-medical spending.

How Do I Apply for Care Credit, and Can I Use It at Any Healthcare Provider?

You can apply for Care Credit at a healthcare provider’s office that offers Care Credit financing. Many doctors, dentists, veterinarians, and other medical professionals have established relationships with Care Credit and can help you apply on the spot. While you can apply for Care Credit independently, it’s commonly offered through these healthcare providers.

What Are the Benefits of Zero Percent Financing, and How Does Deferred Financing Work?

Zero percent financing is a key benefit of Care Credit, allowing you to avoid interest charges if you pay off your balance within the specified zero percent financing period, typically ranging from six to 24 months. However, it’s essential to understand deferred financing. If you fail to pay off the balance within the agreed-upon timeframe, you’ll be retroactively charged interest on the entire original balance from the date you agreed to the financing terms. Care Credit’s current interest rate for retroactive charges is 26.99%.

Who Should Consider Using Care Credit, and What Alternatives Are Available?

Care Credit may be a suitable choice for individuals with lower credit scores who cannot qualify for traditional credit cards with favorable terms. If you’re in a situation where you need medical financing and can’t secure zero percent financing elsewhere, Care Credit offers an option. However, individuals with better credit may find traditional credit cards with zero percent financing offers to be more flexible and manageable. It’s advisable to explore your credit options based on your specific financial circumstances.