In a world where everyone’s talking about credit cards like the AMEX Gold City Premiere and Chase Sapphire Preferred, some other types of travel cards often get overlooked—specifically, Best Hotel credit cards from brands like Marriott, World of Hyatt, and Hilton. This begs the question: Are hotel credit cards worth it? In this article, we will delve into the pros and cons of best hotel credit cards and help you decide if they are the right choice for you.

Best Hotel Credit Cards

When it comes to hotel credit cards, what’s “best” can vary based on your preferences, spending habits, and brand loyalty. Here’s a look at some of the best hotel credit cards, taking into account their welcome offers, rewards rate, and additional perks:

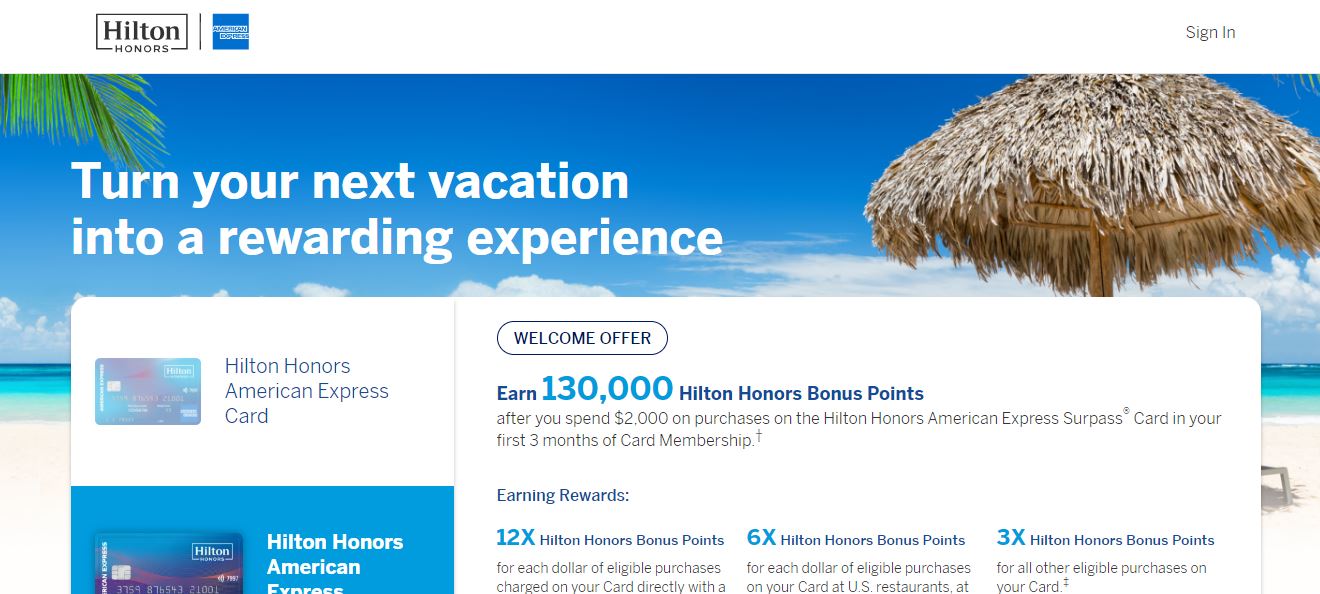

1. Hilton Card (Hilton Honors Card from American Express)

Targeted towards those who prefer the Hilton brand, the Hilton Honors Card from American Express offers a rewarding blend of generous points on hotel stays, as well as everyday purchases. Designed for both frequent travelers and everyday consumers, the card provides significant advantages for Hilton stays without the burden of an annual fee, making it an attractive option for those new to hotel-branded credit cards.

- Welcome Offer: Generous welcome bonus points after meeting initial spending requirements.

- Cashback & Rewards:

- Earn high points per dollar at Hilton properties.

- Points for everyday expenses like dining, supermarkets, and gas.

- Benefits:

- Complimentary Hilton Honors Silver status.

- No foreign transaction fees.

- Pros:

- No annual fee.

- Strong rewards rate on Hilton stays.

- Cons:

- Limited benefits compared to Hilton’s higher-tier cards.

- Rewards value primarily tied to Hilton redemptions.

2. IHG Card (IHG Rewards Club Premier Credit Card)

A perfect companion for IHG enthusiasts, the IHG Rewards Club Premier Credit Card brings together a mix of high rewards rates at IHG properties, exclusive hotel perks, and the potential for significant point earnings on everyday spending. Whether you’re checking into an upscale InterContinental or a comfortable Holiday Inn, this card ensures every stay is rewarding.

- Welcome Offer: Attractive bonus points after meeting the initial spending requirement.

- Cashback & Rewards:

- Earn high points per dollar at IHG properties.

- Points on dining, gas stations, and everyday expenses.

- Benefits:

- One free night stay annually.

- Automatic IHG Platinum Elite status.

- No foreign transaction fees.

- Pros:

- Substantial rewards rate on IHG properties.

- Valuable annual free night benefit.

- Cons:

- Annual fee.

- Rewards mainly benefit IHG loyalists.

3. Marriott Card (Marriott Bonvoy Boundless Credit Card)

Tailored for regular travelers and Marriott aficionados, the Marriott Bonvoy Boundless Credit Card ensures that every stay at Marriott properties, from luxurious Ritz-Carltons to cozy Courtyards, comes with rich rewards. With added benefits like annual free nights and automatic elite status, it’s a card that promises enhanced travel experiences.

- Welcome Offer: Significant bonus points after hitting initial spend threshold.

- Cashback & Rewards:

- Earn high points per dollar at Marriott Bonvoy hotels.

- Points for dining and everyday purchases.

- Benefits:

- One free hotel night every year.

- Automatic Silver Elite Status in Marriott Bonvoy.

- Pros:

- Generous rewards at Marriott properties.

- Valuable annual free night award.

- Cons:

- Annual fee.

- Best value predominantly from Marriott redemptions.

4. Hyatt Card (World of Hyatt Credit Card)

A prized asset for regular travelers, especially those partial to the Hyatt brand, the World of Hyatt Credit Card offers bountiful rewards and perks that enhance every stay at Hyatt properties. Whether you’re enjoying a luxurious spa at a Park Hyatt or a city break at a Hyatt Place, this card ensures you’re handsomely rewarded.

- Welcome Offer: Impressive bonus points after reaching the spending requirement in the initial months.

- Cashback & Rewards:

- High points per dollar at Hyatt hotels and resorts.

- Points for dining, airfare booked directly with airlines, and other purchases.

- Benefits:

- Free nights at select Hyatt properties.

- Automatic Hyatt Discoverist status.

- Pros:

- Strong earning rate at Hyatt properties.

- Wide-ranging bonus categories outside of hotel stays.

- Cons:

- Annual fee.

- Maximum benefits require frequent stays at Hyatt properties.

5. Citi Premier

Citi Premier stands out as a versatile credit card option for those who have varied spending habits. From dining out to fueling up, traveling, or just everyday shopping, this card ensures that every dollar spent translates to rewarding points. Coupled with the flexibility of the ThankYou Points program, the Citi Premier card offers a balanced approach to earning and redeeming points.

- Welcome Offer: Earn a substantial bonus in ThankYou Points after meeting the initial spending limit.

- Cashback & Rewards:

- Earn high points on travel, including gas stations.

- Points for dining, entertainment, and other purchases.

- Benefits:

- Transfer points to various airline partners.

- No expiration on points.

- Pros:

- Broad definition of travel category for rewards.

- Diverse redemption options.

- Cons:

- No intro APR offer.

- Annual fee

6. Amex Gold (American Express Gold Card)

Tailored for those who appreciate the finer things in life, the American Express Gold Card offers a blend of high rewards on dining, groceries, and flights. Whether you’re dining out at a top restaurant, shopping for groceries, or booking a getaway, the card ensures your expenses are rewarded generously, making it a premium choice for food and travel enthusiasts.

- Welcome Offer: Earn a generous amount of Membership Rewards points after meeting the spend requirement.

- Cashback & Rewards:

- High points on restaurants and U.S. supermarkets.

- Points for flights booked directly or through Amex Travel.

- Benefits:

- Monthly dining credit at select restaurants.

- No foreign transaction fees.

- Pros:

- High earning rates on food and dining.

- Notable monthly dining credits.

- Cons:

- Annual fee.

- Limited travel benefits compared to some competitors.

Potential Drawbacks of Hotel Credit Cards

Hotel credit cards, while appealing to some, come with notable downsides. These cards often fall short in providing competitive rewards for everyday spending, lack the long-term rewards stability found in other card types, and offer limited flexibility in point redemption. To make an informed choice, it’s essential to weigh these drawbacks against their benefits but why you spend money on Best Hotel credits cards in place of that you can spend your money for getting business Credit.

1. Earning Rewards on Everyday Spend

One major drawback of best hotel credit cards is that they are not the best when it comes to earning rewards on everyday spending, but why you spend your money on that rather than, you can buy best student credit card for your child. Let’s compare some popular best hotel credit cards with their reward multipliers:

- Hilton Honors American Express Surpass Card

- 12 points per dollar at Hilton Hotels

- Earning 6 points for every dollar spent on dining, groceries, and gas

- Receive 3 points for every dollar spent on all remaining purchases

- IHG Rewards Premier Card

- 10 points per dollar at IHG properties

- 5 points per dollar on dining, travel, and gas stations

- Receive 3 points for every dollar spent on all remaining purchases

- Marriott Bonvoy Boundless

- 6 points per dollar at Marriott properties

- 3 points per dollar on dining, groceries, and gas

- 2 points per dollar on all other purchases

- World of Hyatt Credit Card

- 4 points per dollar at Hyatt properties

- 2 points per dollar on restaurants, airline tickets, local transit, and fitness club memberships

- 1 point per dollar on all other purchases

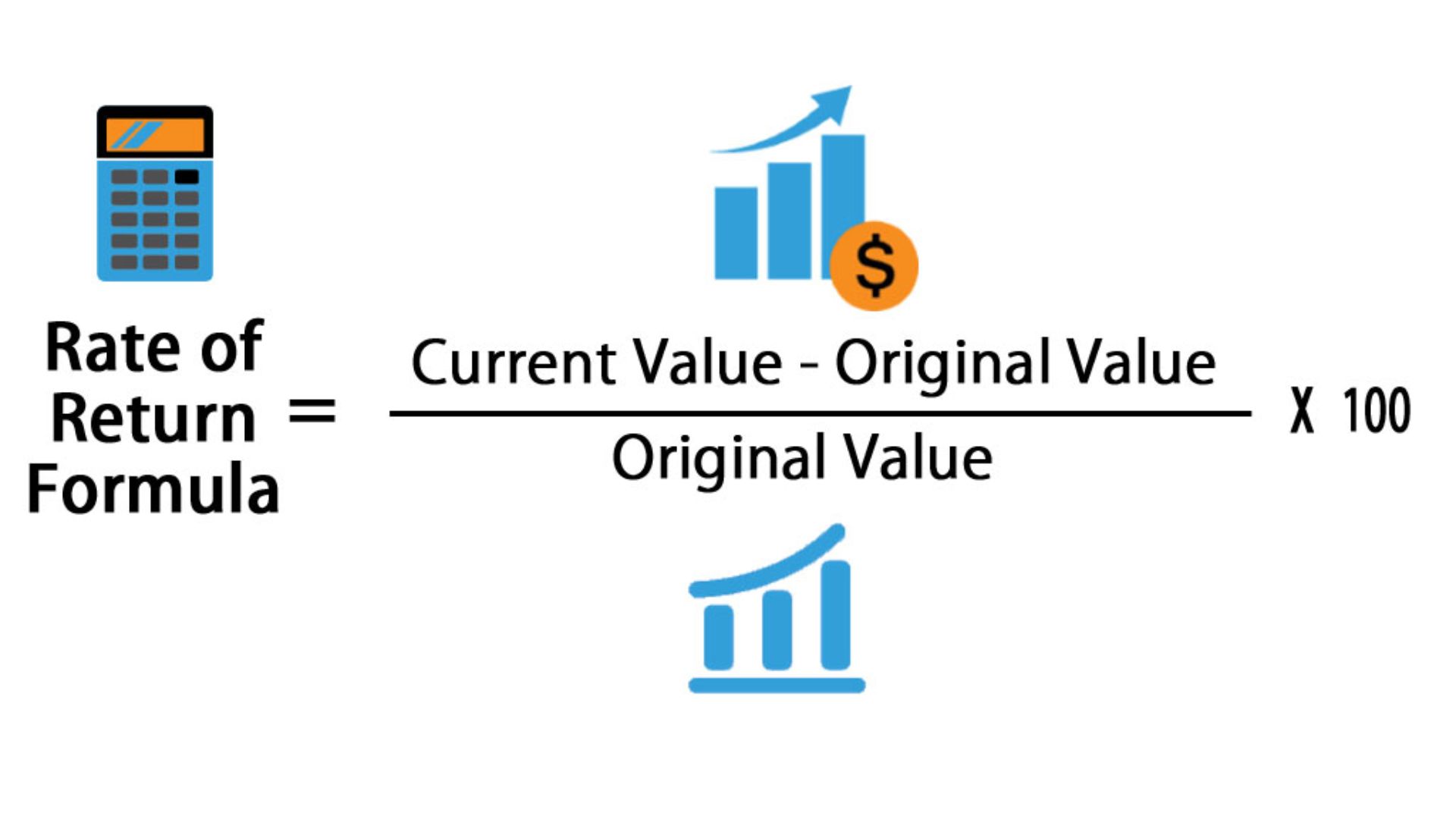

2. Calculating the Return on Spend

Competing with General Travel Cards: Many general travel rewards credit cards offer competitive rates on accommodations, broad travel categories, and more flexible redemption options, making them often more versatile than hotel-specific cards.

To make an accurate comparison, we need to calculate the return on spend for these cards. Since different programs have different point values, we need to put them in cashback equivalent terms. Here are the average point values and their corresponding return percentages:

- Hilton: 0.5 cents per point

- IHG: 0.5 cents per point

- Marriott: 0.7 cents per point

- Hyatt: 1.5 cents per point

Using these values, we can calculate the percent return for each card based on their category multipliers. Here are the results:

| Card | Hilton | IHG | Marriott | Hyatt |

|---|---|---|---|---|

| Return on Hilton Spend | 6% | 5% | 4.2% | 6% |

| Return on IHG Spend | 3% | 2.5% | 2.1% | 3% |

| Return on Marriott Spend | 1.5% | 1.5% | 1.4% | 1.5% |

| Return on Other Spend | 1.5% | 1.5% | 1.4% | 1.5% |

3. Compared with Flexible Travel Cards

Many general travel rewards credit cards offer competitive rates on accommodations, broad travel categories, and more flexible redemption options, making them often more versatile than hotel-specific cards.Now, let’s bring in some flexible travel cards for comparison:

Here are the reward multipliers for these cards:

- Citi Premier Card: 5.1% return on restaurants, supermarkets, gas stations, air travel, and hotels

- American Express Gold Card: 6.8% return on restaurants and groceries, 5.1% on flights, 3.4% on travel via AmEx portal

- Chase Sapphire Preferred: 8.5% return on travel via its portal, 5.1% on dining, online grocery, and select streaming

- Capital One Venture: 8.5% return on hotels and rental cars through Capital One travel portal

What Are The Benefits of Using Best Hotel Credit Cards?

Despite some drawbacks, best hotel credit cards offer compelling advantages that cater to specific needs. From generous welcome bonuses to elite status benefits and free night awards, these cards can significantly enhance your travel experiences,:

1. Earning Hotel Points Fast via Welcome Offers

One compelling feature of best hotel credit cards is their enticing welcome bonuses, which provide a fast-track to amassing a substantial number of points. As an illustration, consider the Hilton Honors Surpass Card, which offers an impressive 150,000 bonus points when you spend just $3,000 within the initial six months of card membership. These bonuses empower travelers to kickstart their rewards journey and unlock valuable benefits.

2. Obtaining Elite Status

Best Hotel credit cards often grant cardholders automatic elite status or present opportunities to achieve elite status through card spending. These elite perks can include coveted benefits like complimentary room upgrades, extended check-out times, and bonus points accrual. Gaining elite status through your credit card can enhance your hotel experience, making your stays more rewarding and comfortable.

3. Paying for Hotel Nights Directly

Best Hotel credit cards excel in rewarding cardholders for direct spending at affiliated hotels, making them an ideal choice for avid travelers who favor branded properties. These cards offer competitive returns on hotel expenses, ensuring that every stay is not only enjoyable but also economically advantageous. Whether it’s earning points, receiving discounts, or accessing exclusive amenities, using a hotel credit card for your accommodations enhances your travel experience while optimizing your rewards.

4. Earning Free Night Awards

Best Hotel credit cards offer a standout feature: the opportunity to earn valuable free night certificates. These certificates are prized for their ability to provide significant value when redeemed for hotel stays. By accumulating these certificates through card benefits, cardholders can enjoy complimentary nights at their favorite hotel chains, enhancing the overall value of their card membership and making their travels even more rewarding.

The Verdict: Flexible Travel Cards vs. Hotel Cards

When comparing the overall average return on spend for both hotel and flexible travel cards, it’s clear that flexible travel cards have the edge, especially for everyday spending categories. Even the highest-performing best hotel credit card falls short of the lowest-performing flexible travel card.

| Card | Average Return on Spend |

|---|---|

| Hilton Card | 3.3% |

| IHG Card | 2.8% |

| Marriott Card | 2.38% |

| Hyatt Card | 3.25% |

| Citi Premier | 4.53% |

| Amex Gold | 4.76% |

| Chase Sapphire | 4.82% |

| Capital One Venture | 6.98% |

For most people, who spend more on everyday expenses than travel, flexible travel cards offer better value.

Frequently Asked Questions (FAQs)

What exactly is a hotel credit card, and how does its operation function?

A hotel credit card is a type of rewards credit card that is co-branded with a specific hotel chain, such as Marriott, Hilton, or Hyatt. These cards offer various benefits, including earning points or miles for hotel stays, elite status perks, and often come with welcome bonuses. Cardholders can accumulate points or miles through card spending and redeem them for free hotel nights, upgrades, and other hotel-related rewards.

What are the key advantages of having a hotel credit card?

Best Hotel credit cards offer several advantages, including the ability to earn points quickly through welcome bonuses and spending, access to elite status benefits like room upgrades and late check-outs, high earning rates on hotel spending, and the potential to earn free night certificates. These cards are ideal for frequent travelers who prefer staying at specific hotel chains.

Are hotel credit cards worth the annual fees?

The value of a hotel credit card’s annual fee depends on your travel habits and how you plan to use the card’s benefits. If you stay at hotels frequently and can maximize the rewards and perks offered by the card, the annual fee may be justified. However, it’s essential to calculate the potential value you’ll receive from the card’s features to determine if it outweighs the fee.

Can I use hotel points for anything other than hotel stays?

While hotel points are primarily designed for redeeming hotel-related rewards, many hotel loyalty programs offer flexibility. Some programs allow you to use points for experiences, car rentals, or even transfer them to airline partners for flights. Check the specific program’s terms and conditions to explore all the redemption options available.

What should I consider when choosing a hotel credit card?

When selecting a best hotel credit card, consider factors such as the hotel chain’s presence in your preferred travel destinations, the card’s annual fee, the value of the welcome bonus, earning rates on spending categories that align with your expenses, and the additional benefits like elite status perks, free night certificates, and travel insurance. It’s essential to choose a card that complements your travel and spending habits.

Conclusion

Whether best hotel credit cards are worth it depends on your spending habits and travel preferences. If you value flexibility and high returns on everyday spending, flexible travel cards may be the better choice. However, if you frequently stay at branded hotels, seek elite status, or can maximize the value of free night certificates, a hotel credit card could be a valuable addition to your wallet.

Remember to analyze your spending patterns and travel goals to determine which type of credit card aligns best with your financial needs and lifestyle. Hotel credit cards may not be for everyone, but for the right traveler, they can unlock a world of benefits and rewards.