When it comes to credit cards, the AmEx Gold Credit Card stands out as one of the best options on the market. Its enticing signup bonuses, generous points multipliers, and lesser-known perks make it a favorite among savvy consumers. If you’re a proud AmEx Gold cardholder or considering getting one, here are ten essential tips and tricks to maximize its value and make that $250 annual fee well worth it.

1. Always Keep Your AmEx Gold Credit Card Handy

The key to making the most of your AmEx Gold Credit Card is accessibility. Ensure you have it in both your physical and digital wallets. This credit card offers excellent points multipliers for everyday spending categories, including:

- 4X points per dollar at restaurants worldwide

- 4X points for every dollar spent on groceries at US supermarkets

- 3X points per dollar on flights booked directly with airlines or through Amex Travel

Since dining and groceries are substantial monthly expenses for most people, maximizing these categories can significantly boost your rewards. Consider adding your AmEx Gold Credit Card to your digital wallet for quick and convenient payments while keeping the physical card for restaurant transactions, use 0 interest credit cards for avoiding extra fees.

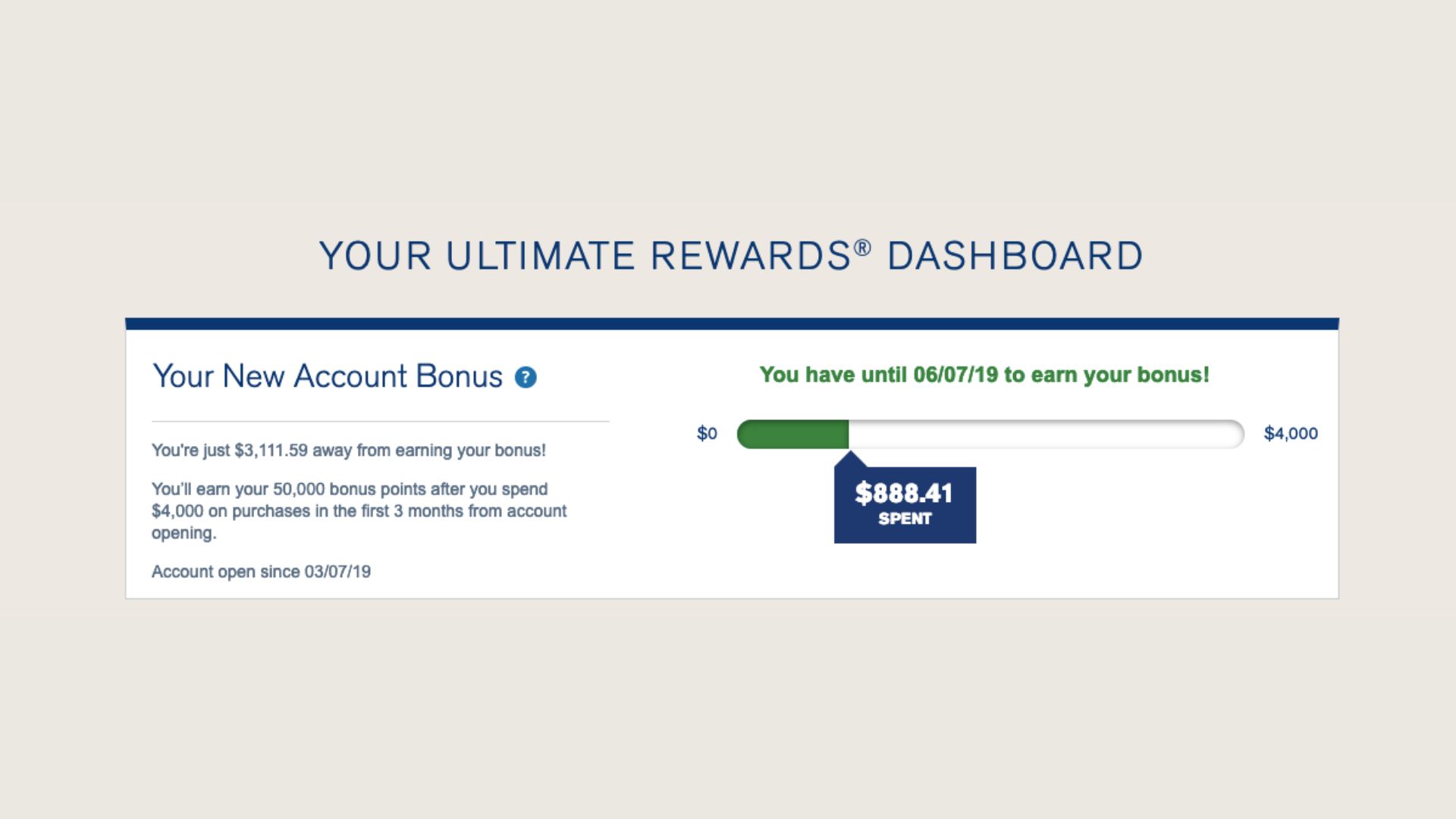

2. Track Your Signup Bonus Progress

The AmEx Gold Credit Card frequently offers enticing signup bonuses, often exceeding 60,000 Membership Rewards points. To qualify for these bonuses, you typically need to meet a minimum spending requirement within a specific timeframe, like spending $4,000 within the first six months.

While American Express doesn’t offer a built-in tracking system for your progress, you can estimate your monthly spending habits before applying to ensure you won’t struggle to meet the requirement. Additionally, set a reminder to check your progress halfway through the timeframe and contact Amex support for updates. Missing out on a signup bonus would be a costly oversight.

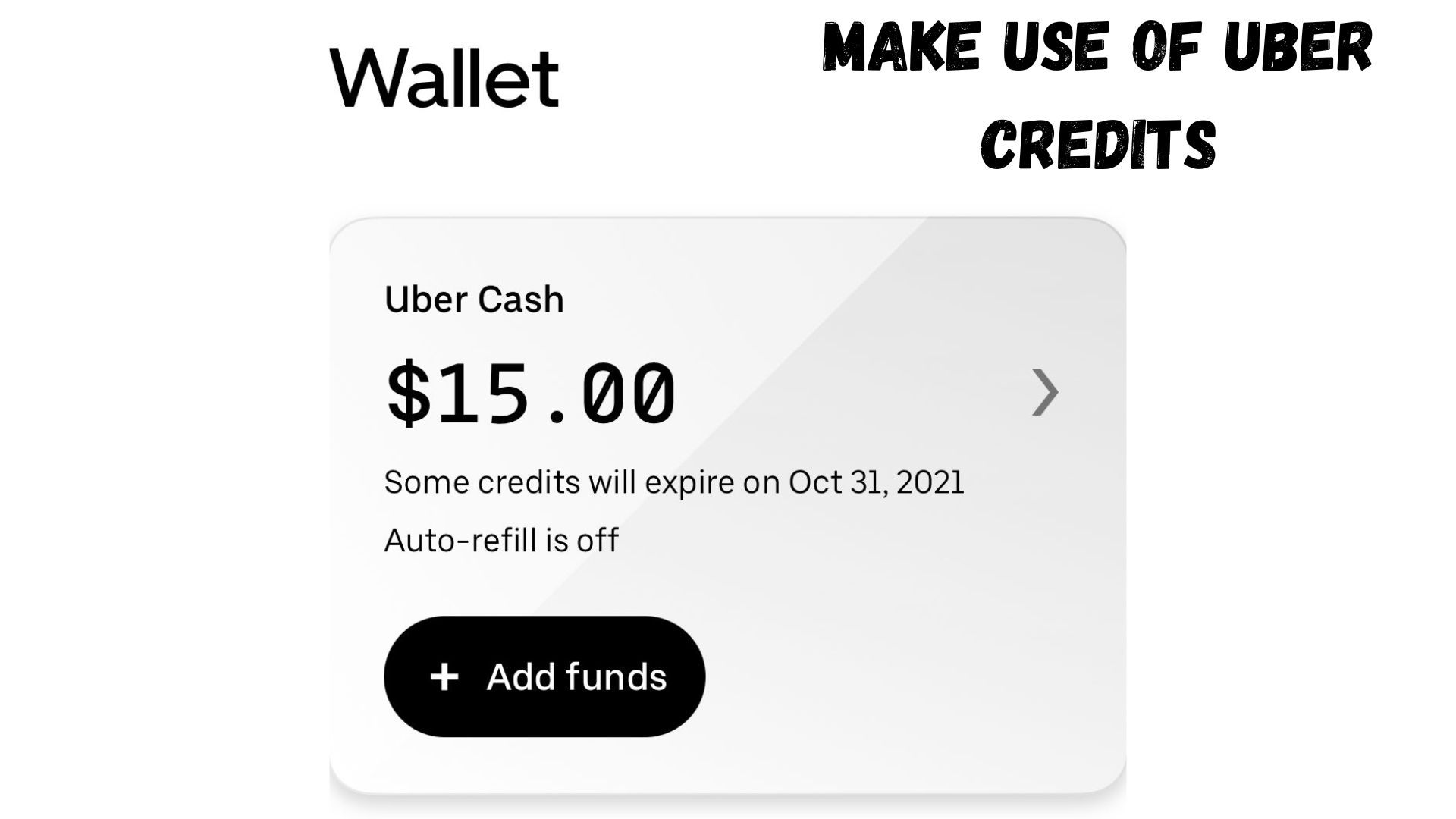

3. Make Use of Uber Credits

The AmEx Gold Credit Card provides $10 in Uber credits each month. To benefit from this perk, add your AmEx Gold card to your Uber wallet. These monthly credits can add up quickly and significantly offset the annual fee. Remember that these credits expire at the end of each month, so be sure to use them.

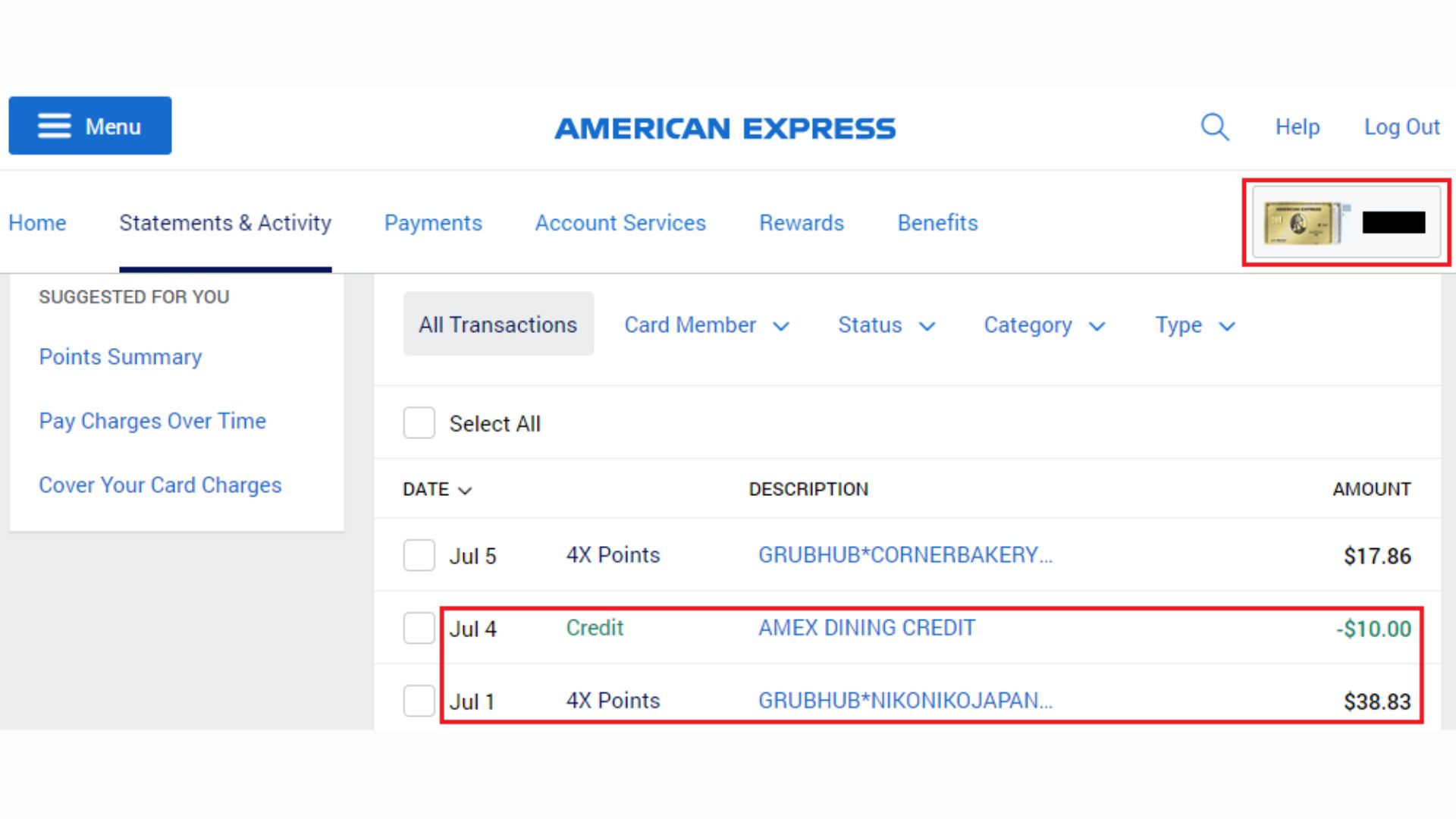

4. Enroll in the Dining Credit

Another way to reduce the annual fee is by enrolling in the dining credit program within your American Express account. You can receive up to $10 back each month at select dining partners, which include GrubHub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations. These credits can substantially lower your effective annual fee if you’re already spending money at these establishments.

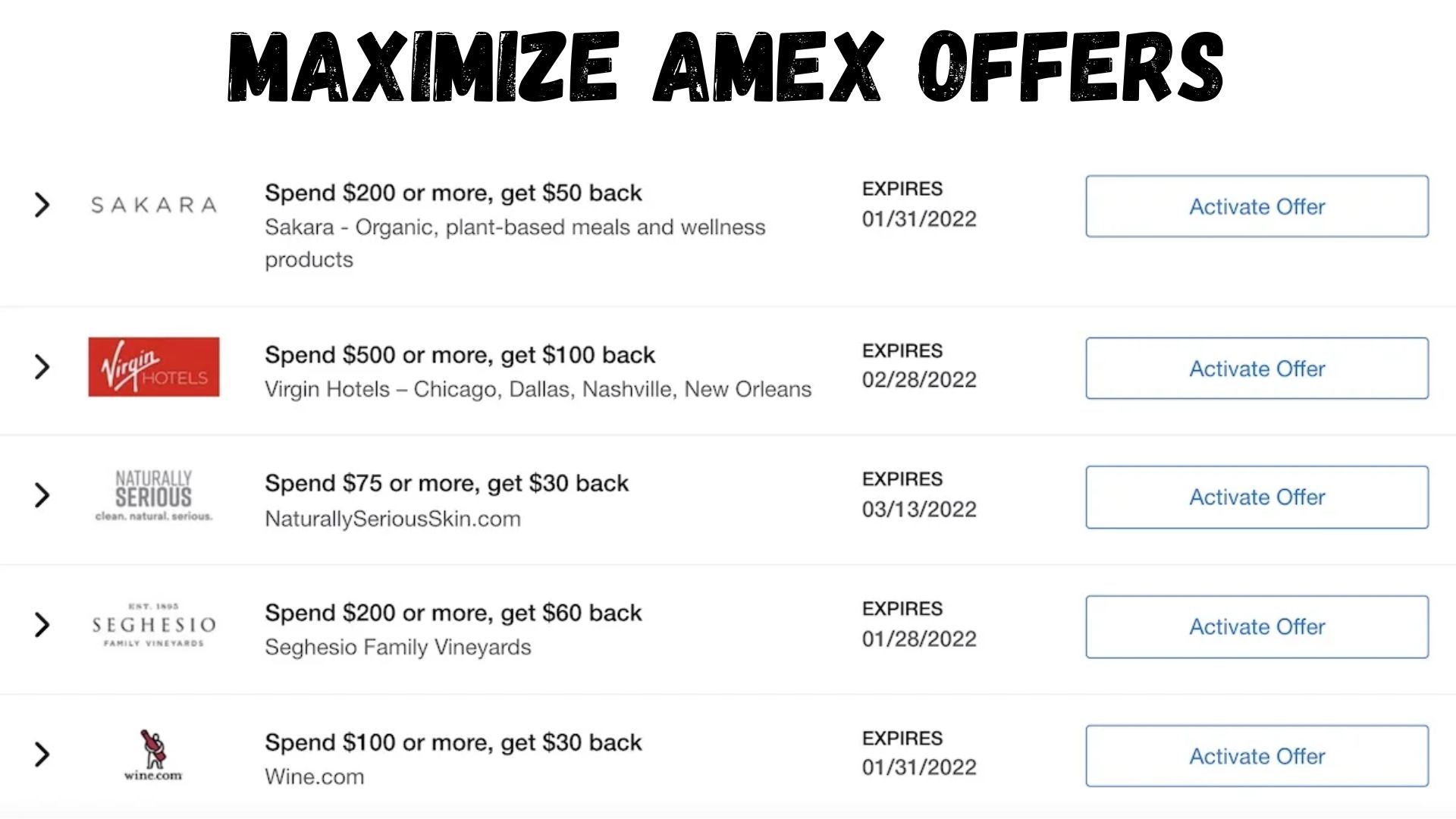

5. Maximize AmEx Offers

American Express regularly offers bonus deals with popular brands through its AmEx Offers program. You can save extra money or earn additional points by taking advantage of these offers. Simply log in to your American Express account, browse available offers, and add them to your card. Consider using tools like the Card Pointers app to efficiently add these offers to your account and maximize your savings.

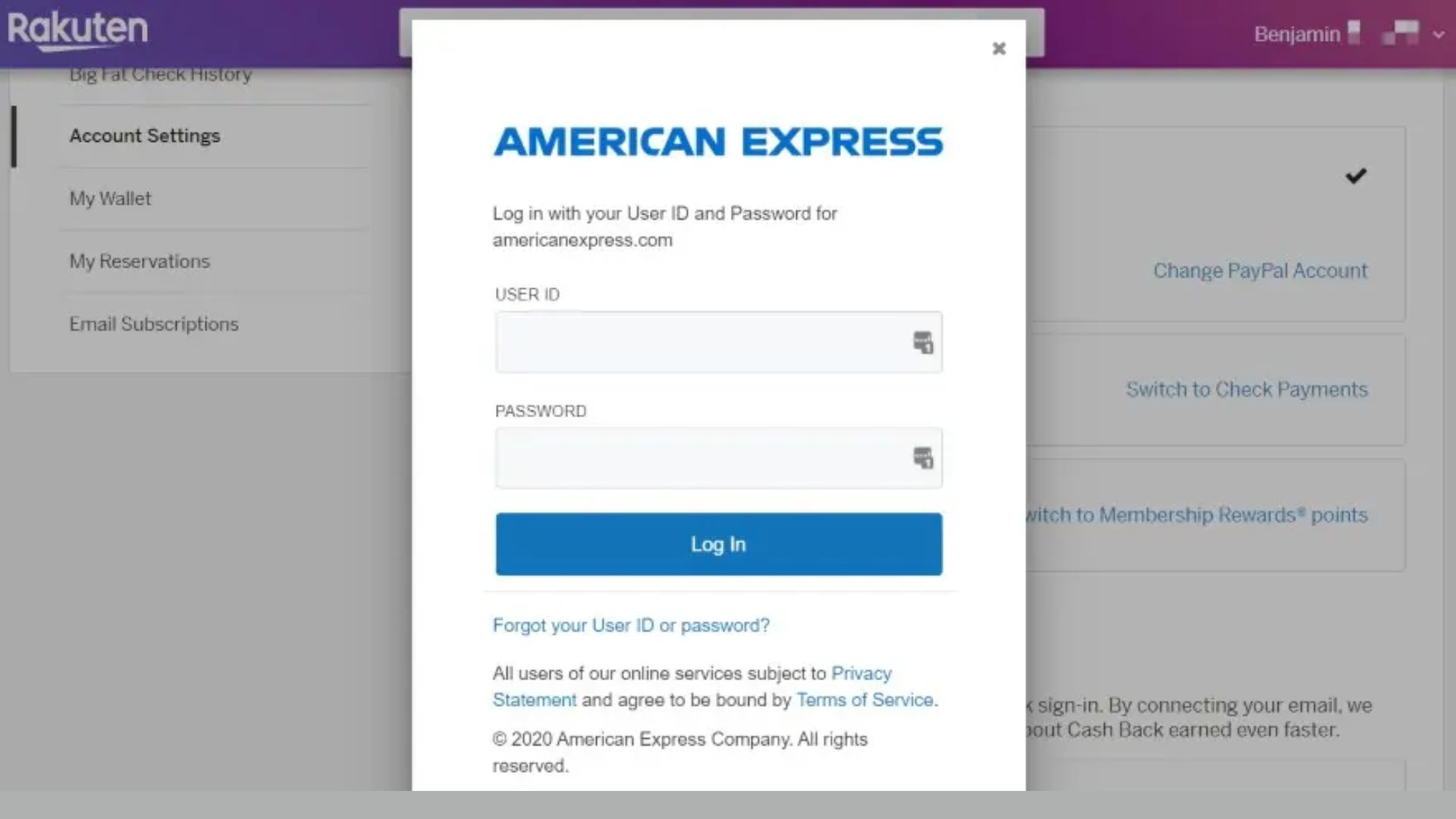

6. Link Rakuten to Membership Rewards

Rakuten, a cashback website, can help you earn extra Membership Rewards points when shopping online. Create a Rakuten account, click through their links to your favorite online stores, and earn cashback. What’s more, you can convert this cashback into American Express Membership Rewards points, which can be highly valuable when redeemed for travel.

7. Use the Hotel Collection for Travel

If you’re planning a hotel stay, consider booking through the AmEx Gold card’s, Hotel Credit Card Collection via Amex Travel. When booking a minimum of two nights at select hotels, you can enjoy room upgrades and a $100 experience credit, redeemable for dining, spa services, or resort activities. This hidden feature can significantly enhance your travel experience while getting the most out of your card.

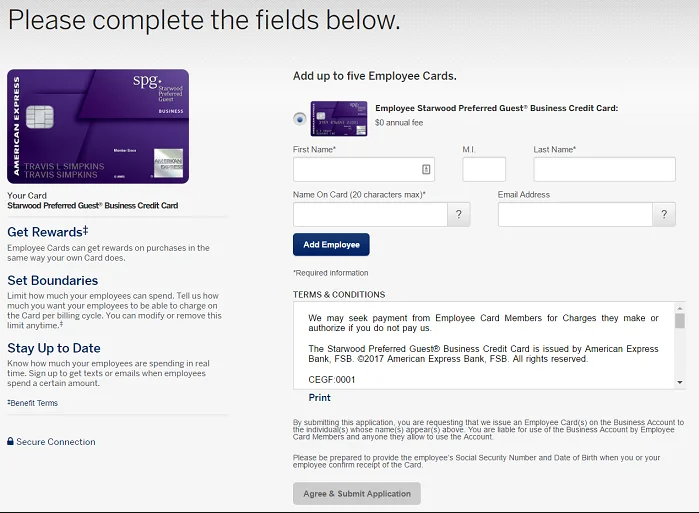

8. Add Authorized Users and Refer Others

The AmEx Gold card allows you to add up to five authorized user cards for free. This can be a valuable feature for families, as all the cards can earn rewards under one primary cardholder. Additionally, consider referring friends and family to get the AmEx Gold Credit Card. You can earn referral bonuses while helping others access the card’s benefits.

9. Lower Your Annual Fee

If you’re eligible, you can reduce your annual fee in several ways. Active-duty military members often have their annual fees waived. Corporate cardholders may receive a $100 personal card annual credit, making the annual fee more manageable. Lastly, explore retention offers by contacting Amex support before considering card cancellation.

10. Optimize Points Redemption

To make the most of your Membership Rewards points, explore transferring them to Amex’s travel transfer partners. This can yield a significantly higher redemption value compared to using points for cashback or merchandise. Understanding the redemption options and airlines credit card partner can help you stretch your points further.

Conclusion

In the world of credit cards, the AmEx Gold Credit Card shines as a brilliant gem, offering a multitude of ways to not only cover its annual fee but also to unlock a treasure trove of rewards and benefits. By following these ten savvy strategies, you can turn your AmEx Gold card into a powerful tool for saving money, earning valuable points, and enjoying a host of perks.

Remember, it’s not just a credit card; it’s your ticket to travel upgrades, dining delights, and financial flexibility. Whether you’re a long-time cardholder or considering joining the ranks, these tips will help you make the most of your AmEx Gold Credit Card and embark on a journey of smart spending and rewarding experiences. So, go ahead and maximize the value of your AmEx Gold card – the possibilities are as boundless as your imagination. Happy spending!

Frequently Asked Questions (FAQs)

What is a credit card annual fee, and should I be concerned about it?

A credit card annual fee is a yearly charge that some credit card issuers impose for using their cards. Whether you should be concerned about it depends on the card’s benefits. High annual fees are typically associated with premium cards that offer substantial rewards and perks. Consider if the card’s rewards and benefits outweigh the fee before applying.

What sets credit cards apart from debit cards?

A credit card allows you to borrow money from the card issuer up to a predetermined credit limit. You’ll need to repay the borrowed amount, often with interest, at a later date. A debit card, on the other hand, is linked to your bank account and directly deducts funds when you make a purchase, without borrowing or accruing interest.

How can I improve my credit score with a credit card?

To improve your credit score with a credit card, pay your bills on time, keep your credit utilization low (ideally below 30% of your credit limit), and maintain a long, positive credit history. Responsible credit card use, like avoiding late payments and not maxing out your cards, can positively impact your credit score.

What is a secured credit card, and who should consider getting one?

A secured credit card requires a cash deposit as collateral, which typically becomes your credit limit. It’s an excellent option for people with limited or damaged credit histories who want to build or rebuild their credit. Secured cards offer the opportunity to demonstrate responsible credit use to credit bureaus.

How do I choose the right credit card for my needs?

Selecting the appropriate credit card hinges on your financial objectives and spending patterns. Consider factors such as your credit score, the type of rewards you prefer (cashback, travel rewards, points), annual fees, and specific benefits like travel insurance or extended warranties. Compare different card offers and choose one that aligns with your priorities.