Are you a movie enthusiast who enjoys the immersive experience of AMC theaters? If so, we’re going to let you in on some fantastic news. AMC has recently introduced a brand-new Visa credit card that can elevate your movie-going experience to new heights. In this guide, we delve into the exciting world of this Visa credit card, offering exclusive insights into its benefits, rewards, and application process. Whether you’re a dedicated moviegoer seeking ticket discounts and popcorn perks or someone aiming to boost their credit score responsibly, our comprehensive coverage of the AMC Credit Card has you covered.

AMC credit card

The AMC credit card is a movie enthusiast’s dream, offering a unique blend of entertainment perks and credit-building potential. With pre-qualification without affecting your credit score, bonus bucks, free popcorn, and rewards on everyday spending, it enhances your movie nights and financial well-being. Exclusive benefits for AMC Stub members, no annual fee, and widespread Visa acceptance make it a versatile choice. Whether you’re a movie buff or aiming to boost your credit score, this card offers a rewarding experience.

Discover Your Pre-Qualified Limit

One of the standout features of the AMC credit card is its commitment to transparency. Unlike many other credit cards, the AMC card provides you with your pre-qualified credit limit before you even complete the application process. This feature is a game-changer, especially for those looking to build or rebuild their credit.

A Soft Pull Pre-Approval

One of the primary concerns when applying for credit cards is the impact on your credit score. With the AMC card, you can explore your pre-qualification status without worrying about a hard inquiry affecting your credit. If you have bad credit score, check best credit cards to rebuild your credit score. The pre-qualification process involves a soft pull, which leaves no trace on your credit report. It’s a risk-free way to gauge your eligibility for this card.

Building Your Credit Score

If your credit score is currently below 700, adding a new credit card line like the AMC credit card can be a powerful tool for improving your credit score. According to users, on average, adding this card to their credit profile has resulted in an increase of approximately 50 points. Remarkably, this improvement doesn’t require the removal of any negative items from your credit history. It’s a testament to the card’s potential as a credit-building tool.

Movie Rewards Galore

While the credit-building aspect is undoubtedly enticing, what truly sets the AMC credit card apart is its commitment to rewarding movie lovers. Here are some of the key benefits that will make your movie nights even more enjoyable:

AMC 50 Stub Bonus Bucks

New cardholders have the privilege of receiving $50 worth of bonus bucks. These bonus bucks can be used for movie snacks, tickets, or any other purchases within the theater. However, there’s a catch – you must utilize these bonus bucks within the first three months of opening your account. It’s a fantastic incentive to kickstart your journey with this card.

Free Large Popcorn

Who doesn’t love the delicious aroma of freshly popped popcorn at the movies? With the AMC credit card, you can enjoy a free large popcorn every month. To qualify, simply spend $250 or more each month during your initial six months as a cardholder. This means that you can collect up to six complimentary large popcorns during this period. The offer is loaded directly into your account the following month.

Earn Points Everywhere

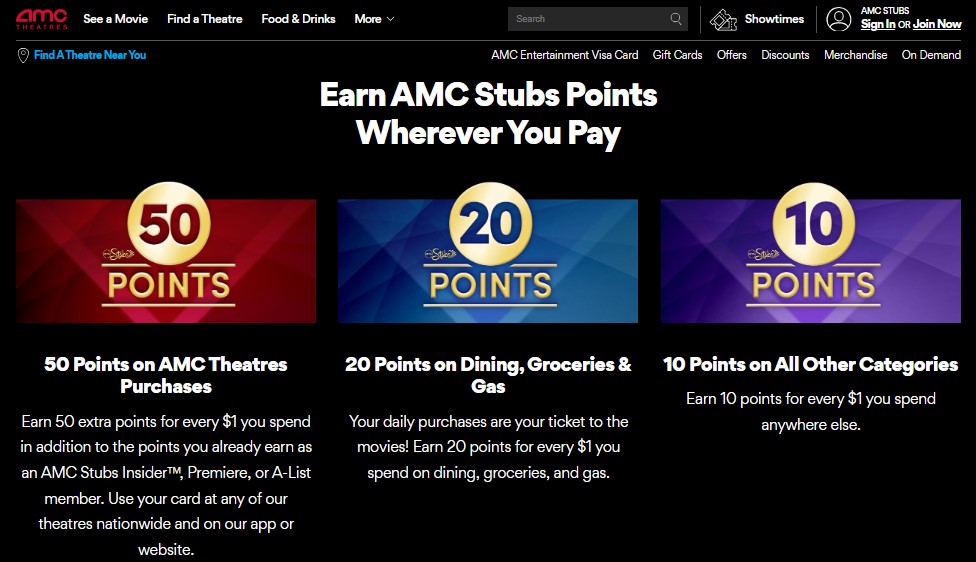

The AMC credit card allows you to earn points not just at the movies but everywhere you shop. The breakdown of the income potential is as follows:

- 50 points on AMC Theater purchases: Every time you buy movie tickets, snacks, or other items at AMC theaters, you earn valuable points.

- 20 points on dining, grocery, and gas: Your everyday expenses can now contribute to your next movie night. Check the list of best credit card for groceries.

- 10 points on all other categories: Even if your purchases don’t fall into the above categories, you’re still earning points that can be redeemed for movie-related rewards.

Exclusive Benefits for Stub Members

To apply for the AMC Visa credit card, you need to become a Stub member. The good news is that becoming a Stub member is entirely free, and it comes with its own set of benefits. Stub members have the opportunity to earn points even faster, making their movie experiences even more rewarding.

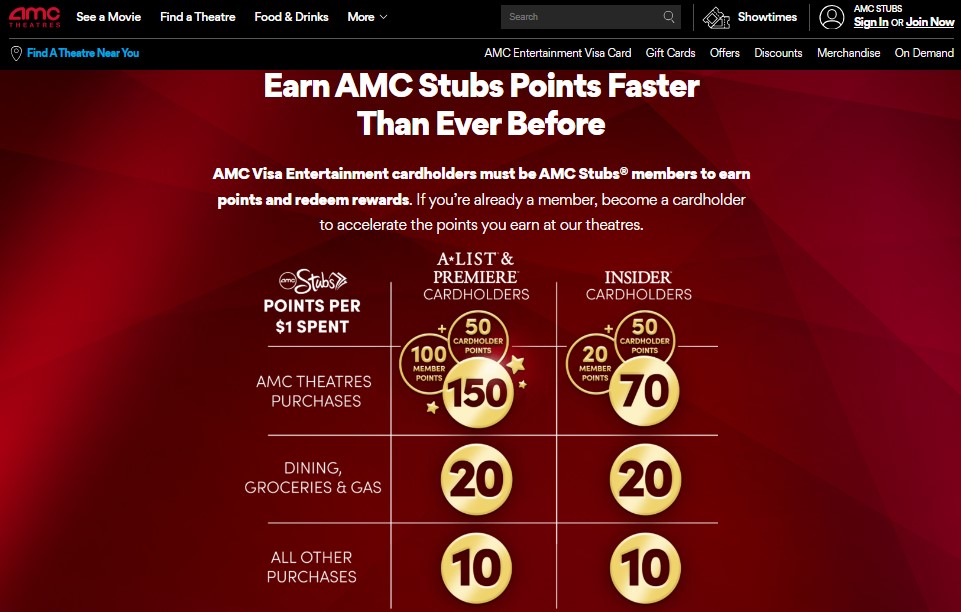

Enhanced Rewards for A-List Premier Cardholders

If you’re an A-list premier cardholder, you’re in for even more rewards. With the AMC credit card, A-list premier members can enjoy the following benefits:

- Up to 150 points on AMC purchases: Your loyalty to AMC theaters is recognized and rewarded with extra points.

- 20 points on dining, grocery, and gas: These everyday expenses now contribute significantly to your rewards.

- 10 points on all other purchases: Whether you’re shopping for clothes, electronics, or anything else, you’ll keep earning points.

This added bonus is a great reason to consider becoming an A-list premier member if you’re not one already.

No Annual Fee and Wider Acceptance

Let’s face it; credit cards often come with a laundry list of fees that can add up over time. The AMC credit card bucks this trend by offering no annual fee. That’s right; you can enjoy all the incredible benefits of this card without worrying about any additional costs eating into your rewards.

Wider Acceptance with Visa

The AMC credit card is not just limited to AMC theaters. It’s a Visa card, which means it can be used wherever Visa is accepted. This broader acceptance allows you to accumulate points on a wide range of purchases, further enhancing the rewards potential of this card. Whether you’re shopping for groceries, filling up your gas tank, or treating yourself to a nice dinner, you’re earning points that can be redeemed for cinematic experiences.

The Application Process

Now that you’re intrigued by the AMC credit card’s benefits, let’s walk through the application process. It’s essential to understand the steps involved so that you can apply with confidence and ease.

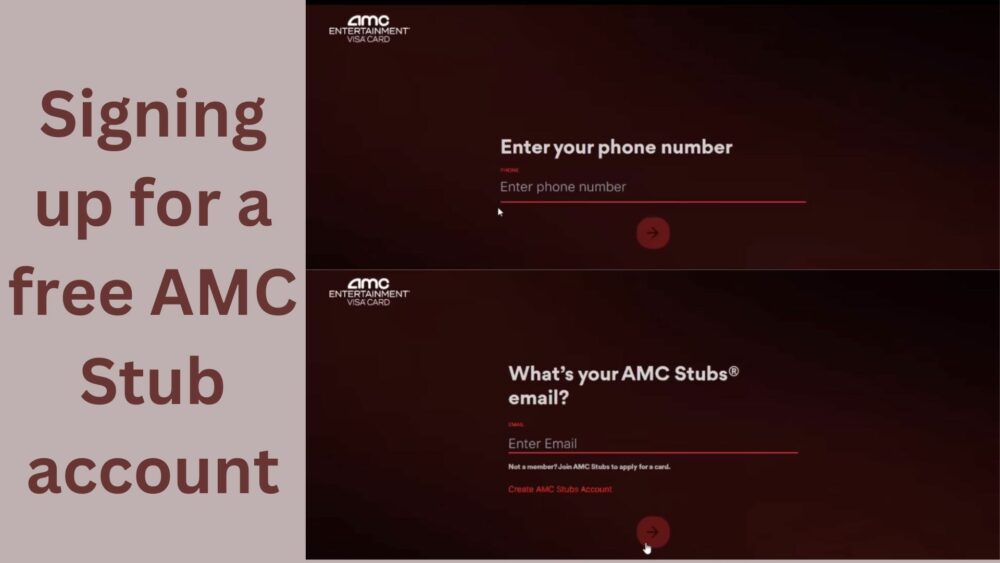

Stub Membership

To initiate the application process for the AMC Visa credit card, you must first become a Stub member. The good news is that this membership is entirely free. Here’s how to get started:

- Sign Up: Visit the AMC website and sign up for a free AMC Stub account. This account is required to apply for the credit card.

- Email Verification: After signing up, you’ll receive an email verification to confirm your account.

- Personal Information: Complete your account setup by providing the necessary personal information.

- Email Confirmation: Once your Stub account is set up, you can proceed with the credit card application.

Credit Card Application

Now that you’re a Stub member, you’re ready to apply for the AMC Visa credit card. The following is a list of the steps in the application process:

- Enter Your Email: Provide the email address associated with your Stub account. You’ll receive a verification code at this email address.

- Verification Code: Enter the verification code you received in your email.

- Complete Your Application: Fill out your credit card application, starting with your first and last name.

- Agree to Terms: Review the terms and conditions, and check the box to indicate your agreement.

- Continue the Application: Click the arrow to proceed to the next step.

- Personal Information: Enter your date of birth and address information accurately.

- Income Details: Select the option that best fits your primary source of income, and provide your annual or monthly income.

- Living Situation: Indicate whether you own or rent your home and specify the amount you pay for living expenses.

- Social Security Number: Enter your full social security number. It’s essential to note that, once again, this step will not impact your credit score; it’s a soft pull.

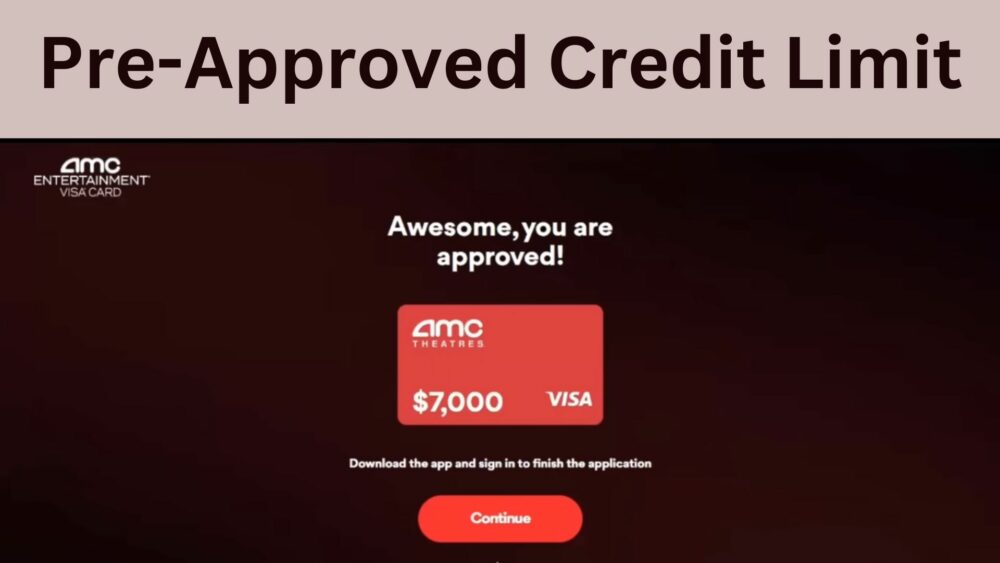

Soft Pull Pre-Qualification

After submitting your application, you’ll receive your pre-approved credit limit. For many applicants, this can be a substantial sum. In our case, it was a generous $7,000. This is a fantastic opportunity to assess whether the card aligns with your financial goals.

Decision Time

Here’s where you’ll need to make a choice. If you’re pleased with your pre-approved credit limit and the card’s terms and conditions, you can choose to continue with the application. However, be aware that proceeding will result in a hard inquiry on your credit report. The good news is that the approval rates at this stage are quite high, ranging from 80% to 90%. Still, it’s crucial to understand that approval is not guaranteed, despite the high likelihood.

If you’re uncertain or not satisfied with the offer, you have the freedom to decline without any negative consequences. It’s a no-harm, no-foul scenario, and your credit remains unaffected.

Conclusion

The AMC Entertainment Visa credit card is more than just a credit card; it’s a ticket to a more rewarding movie experience. Whether you’re a regular at AMC theaters or just beginning your credit journey, this card has something to offer you. Remember, when considering a credit card, it’s essential to assess your financial situation, needs, and goals. Credit cards can be valuable financial tools, but they should be used wisely and responsibly.

Frequently Asked Questions (FAQs)

What is the AMC Entertainment Visa credit card?

The AMC Entertainment Visa credit card is a co-branded credit card offered by AMC Theatres and Visa. It’s designed for movie enthusiasts and provides various benefits, including rewards for AMC movie purchases, bonus bucks, and the opportunity to build or improve your credit score.

How can I check if I’m pre-qualified for the AMC credit card?

You can check your pre-qualification status for the AMC credit card without affecting your credit score. The pre-qualification process involves a soft pull, which means it won’t leave a mark on your credit report. To see if you’re pre-qualified, follow the application process, and you’ll receive your pre-approved credit limit before making a final decision.

What rewards can I expect with the AMC credit card?

The AMC credit card offers several rewards, including:

- $50 worth of bonus bucks for new cardholders.

- Free large popcorn every month for cardholders who spend $250 or more each month during their initial six months.

- Points on various purchases, such as 50 points on AMC Theater purchases, 20 points on dining, grocery, and gas, and 10 points on all other categories.

Is there an annual fee for the AMC credit card?

No, there is no annual fee for the AMC Entertainment Visa credit card. You can enjoy all the card’s benefits without having to worry about annual charges.

Can I use the AMC credit card outside of AMC theaters?

Yes, you can! The AMC credit card is a Visa card, which means it’s widely accepted wherever Visa cards are taken. This feature allows you to earn points on a variety of purchases beyond just movie-related expenses, making it a versatile rewards card.