If you’ve ever thought of the question, “How much house can I afford with a 100k salary?”, you’re not alone. Navigating the real estate market with a $100,000 annual income requires a comprehensive understanding of various financial factors. In this guide, we’ll delve into the essential aspects of determining your home affordability, including the renowned 28/36 rule, the significance of your down payment, the impact of your credit score, and how location influences your housing budget. By the end, you’ll have a well-rounded perspective on how to make the most informed decisions when it comes to finding your dream home within the confines of your financial means.

Understanding Your Income

The first factor is your monthly gross income is a crucial figure in the homebuying process. It’s essential to clarify that lenders always consider your gross income, not your net pay when assessing your eligibility for a mortgage. Gross income represents the total amount you earn before deductions, such as taxes and retirement contributions.

In your case, with an annual salary of $100,000, your monthly gross income would be approximately $8,333. This serves as the starting point for understanding your housing budget.

The Role of Debt-to-Income Ratio (DTI)

The next critical factor in assessing your home affordability is your Debt-to-Income Ratio (DTI). The DTI represents the percentage of your monthly gross income that goes toward servicing debts. This ratio is a key metric that lenders consider when determining your eligibility for a mortgage.

Typically, a DTI of 43% is a widely accepted guideline. To calculate your maximum recommended monthly debt payments, you can use the following formula:

DTI = (Total Monthly Debt Payments / Monthly Gross Income) x 100

For a $100,000 annual income, this translates to a maximum recommended monthly debt payment of approximately $3,583.

Your total monthly debt payments should include obligations such as auto loans, student loans, and credit card payments. However, it’s essential to consider only the minimum monthly payments for these debts when calculating your DTI.

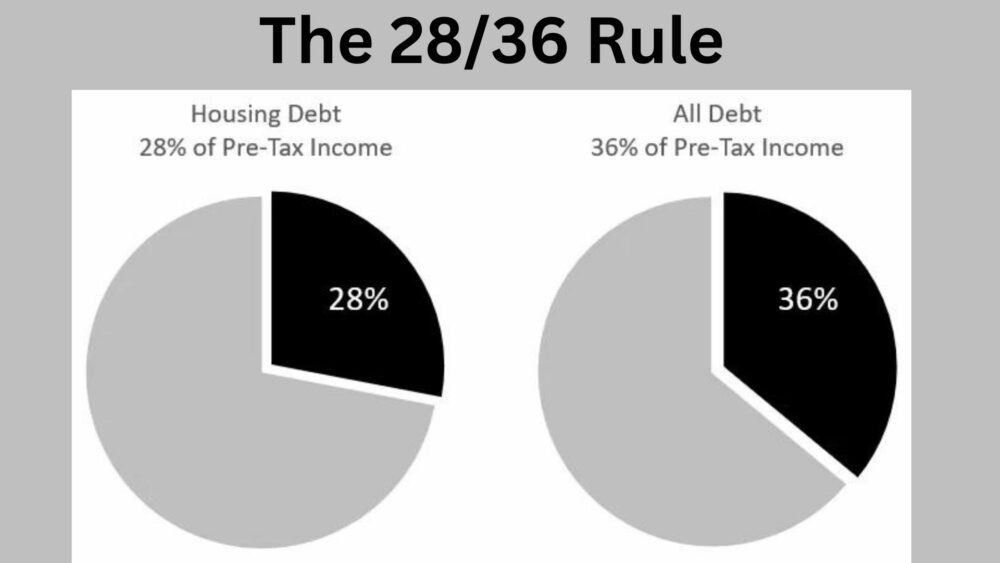

The 28/36 Rule: Breaking It Down

The 28/36 rule is a practical guideline that simplifies the DTI concept. It provides a clear framework for determining how much house you can afford while considering your overall financial situation.

Here’s a closer look at the components of the 28/36 rule:

1. The 28% Rule

The first number in the 28/36 rule, 28%, represents the maximum recommended percentage of your gross monthly income that should be allocated to housing-related expenses. This includes your potential mortgage payment, property taxes, homeowners’ insurance, and any homeowners’ association fees.

For example, if you earn $100,000 annually, your monthly gross income is around $8,333. Following the 28% rule, your total monthly housing expenses should not exceed $2,333 (28% of $8,333).

2. The 36% Rule

The second number in the 28/36 rule, 36%, represents the maximum recommended percentage of your gross monthly income that should be dedicated to all of your monthly debts. This includes housing costs, credit card payments, auto loans, student loans, and any other financial obligations.

Continuing with our $100,000 salary example, this means that your total monthly debt payments, including housing expenses, should not surpass $3,000 (36% of $8,333).

Calculating Your Maximum Monthly Housing Payment

This figure is a critical element in determining how much house you can afford while maintaining a balanced financial life.

Let’s break down the calculation:

- 28% of Your Gross Monthly Income: In our example, this is $2,333.

- Total Monthly Debt Payments: As per the 36% rule, this should not exceed $3,000.

To ensure that your housing expenses remain within the recommended 28% of your income, you must subtract your total monthly debt payments from that figure:

$2,333 – $3,000 = -$667

In this hypothetical scenario, you would need to adjust your total monthly housing expenses to $2,333 or less to align with the 28/36 rule. This is a simplified illustration, and your specific situation may differ. However, the 28/36 rule provides a helpful starting point for understanding your financial capacity.

The Role of Down Payment

One of the most significant variables is your down payment. A down payment is the initial cash amount you contribute when purchasing a home.

The standard recommendation for a down payment is typically 10% to 20% of the home’s purchase price. However, various loan programs offer flexibility in this regard:

- Conventional Loans: These loans often require down payments ranging from 3% to 20%. The specific requirement depends on factors such as your credit score and lender policies.

- FHA Loans: FHA loans allow down payments as low as 3.5% of the home’s purchase price, making homeownership more accessible for many individuals.

- VA and USDA Loans: These VA and USDA loan programs offer the opportunity for a 0% down payment, which can be particularly advantageous for eligible veterans and rural homebuyers.

The amount you put down as a down payment significantly influences your monthly mortgage payment and, consequently, the overall price range of homes you can consider.

The Role of Credit Score

Another critical factor in determining your mortgage options and interest rates is your credit score. Your credit score is a tool that lenders can use to determine your creditworthiness. A higher credit score typically leads to better loan terms, such as lower interest rates and more favorable loan conditions.

Conversely, a lower or bad credit score may limit your loan options and result in higher interest rates, potentially making homeownership less affordable. Therefore, it’s essential to monitor your credit report, address any issues or discrepancies, and work on improving your credit score before embarking on the homebuying journey.

Considering Additional Costs

When determining how much house you can afford, it’s crucial to consider not only your mortgage payment but also other associated costs. Owning a home comes with various financial responsibilities, and understanding these expenses is key to maintaining financial stability.

Consider the following additional expenses:

Property Taxes

Property taxes are a significant component of homeownership expenses, and their impact can vary widely depending on your location. It’s essential to research property tax rates in the area where you plan to buy a home, however you can avoid taxes legally for savings. High property tax rates can substantially increase your monthly housing expenses, potentially affecting how much house you can afford.

Homeowners Insurance

In order to safeguard your investment, you must have homeowner’s insurance. The cost of homeowners insurance can vary based on factors such as the size and condition of the home and your location. It’s advisable to obtain insurance quotes to factor this expense into your budget.

Homeowners Association (HOA) Fees

If you purchase a property in a community with a homeowners’ association (HOA), you’ll likely have monthly or annual HOA fees. These fees cover common area maintenance, community amenities, and other shared expenses. HOA fees can vary widely, so it’s essential to understand the financial obligations associated with your chosen neighborhood.

Maintenance and Repairs

Owning a home entails ongoing maintenance and potential repairs. Budgeting for routine maintenance, such as lawn care, HVAC servicing, and general upkeep, is essential. Additionally, it’s wise to set aside funds for unexpected repairs, such as a leaking roof or a malfunctioning furnace. Being financially prepared for these situations can help you avoid financial stress down the road.

Balancing Your Budget and Financial Goals

Like other guidelines are valuable tools, it’s equally crucial to balance your budget and financial goals when considering homeownership. Your housing expenses should fit comfortably within your overall financial framework, ensuring that you have room for other essential expenses, savings, and leisure activities that contribute to your quality of life. Learn how to create a budget to manage the finances.

Remember that pursuing homeownership should align with your broader financial objectives. While having a $100,000 salary is a significant achievement, it’s not the sole determinant of your financial well-being. Prioritizing your financial stability and happiness over arbitrary income or purchase price targets is paramount.

The Stepping Stone Approach

If your current financial situation doesn’t allow you to afford your dream home immediately, don’t be discouraged. The stepping stone approach to homeownership offers a strategic path to gradually achieve your housing goals while maintaining financial stability.

Here’s how the stepping stone approach works:

- Start with What You Can Afford: Begin by purchasing a home that aligns with your current financial capacity. This might mean buying a smaller or less expensive home than your long-term goal.

- Build Equity and Appreciation: As you make mortgage payments and the value of your home appreciates, you’ll start building equity. This equity can be leveraged for future home purchases.

- Pay Down the Mortgage: Consider making extra payments on your mortgage or paying it down more quickly to build equity faster. Reducing your mortgage balance increases your financial flexibility.

- Leverage Equity for a Bigger Home: Once you’ve built sufficient equity, consider selling your current home and using the proceeds as a down payment for a larger, more expensive home. This step-by-step approach allows you to progressively move toward your desired homeownership goals while maintaining financial stability and security.

Local Variations in Home Affordability

Keep in mind that your geographical location plays a significant role in determining how much house you can afford with a $100,000 salary. Housing markets across the United States vary widely, and what may be affordable in one region could be out of reach in another.

For example, in areas with a higher cost of living, a $100,000 salary may be considered moderate, and individuals might purchase homes in the lower price range. Conversely, in regions with a lower cost of living, a $100,000 salary may provide more purchasing power, enabling individuals to consider more expensive homes.

Additionally, if you’re moving to a new area, consider how your current equity and assets can be transferred to your new home purchase. Transferring equity from a previously owned property can significantly impact your affordability and options in the new location.

Conclusion

In conclusion, determining how much house you can afford with a $100,000 salary involves a holistic approach that considers various factors, including income, debts, location, down payment, credit score, and additional expenses. Remember that your happiness and financial peace of mind should be the guiding factors in your homeownership journey. By following sound financial principles and considering all aspects of your financial situation, you can confidently navigate the path to homeownership that suits your needs and aspirations.

Frequently Asked Questions (FAQs)

What is the 28/36 rule, and how does it help me determine my housing affordability?

The 28/36 rule advises that housing costs should not exceed 28% of your income, and total debts, including housing, should not surpass 36%. It guides you in budgeting for a mortgage responsibly.

Can I afford a home with a $100,000 salary if I have existing debts?

Yes, you can. Lenders often allow a debt-to-income ratio (DTI) of up to 43%. Managing your DTI and budgeting effectively will help determine your home affordability.

How does my down payment amount impact the type of home I can afford?

A larger down payment reduces your loan amount and lowers your monthly mortgage payment. While 20% is common, various loan programs offer flexibility.

What role does my credit score play in determining my ability to afford a home?

A higher credit score leads to better loan terms, including lower interest rates. It can help you qualify for larger loans, making homeownership more affordable.

How can I determine the affordability of homes in different locations with a $100,000 salary?

Assess affordability in various areas by researching local property taxes, insurance costs, and housing market trends. Consider equity from a previous property when moving to a new location.