If you’re looking to build or rebuild your credit, you’ve probably come across the Total Credit Card. In this comprehensive guide, we’ll delve into the details of this credit card and explore whether it’s the right choice for you. We’ll also provide you with alternative credit-building options that might be more cost-effective and efficient.

What is the Total Credit Card?

Total Credit Card is known for extending credit to individuals with poor or limited credit histories. This means that even if your credit score isn’t stellar, you may still qualify for this card. However, before you rush to apply, let’s examine the critical aspects, including the application process, fees, and more.

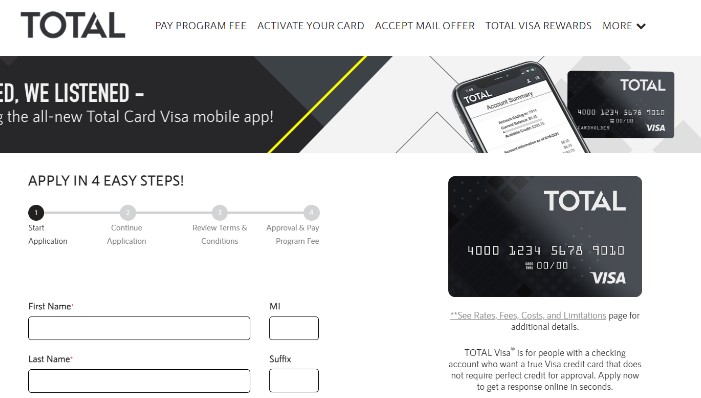

How to Apply for the Total Visa Credit Card

To apply for the Total Visa Credit Card, follow these steps:

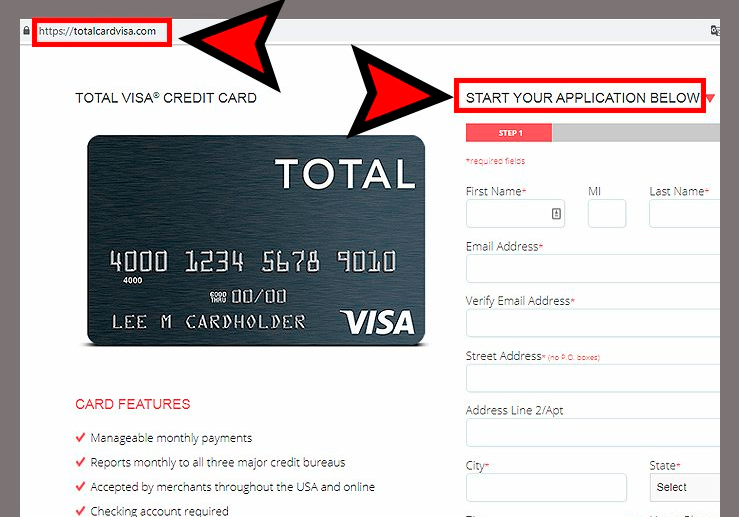

- Visit my website www.totalcardvisa.com

- Their application is on the home page. Scroll down and look for the heading “Start Your Application Below.”

- Enter your first and last name. Provide and re-enter your email address. Enter your street address, your home phone number, and your mobile phone number.

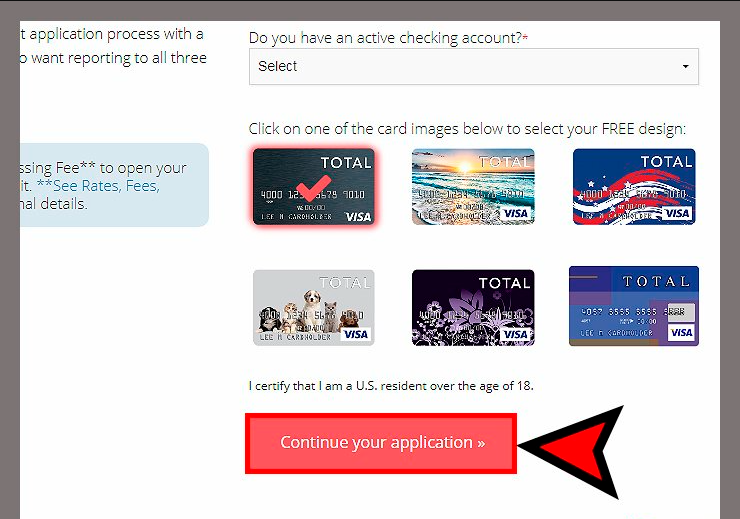

- Select whether you have an active checking account and choose a card design. Click the red button saying “Continue Your Application” and follow the prompts to finish your Total credit card application.

Beware of High Fees

While the Total Credit Card may offer credit to those with poor credit, it comes with some significant drawbacks, primarily high fees. Here’s a breakdown of the fees associated with this card:

- APR (Annual Percentage Rate): The APR for this card is a staggering 34.99–35%, which is considerably higher than average.

- Program Fee: There’s a one-time program fee of $89 when you first get the card.

- Annual Fee: The annual fee is $75 after the first year. This fee is charged annually.

- Monthly Servicing Fee: After the first year, a monthly servicing fee of $75 is imposed.

These fees can add up quickly and make the Total Credit Card an expensive choice for building credit. While it’s true that this card can help boost your credit score if you keep the balance low and pay on time, there are more cost-effective alternatives.

Explore Better Alternatives

Here are some alternative options that can help you build or rebuild your credit without the high fees associated with the Total Visa Credit Card:

1. Capital One Credit Cards

Capital One offers a variety of credit cards designed to cater to different credit profiles. You can check if you’re pre-approved for one of their cards without a hard credit inquiry, which won’t negatively impact your credit score.

2. Navy Federal Credit Union

Navy Federal Credit Union is known for providing generous credit limits. They also offer secured credit cards for those with poor credit, and you can pre-qualify for their cards without a hard inquiry.

3. Discover Credit Cards

Discover also has a range of credit cards, and they offer pre-qualification options. Many of their cards have no annual fees.

4. Credit Builder Card

Consider a credit builder card, like the one that comes with a $200 limit. These cards don’t require a credit check and report to all three major credit bureaus, helping you establish or rebuild your credit.

5. OpenSky Secured Credit Card

OpenSky offers a secured credit card without a credit check. You can put down a deposit, and if you manage your account responsibly, they may increase your credit limit over time.

6. Other Options

Additional options to explore include Credit One Bank, Mission Lane, Mode, Prosper, Milestone, Indigo, and Destiny. Many of these cards offer pre-qualification without a hard inquiry, making it easier to assess your eligibility without affecting your credit score.

Conclusion

While the Total Credit Card may be an option for those with poor credit, the high fees associated with it make it a less desirable choice. We recommend exploring alternative credit-building options that offer more favorable terms and conditions.

Remember that building or rebuilding your credit is a journey, and you have several paths to choose from. Consider your financial situation and goals, and select the credit card that best aligns with your needs. As you make responsible financial decisions and manage your credit wisely, you’ll be on your way to improving your credit score and achieving your financial objectives.

Frequently Asked Questions(FAQs)

Is the Total Visa Credit Card a good option for building credit?

A1: The Total Visa Credit Card can be an option for those with poor credit, but it comes with high fees, including a high APR, annual fee, and monthly servicing fee. There are more cost-effective alternatives to consider.

What are the alternatives to the Total Visa Credit Card for building credit?

A2: There are several alternatives to the Total Visa Credit Card, including credit cards from Capital One, Navy Federal Credit Union, and Discover. Additionally, credit builder cards and secured cards can help you build credit without the high fees associated with Total Visa.

How can I check if I’m pre-approved for a credit card without a hard inquiry?

A3: Many credit card issuers, such as Capital One, Navy Federal, and Discover, offer pre-qualification tools on their websites. You can use these tools to see if you’re pre-approved for their credit cards without affecting your credit score.

What is a credit builder card, and how does it work?

A4: A credit builder card is a type of credit card that is designed to help individuals with limited or poor credit histories build or rebuild their credit. These cards typically have lower credit limits and may require a security deposit. They report your payment history to the major credit bureaus, helping you improve your credit over time.

Are there credit cards with no annual fees for building credit?

A5: Yes, many credit cards designed for building or rebuilding credit have no annual fees. These cards can be a more budget-friendly option for those looking to establish or improve their credit.

What’s the importance of responsible credit management?

A6: Responsible credit management is crucial for building and maintaining good credit. This includes paying your bills on time, keeping your credit card balances low, avoiding late payments, and monitoring your credit reports for accuracy.

Can I apply for multiple credit cards to build credit faster?

A7: Applying for multiple credit cards at once can lead to hard inquiries on your credit report, which may temporarily lower your credit score. It’s generally recommended to apply for one or two credit cards at a time, use them responsibly, and build your credit gradually.

What should I consider when choosing a credit card for building credit?

A8: When choosing a credit card for building credit, consider factors like annual fees, APR, credit limits, and the issuer’s reputation. Select a card that aligns with your financial goals and ability to manage credit responsibly.