When it comes to luxury hotel chains, Hilton is undoubtedly one of the biggest names in the world. With properties scattered across glamorous destinations like Hawaii, Cabo, and even Rome, Hilton offers travelers a taste of elegance wherever they go. While there are hundreds of Hilton properties worldwide, there are only three primary Hilton credit cards, and four if you include the Hilton Business Credit Card. In this article, we will focus on the personal credit cards – the Hilton Honors, Hilton Surpass, and Hilton Aspire. No matter where you are in life or what your spending habits are, one of these three credit cards is likely to be the perfect fit for you.

Annual Fees: Just the Tip of the Iceberg

Annual fees are just the starting point when it comes to differentiating these three credit cards. In this article, we will explore the benefits, credits, and other features offered by each card. This comprehensive analysis will help you determine which card is the best choice for your specific needs. It’s akin to a Goldilocks journey – we’ll figure out which card offers just the right features for your taste.

Reward Multipliers: Earning Hilton Points

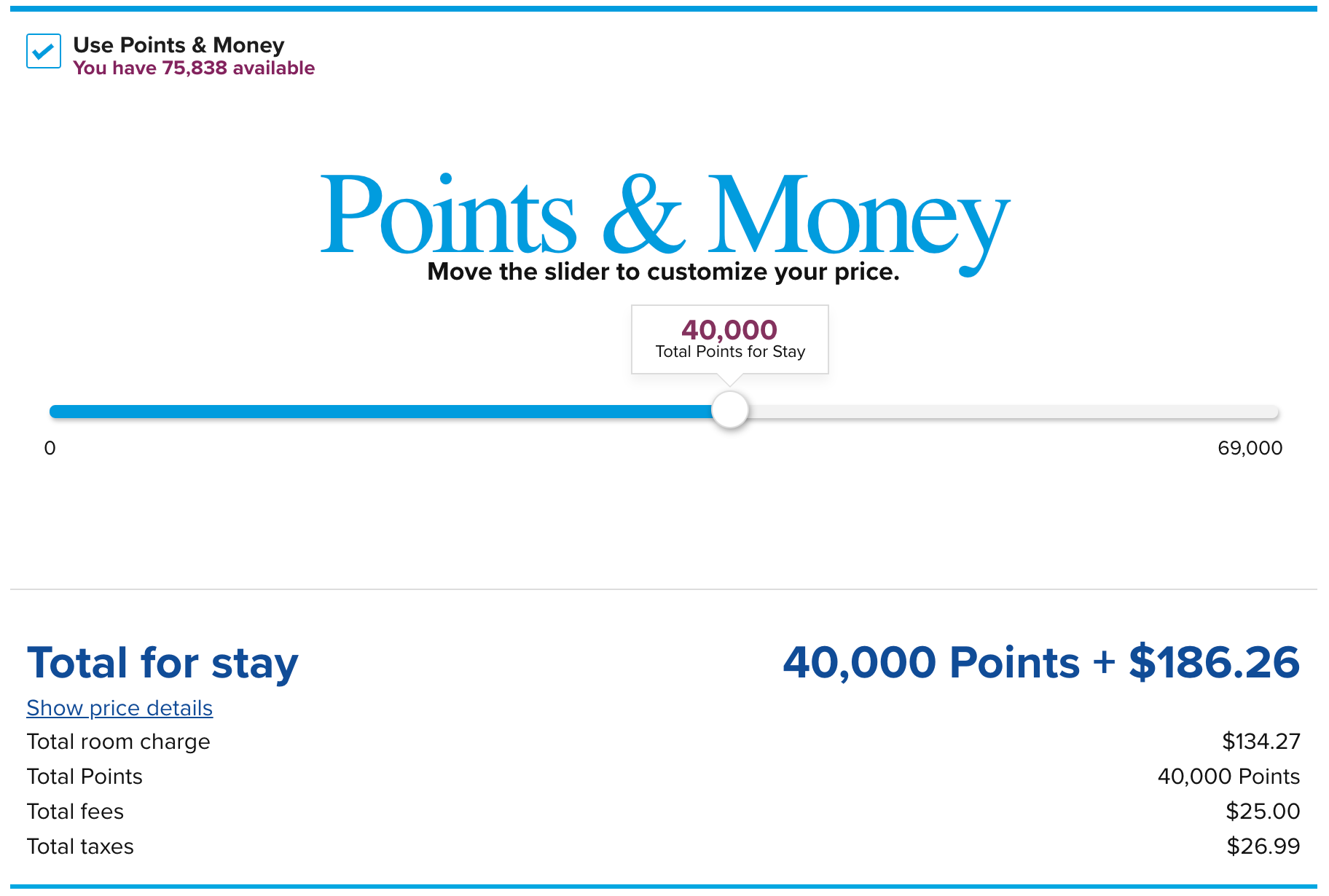

All three Hilton credit cards earn Hilton points, not American Express points, despite being Amex cards. Hilton points are typically valued at around 0.5 to 0.6 cents per point. Let’s dive into the reward multipliers for each of these cards:

Hilton Honors Card

- 7x points at Hilton hotels and resorts

- 5x on US dining

- 5x at US supermarkets

- 5x at US gas stations

- 3x on all other purchases

Hilton Surpass Card

- 12x points at Hilton hotels and resorts

- 6x points on US dining

- 6x points at US supermarkets

- 6x points at US gas stations

- 3x points on all other purchases

Hilton Aspire Card

- 14x points at Hilton properties

- 7x points on travel booked directly with airlines or through AmexTravel.com

- 7x on US dining

- 3x on all other purchases

While there are similarities across all three credit cards, such as bonus points for spending at Hilton properties, there are notable differences. Only the Honors and Surpass cards offer bonus points at US gas stations and US supermarkets. The Aspire card, on the other hand, provides extra points for flights booked directly with airlines or through AmexTravel.com and select car rental companies.

Let’s create an example budget to understand how many points each credit card can earn annually. Our budget consists of $15,000 per year, distributed across various categories. While your spending habits may differ, this example will allow us to compare the reward multipliers of each card.

- $1,000 at Hilton

- $4,000 at restaurants

- $4,000 at supermarkets

- $2,000 at gas stations

- $1,000 on flights

- $3,000 on everything else

With this budget, you would earn the following points:

- Hilton Honors: 69,000 Hilton points

- Hilton Surpass: 84,000 Hilton points

- Hilton Aspire: 76,000 Hilton points

At a conservative valuation of 0.5 cents per point, this translates to:

- Hilton Honors: $345

- Hilton Surpass: $420

- Hilton Aspire: $380

The card that’s right for you depends on your spending habits, especially regarding flights. If you travel frequently by air, the Hilton Aspire card might yield the most Hilton points.

To get a more precise estimate, consider plugging in your personal spending habits to determine which card is most rewarding for you. Keep in mind that not every transaction needs to go on your Hilton credit card. You may have other cards with better multipliers or perks, and a useful app called Max Rewards can help you decide which card to use for each transaction.

Sign-Up Bonuses: Earning Points Right from the Start

As of now, all three Hilton credit cards offer sign-up bonuses:

- Hilton Honors: 80,000 Hilton points after spending $1,000 in the first three months (valued at $400).

- Hilton Surpass: 130,000 Hilton points after spending $2,000 in the first three months (valued at $650).

- Hilton Aspire: 150,000 Hilton points after spending $4,000 in the first three months (valued at $750).

The Hilton Honors card stands out because it’s a no-annual-fee card, yet it offers a significant sign-up bonus that can cover one or even two nights at a Hilton property and coming as a credit card with lounge access.

Earning Free Nights: Making the Most of Your Card

The Hilton Honors card doesn’t provide free night awards since it’s fee-free. However, the Hilton Surpass card offers a free weekend night award if you spend $15,000 on the card within a calendar year. This award is flexible and can be used at most Hilton properties, making it valuable.

The Hilton Aspire card takes it a step further by providing a free weekend night award without additional spending, along with the opportunity to earn another free night after spending $60,000 on the card within the calendar year. This benefit alone can offset the card’s annual fee and offers flexibility in choosing how to redeem it.

Credits: Getting More Value

- Hilton Honors: No credits offered.

- Hilton Surpass: No credits offered.

- Hilton Aspire: Offers a range of valuable credits:

- $250 Hilton resort statement credit

- $250 airline fee credit (annual, with airline selection)

- $100 property credit with each two-night minimum stay at Waldorf Astoria or Conrad properties (reusable throughout the year)

The Hilton Aspire card’s credits can substantially offset its annual fee and enhance your Hilton experience.

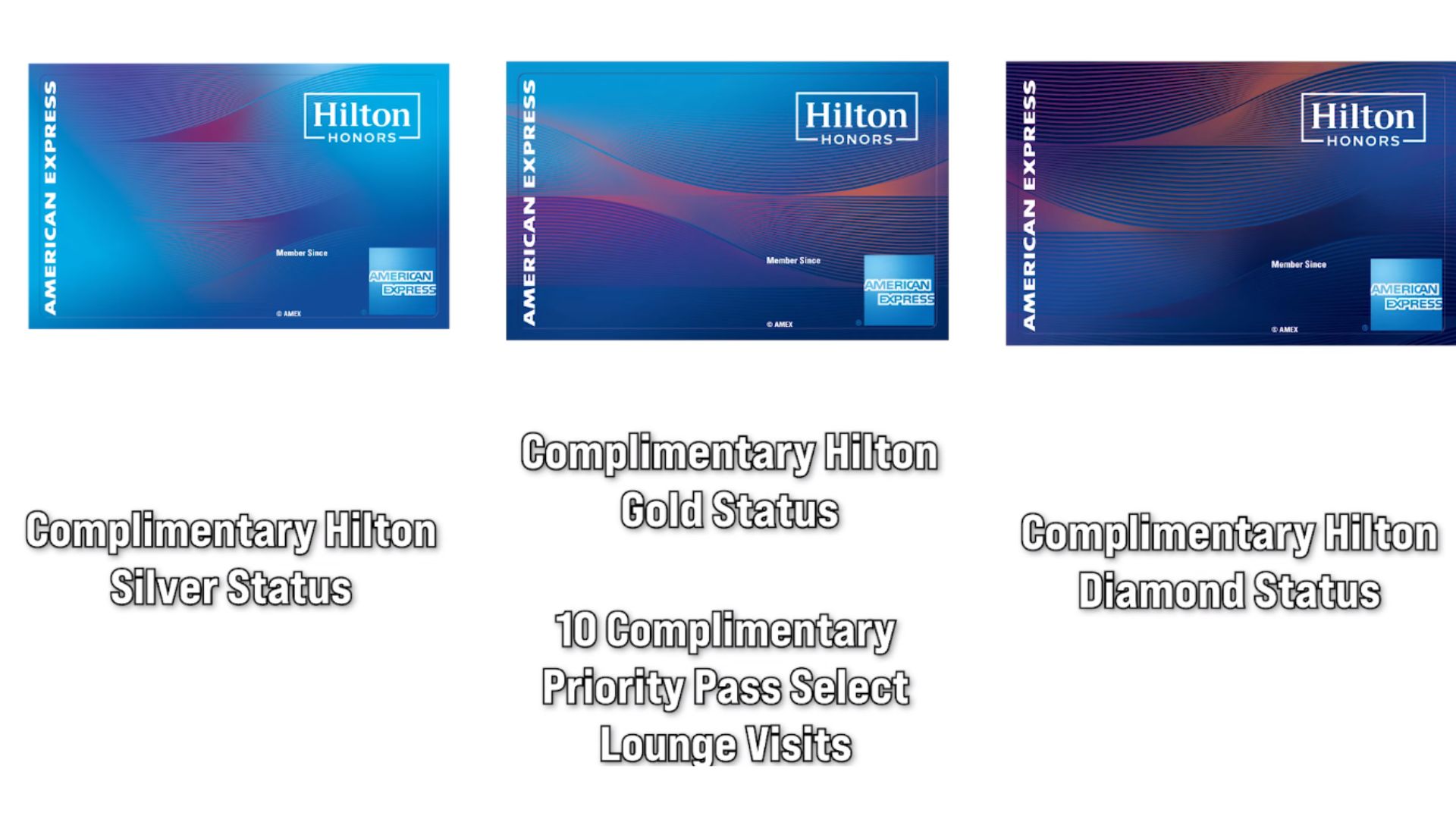

Benefits: Going Beyond Points and Credits

- Hilton Honors: Offers complimentary Silver status, with the standout benefit being the fifth-night free when booking four consecutive nights with points.

- Hilton Surpass: Provides Gold status, including room upgrades, daily food and beverage credits (in the US), or continental breakfasts (outside the US), and 10 complimentary visits at Priority Pass Select lounges.

- Hilton Aspire: Offers top-tier Diamond status, which includes space-available room upgrades to suites, lounge access, premium Wi-Fi, and a 48-hour room guarantee. The card also provides the fifth-night free benefit and Priority Pass Select with unlimited visits, allowing up to two guests at no extra charge.

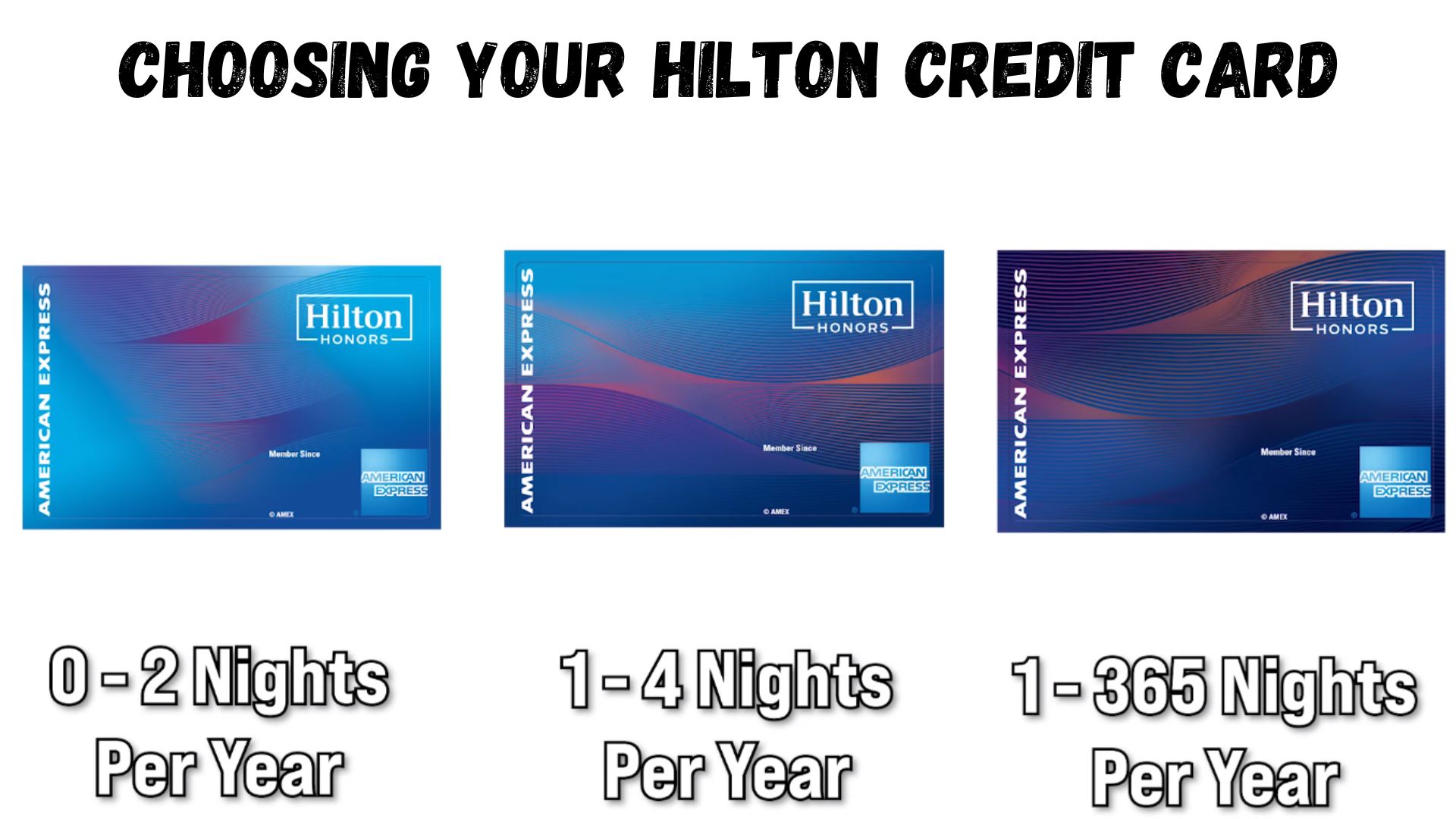

Choosing Your Hilton Credit Card

After reviewing the features and benefits of these Hilton credit cards, the choice ultimately depends on your travel and spending habits:

- Hilton Honors Card: Ideal for those who stay at Hilton properties 0-2 times a year. It’s the perfect choice for a no-annual-fee card that still offers valuable points and a unique fifth-night free benefit.

- Hilton Surpass Card: Suitable if you stay at Hilton properties 1-4 times a year and value Gold status, Priority Pass Select lounge access, and the opportunity to earn free weekend nights.

-

Hilton Aspire Card: If you stay at Hilton properties at least once a year or more and want to enjoy a luxurious, top-tier experience with Diamond status, the Hilton Aspire card is tailor-made for you.

Conclusion

Choosing the right Hilton credit card hinges on your unique preferences and travel habits. Each of the three cards – Hilton Honors, Hilton Surpass, and Hilton Aspire – offers a distinct array of benefits, credits, and reward multipliers.

For those who enjoy occasional Hilton stays and want to earn Hilton points without an annual fee, the Hilton Honors card is a valuable choice. Its fifth-night free benefit and no annual fee make it a great entry-level option.

The Hilton Surpass card is ideal for those who stay at Hilton properties a few times a year. With Gold status, Priority Pass Select lounge access, and the potential for free weekend nights, it caters to travelers seeking a balance between rewards and annual fees.

The Hilton Aspire card is the pinnacle of Hilton credit cards, offering Diamond status, an array of credits, and premium benefits. It’s the card of choice for those who frequently stay at Hilton properties, as its credits can easily offset its annual fee and provide a luxurious Hilton experience.

Frequently Asked Questions (FAQs)

Which Hilton credit card is right for me if I’m new to Hilton and don’t want to pay an annual fee?

The Hilton Honors card is a great choice. It has no annual fee and provides you with a valuable entry into the Hilton Honors program, allowing you to earn Hilton points with your everyday spending.

How can I determine which Hilton credit card is the most rewarding for my specific spending habits?

To find the best card for your spending habits, consider using a budgeting tool or app that allows you to input your expenses. This will help you calculate which card will earn you the most Hilton points based on your unique financial situation.

Do Hilton credit cards offer any travel-related benefits?

Yes, the Hilton Surpass and Hilton Aspire cards provide travel-related perks. Hilton Surpass offers Priority Pass Select lounge access, while the Hilton Aspire card provides airline fee credits and Priority Pass Select with unlimited visits. These benefits enhance your overall travel experience.

Can I use the Hilton Aspire card’s resort credit at any Hilton property?

The Hilton Aspire card’s $250 resort statement credit can be used at eligible Hilton resorts. It’s important to check Hilton’s specific list of eligible properties on their website to ensure that your desired hotel qualifies for this credit.

Are the fifth-night free benefits available to all Hilton credit cardholders?

No, the fifth-night free benefit is primarily associated with the Hilton Honors card. It allows cardholders to enjoy a complimentary fifth night when booking four consecutive reward nights with points at Hilton properties. This unique benefit is exclusive to the Hilton Honors card.