In today’s rapidly changing financial landscape, many individuals are eager to explore the world of digital assets and discover how to invest in crypto. Cryptocurrency, a revolutionary form of decentralized currency, has garnered immense attention in recent years. However, understanding the intricacies of this emerging financial frontier is crucial for potential investors. This article serves as a comprehensive guide, shedding light on the fundamentals of cryptocurrency investment. From demystifying the concept of crypto to unraveling the intricate workings of blockchain technology, we will navigate through the complexities and equip you with the knowledge needed to make informed investment decisions in the world of crypto.

Understanding Cryptocurrency

Before we dive into the investment process, let’s gain a deeper understanding of what cryptocurrency is and how it operates.

Cryptocurrency as a Digital Payment System

Cryptocurrency operates on a fundamental concept that resembles our everyday payment processors like Venmo, Cash App, and PayPal. When you use these apps, a central company facilitates your transactions. For instance, when you send money to a friend via Venmo, Venmo checks your account balance, processes the transaction, and records it on their platform. In essence, Venmo acts as an intermediary or middleman, facilitating the transaction.

Now, imagine a world where transactions are handled differently, without the need for a central entity like Venmo. Instead, a network of computers spread worldwide verifies and records transactions. When this network agrees that a transaction is valid, it gets added to a long list of all previous transactions known as a blockchain.

The Blockchain: A Public Ledger

The blockchain is a critical component of how cryptocurrency works. It serves as a digital ledger that records transactions for a specific cryptocurrency. For example, the Bitcoin blockchain records every Bitcoin transaction. Each entry on the blockchain includes details such as the sender’s address, the receiver’s address, and the amount of Bitcoin transferred.

But what sets the blockchain apart is its structure. Instead of traditional ledger pages, the blockchain is composed of blocks, with each block containing a list of several transactions. When a block is full, a new block is created and linked to the previous one, forming a chain of blocks—hence the name “blockchain.”

Moreover, the blockchain isn’t tucked away in a drawer like an accountant’s ledger; it’s open for everyone to see worldwide, at any time. This transparency is a core element of cryptocurrencies like Bitcoin, symbolizing a shift away from traditional financial systems, where transactions are hidden behind closed doors, accessible only to a select few.

The Philosophy of Cryptocurrencies

The transparent and public nature of blockchain technology represents the heart of the philosophy behind cryptocurrencies like Bitcoin. It’s about shifting trust from central authorities like banks and governments to a decentralized and transparent system where anyone can verify transactions. This transformation opens up the world of finance, making it accessible to everyone.

In essence, cryptocurrencies are more than just digital assets; they are transformative technologies with the potential to redefine how we interact with financial systems. By removing intermediaries, cryptocurrencies provide a vision of a more open and decentralized financial world.

The Economic Landscape

Cryptocurrencies have gained popularity not only for their technological innovation but also as potential investments. Let’s explore the economic landscape of cryptocurrencies, starting with the impact of traditional financial systems.

The Flaws of Traditional Finance

In recent years, traditional financial systems have faced several challenges. The money supply in countries like the United States has seen significant increases, leading to multiple bank closures and rising poverty rates. Economic recessions have hit hard, and inflation is affecting everyday expenses, from gas to food and housing. The rising costs of living are impacting people’s financial stability, while income remains stagnant.

This economic landscape has fueled interest in cryptocurrencies as an alternative to traditional financial systems. Many see cryptocurrencies as a potential hedge against inflation and a way to secure their financial future.

The Role of Bitcoin

Bitcoin has often been likened to digital gold due to its potential to appreciate in value over time. Looking at its historical performance, Bitcoin has shown substantial growth since its inception. However, it’s essential to note that Bitcoin’s value is volatile, and it experiences cycles of rapid growth (bull markets) followed by corrections (bear markets).

These market cycles typically occur every three to four years, which suggests that another bull market may be on the horizon. Bitcoin has already shown signs of resurgence, with its value increasing by over 60% since the start of the year. If history repeats itself, investors who buy and hold Bitcoin during a bull cycle could potentially see significant profits.

Getting Started: Coinbase

Now that we’ve delved into the fundamental concepts of cryptocurrency, let’s get practical. How do you start investing in cryptocurrency? We’ll guide you through the process, and we recommend starting with a user-friendly platform like Coinbase.

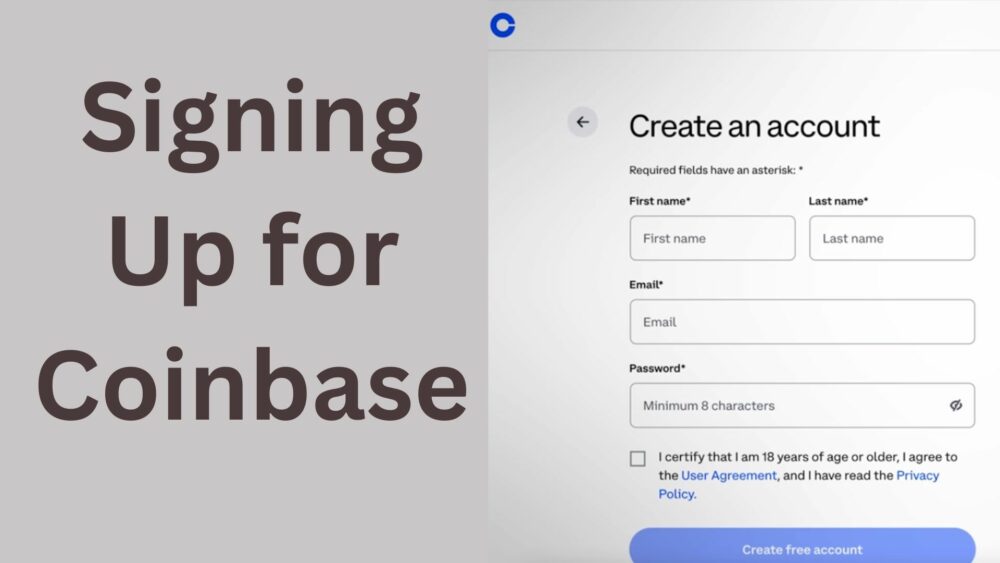

Step 1: Sign Up

Begin your cryptocurrency journey by signing up for Coinbase. Signing up is straightforward, requiring your name, last name, email address, and confirmation that you’re 18 years or older.

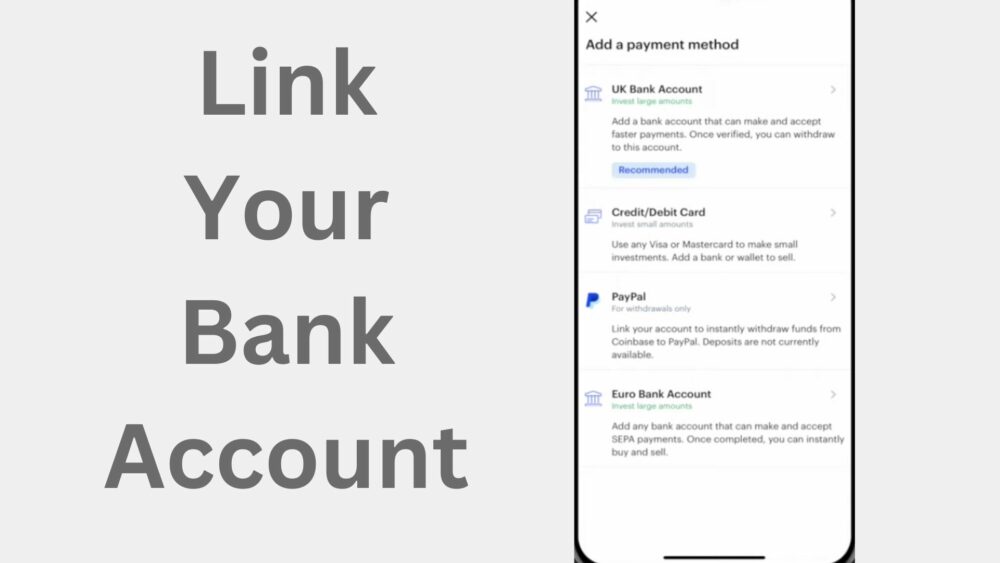

Step 2: Link Your Bank Account

To fund your cryptocurrency purchases, you’ll need to link your checking account to Coinbase. This allows you to transfer funds easily and start investing.

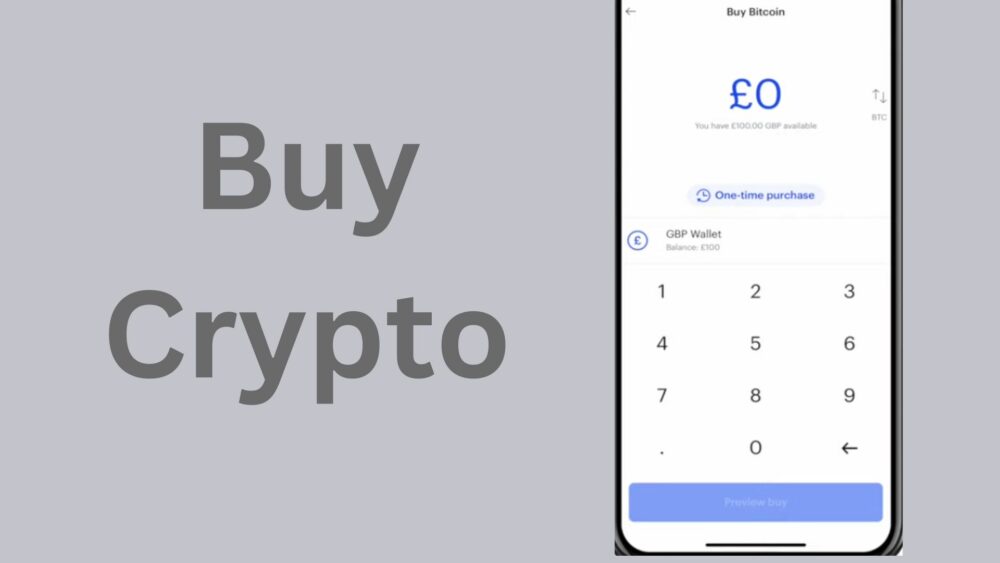

Step 3: Buy Crypto

Once your account is set up and linked to your bank, you can start buying cryptocurrencies. Coinbase offers a straightforward interface for purchasing Bitcoin and other digital assets. If you plan to trade frequently, consider joining Coinbase Pro, which offers lower trading fees. You can also transfer cryptocurrency from crypto.com to coinbase if you already have some cryptocurrency.

Step 4: Secure Your Investments

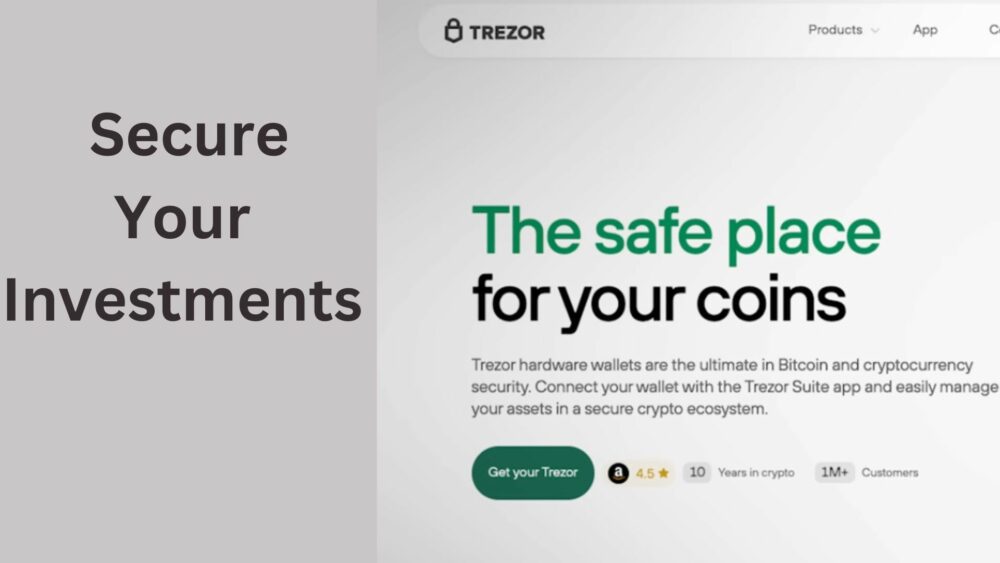

Security is paramount in the world of cryptocurrency. While Coinbase is a secure platform, it’s essential to take extra precautions. Here are some safety measures to consider:

- Use a Cold Storage Wallet: Consider using hardware wallets like Ledger or Trezor to store your cryptocurrencies securely offline. These wallets provide an added layer of protection against online threats.

- Two-Factor Authentication (2FA): Enable 2FA on your Coinbase account using an authenticator app or a hardware key (e.g., Yubico). This further strengthens your account’s security.

- Staking: Explore opportunities for staking your cryptocurrencies on Coinbase. You can generate passive income from your investments by staking.

Step 5: Additional Tips

Before we move on to more advanced strategies, let’s revisit some important lessons from experienced crypto investors:

- Patience: Cryptocurrency markets can be volatile, but patience pays off. Historical trends suggest that long-term investors tend to fare better than those who panic-sell during market dips.

- Time in the Market: Rather than trying to time the market, consider buying early and holding. This strategy can be more reliable in the long run.

- Focus on Safer Assets: While meme coins may be enticing, stick to higher market cap assets like Bitcoin and Ethereum, which tend to be more stable and less speculative.

- Security Matters: Protect your investments by using secure wallets, enabling 2FA, and following best practices for online security.

Conclusion

Cryptocurrencies represent a transformative force in the world of finance, offering a vision of a more open, decentralized, and accessible financial system. Investing in cryptocurrency can be both exciting and rewarding, but it requires patience, research, and a commitment to security. Coinbase is a great platform to start your crypto journey, and by following the steps in this guide, you can position yourself for potential gains in the crypto market. Remember, only invest what you can afford to lose, and always do your due diligence. Happy investing!

Frequently Asked Questions (FAQs)

What is cryptocurrency, and how does it work?

Cryptocurrency is a virtual form of currency that uses cryptography for it’s security. It operates on decentralized networks based on blockchain technology, which is a transparent digital ledger that records all transactions. Transactions are verified by a network of computers (miners) instead of central authorities like banks.

How do I start investing in cryptocurrency?

- To start investing in cryptocurrency, you need to follow these steps:

- Sign up with a reputable cryptocurrency exchange like Coinbase.

- Link your bank account to the exchange for funding.

- Buy the cryptocurrency of your choice through the exchange.

- Secure your investments by using hardware wallets and enabling two-factor authentication (2FA).

Is cryptocurrency a safe investment?

Cryptocurrency investments carry risks due to their volatility. Prices can change quickly, potentially resulting in gains or losses. It’s crucial to invest only what you can afford to lose and conduct thorough research before investing. Using secure wallets and following best security practices can enhance safety.

Which cryptocurrency should I invest in?

The choice of cryptocurrency depends on your investment goals and risk tolerance. While Bitcoin and Ethereum are more established and considered safer, newer cryptocurrencies may offer higher potential returns but come with greater risks. It’s advisable to diversify your portfolio and prioritize well-known assets.

What is staking, and how can I earn from it?

Staking is the process of keeping cryptocurrency in a wallet to maintain a blockchain network’s functioning. In return, you get rewards in the form of more cryptocurrency. Some exchanges, like Coinbase, offer staking services for specific coins. Staking allows you to earn passive income while contributing to the security and functionality of the blockchain network.