Are you dreaming of owning a home but feeling the financial squeeze of rising interest rates? You’re not alone. With the cost of homeownership becoming increasingly unattainable for many, it’s crucial to explore creative financing options that can help ease the burden of high monthly mortgage payments. One such program that’s generating a buzz in the real estate world is the 2-1 buydown.

In this informative guide, we’ll take you on a journey through the intricacies of the 2-1 buydown program. We’ll not only explain how it works but also dive into its pros and cons. Moreover, we’ll explore alternative strategies you can consider to achieve your homeownership dreams while staying financially savvy.

Understanding the 2-1 Buydown Program

The 2-1 buydown program is like a lifeline for aspiring homebuyers during times when interest rates are soaring. In essence, it’s a temporary interest rate reduction plan that operates during the initial years of your mortgage. The “2-1” in its name signifies that the interest rate is lowered for the first two years of the loan term before reverting to the standard rate.

Here’s how it typically works: Imagine you’re about to secure a mortgage with a 7% interest rate, which is the norm in today’s market. With a 2-1 buydown, your rate would be reduced to 5% in the first year and 6% in the second year, before returning to the standard 7% from year three onwards.

The Mechanics of a 2-1 Buydown

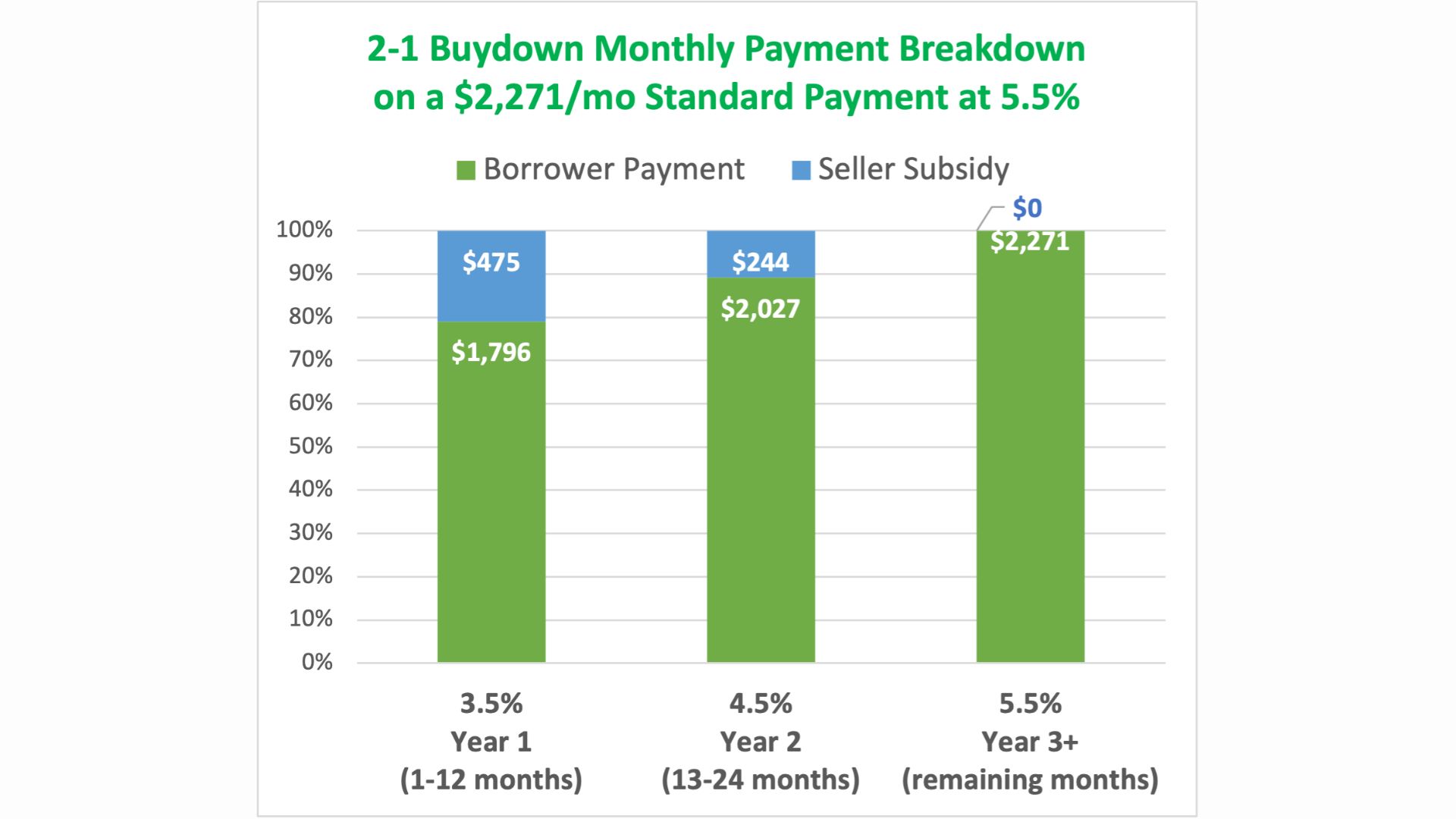

The genius of the 2-1 buydown lies in its simplicity and effectiveness. Although the nominal interest rate remains at 7% during the first two years, the seller or builder steps in to provide financial assistance to the buyer. This financial aid effectively subsidizes the buyer’s monthly mortgage payment.

Here’s a breakdown of how it all comes together:

- Year 1: The interest rate is 2% lower than the standard rate, making it 5% for the buyer during this year.

- Year 2: The interest rate is 1% lower than the standard rate, amounting to 6% for the buyer in the second year.

- Years 3 and Beyond: The interest rate returns to the normal 7% for the remainder of the loan term.

In essence, the seller or builder is generously providing funds to ensure that the buyer’s monthly payments are in line with what they would be if the buyer had secured a mortgage with a 5% or 6% interest rate. This gracious act allows buyers to experience lower monthly payments precisely when they need it most – during the initial years of homeownership.

Pros and Cons of a 2-1 Buydown

Like any financial strategy, the 2-1 buydown program comes with its own set of advantages and disadvantages. Let’s delve deeper into both the advantages and disadvantages:

Pros:

1. Lower Initial Payments: The most immediate and apparent benefit is the reduction in your monthly mortgage payments during the critical first two years. This can be a game-changer for those struggling with high upfront costs.

2. Improved Affordability: In a market where interest rates are on the rise, a 2-1 buydown can make homeownership more attainable, especially for first-time buyers.

3. Temporary Relief: If you anticipate that interest rates will decrease in the near future, a 2-1 buydown provides temporary relief, allowing you to secure a lower rate when you refinance.

Cons:

1. Qualification at the Note Rate: Borrowers must still qualify based on the original, higher interest rate (in our example, 7%). This qualification criteria could limit your purchasing power.

2. Source of Funds: To implement a 2-1 buydown, you need the cooperation of the seller or builder, which may not always be feasible or negotiable.

3. Added Complexity: A 2-1 buydown adds complexity to the home buying process, potentially making your offer less attractive to sellers who may prefer straightforward transactions.

Exploring Alternative Financing Strategies

While the 2-1 buydown can be a lifesaver in specific situations, it’s essential to explore alternative financing options. Let’s dive into some strategies you can consider:

1. Closing Costs Assistance:

Negotiate with the seller or builder to have them cover your closing costs. This strategic move not only safeguards your savings for future financial goals but also provides you with a hassle-free transition into the world of homeownership. Say goodbye to unexpected expenses and hello to financial peace of mind as you embark on your exciting journey toward owning your dream home.

2. Discount Points:

If you plan to stay in your home for an extended period, investing in discount points may be a wise choice. This strategy provides a long-term reduction in your interest rate, which can translate into significant savings over the life of your loan. Calculate the break-even period to determine if this approach aligns with your financial goals.

3. Adjustable Rate Mortgage (ARM):

An Adjustable Rate Mortgage (ARM) offers an enticing initial fixed interest rate, followed by periodic adjustments based on market conditions. Be cautious with ARMs, as they come with higher risk due to potential interest rate fluctuations. However, they can be suitable for specific situations and savvy borrowers who understand the associated risks.

Is a 2-1 Buydown Right for You?

Now that you have a solid understanding of the 2-1 buydown program and its alternatives, the million-dollar question is whether it’s the right fit for your unique circumstances. Here are some key considerations to help you make a decision:

1. Market Conditions:

Assess the current and future state of the real estate market. A 2-1 buydown is most effective when you anticipate a decrease in interest rates shortly after your home purchase, allowing you to refinance into a lower-rate loan.

2. Budgetary Constraints:

While the initial lower payments are enticing, avoid overstretching your budget based solely on these temporary savings. Be prepared for the higher payments that will kick in after the first two years.

3. Fair Market Value:

Don’t solely focus on the monthly payment. Evaluate whether the home’s purchase price is fair and aligned with the property’s market value. Consult with a real estate agent to perform a Comparative Market Analysis (CMA) to make an informed decision.

4. Expert Advice:

Leverage the expertise of a real estate agent and lender who can provide guidance tailored to your situation. They can help you navigate the complexities of the home buying process and explore financing options that best suit your needs.

Conclusion

The 2-1 buydown program is a powerful tool that can make homeownership more attainable and affordable during challenging market conditions. However, it’s crucial to approach it with a clear understanding of your financial goals and the intricacies of the program.

Remember that the decision to use a 2-1 buydown, or any financing strategy, should align with your long-term homeownership goals and budget. Don’t let the allure of lower initial payments blind you to the bigger picture of homeownership.

Frequently Asked Questions (FAQs)

What is a 2-1 buydown, and how does it work?

A 2-1 buydown is a temporary interest rate reduction program for mortgages. It lowers the interest rate for the first two years of the loan, typically by 2% in the first year and 1% in the second year, before reverting to the standard rate. The funds for this reduction come from the seller or builder, making it more affordable for buyers in the initial years of homeownership.

Who benefits the most from a 2-1 buydown program?

Buyers who anticipate a decrease in interest rates in the near future can benefit the most from a 2-1 buydown. It provides short-term relief in the form of lower monthly payments, allowing buyers to refinance into a lower-rate loan when interest rates drop.

What are the qualifications for a 2-1 buydown program?

Qualifications may vary, but typically, borrowers need a credit score of around 680 or higher. Additionally, they must qualify for the mortgage based on the standard note rate, which is the higher interest rate used for qualification purposes.

Are there any alternatives to a 2-1 buydown program?

Yes, there are alternatives. Buyers can negotiate for closing cost assistance, which can help cover upfront expenses. They can also consider purchasing discount points for a long-term interest rate reduction or explore Adjustable Rate Mortgages (ARMs) if they are comfortable with potential interest rate fluctuations.

Can I get a refund if I refinance before the two-year buydown period ends?

Yes, if you refinance before the two-year buydown period expires, you can receive a refund of the remaining funds from the escrow account that were initially used to subsidize your monthly payments. This refund can be used to pay down the rate on your new mortgage or cover closing costs.