In the ever-evolving world of credit cards, the X1 Credit Card and its travel-focused counterpart, the X1 Plus Travel Card, have emerged as formidable contenders. With a laser focus on innovation, technology, and an enticing rewards program, these cards have piqued the curiosity of credit enthusiasts across the United States. In this comprehensive guide, we embark on a journey to uncover every facet of these cards, leaving no stone unturned. From their inception and groundbreaking features to the intricacies of their rewards programs, travel benefits, and more, we aim to provide a thorough understanding of whether the X1 Credit Card family is the right financial fit for your needs.

1. The X1 Credit Card’s Remarkable Journey

Two years ago, in the ever-evolving landscape of credit cards, a game-changer emerged— the X1 Credit Card. Its inception in the US market marked a pivotal moment in the credit industry. What set this card apart was its relentless pursuit of innovation and technology.

1.1 A Glimpse into the Future: Key Features

The X1 Credit Card disrupted the status quo with a slew of groundbreaking features:

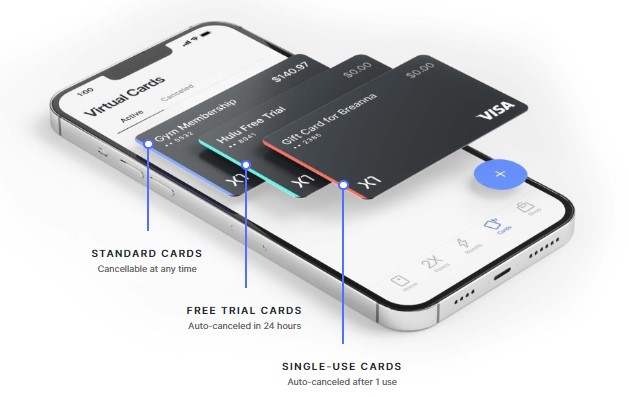

- Free Trial Cards: One of the card’s most intriguing features is the ability to create free trial cards that automatically cancel after 24 hours. This functionality ensures that you won’t be charged when a free trial period expires. It’s a small but valuable innovation that saves you money and hassle.

- Instant Rewards: Points are not just a promise; they’re an immediate reality with this card. The moment you make a purchase, you’re rewarded, ensuring a seamless and satisfying rewards experience.

- Stylish Metal Card: Credit cards aren’t just tools; they’re statements. The X1 Credit Card’s sleek metal design makes an impression even before you swipe it. And yes, it has a unique sound when you drop it on the restaurant table—a subtle way to flaunt your style.

2. Earning Rewards with X1 Credit Card

The X1 Credit Card’s allure isn’t limited to its innovative features. It boasts a rewards program that’s both lucrative and straightforward.

2.1 Points Galore

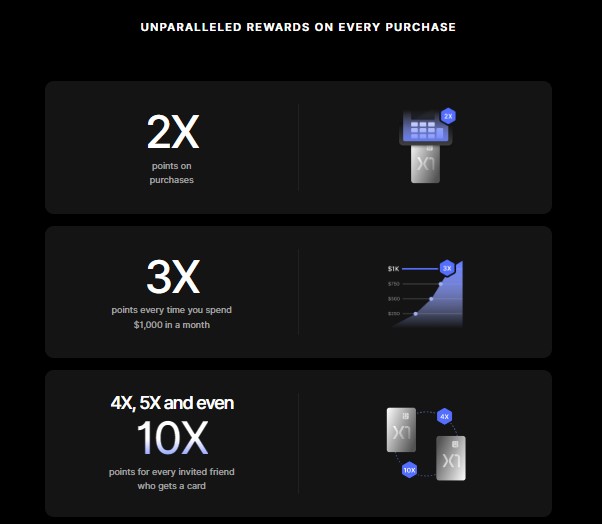

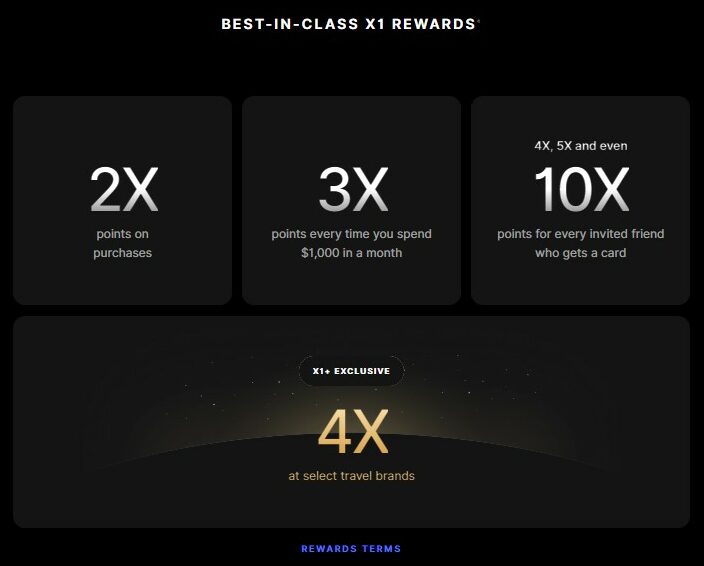

Earning points with the X1 Credit Card is a breeze:

- Spend $1,000 or more in any given month, and you’ll earn three points per dollar on the next $6,500 in spending. This effectively provides the value of a three percent cash back card.

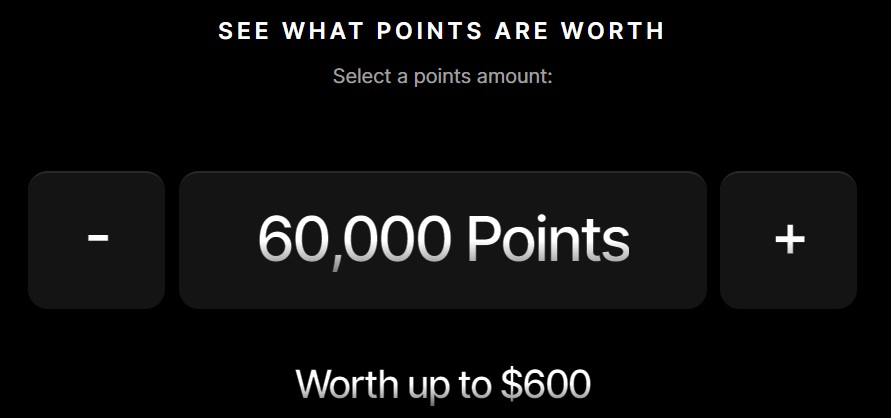

- Each point is worth one cent, making it easy to calculate your rewards. Transparency is key.

3. The Arrival of X1 Plus Travel Card

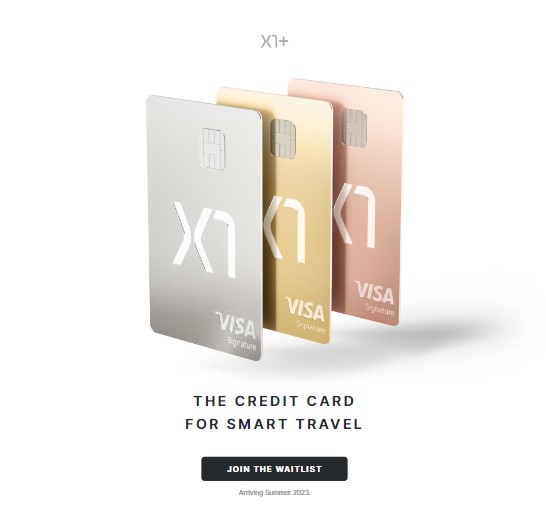

The X1 Credit Card made waves, but its sibling, the X1 Plus Travel Card, expanded the horizon. Available in silver, gold, and pink, this travel card shares the same commitment to innovation and technology. It’s about time we explore what it brings to the table.

3.1 Card Number Security

Security meets convenience with the X1 Plus Travel Card. Just like Apple, it offers the option to hide card numbers on the physical card. Your card numbers remain secure within the app, accessible when needed.

3.2 Lounge Access: A Luxurious Perk

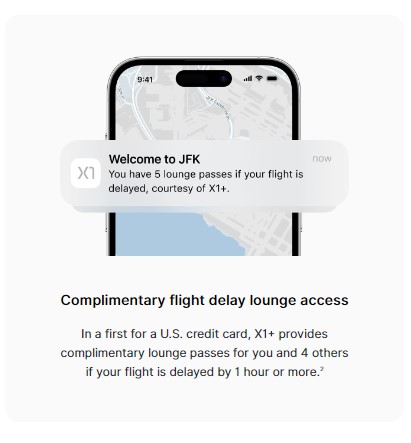

The X1 Plus Travel Card’s standout feature is its airport lounge access. This feature offers two distinct paths:

- Flight Delay: If your flight faces a delay of more than one hour, you and up to four companions receive complimentary lounge passes. These lounges are part of the Lounge Key Network, providing access to over 1,000 lounges. However, it’s worth noting that the terms and conditions provide more details on this aspect.

- On-Demand Access: For those who prefer control, the X1 Plus Travel Card offers on-demand lounge access for a fee. Access over a thousand priority lounges worldwide whenever you need it. While it sounds promising, the card’s details leave some questions unanswered, particularly regarding the specific lounge network. Discover best hotel credit cards the other type of travel card.

3.3 Lounge Access Evaluation

While the X1 Plus Travel Card’s lounge access is undoubtedly a perk, it’s essential to analyze its real value. With a $75 annual fee, the card offers complimentary airport lounge access primarily during flight delays. However, this may not align with everyone’s travel patterns.

For frequent travelers, alternatives like the American Express Hilton Honors Surpass Card provide ten free Priority Pass Lounge passes for a slightly higher $95 annual fee. Importantly, these passes don’t expire immediately after your flight, adding versatility.

4. Beyond Lounge Access

The X1 Plus Travel Card is more than just lounge access. Let’s explore the card’s other benefits and incentives.

4.1 Rewards Program

The X1 Plus Travel Card’s rewards program is worth mentioning:

- Earn two points per dollar on all purchases, with the opportunity to earn three points per dollar when spending over $1,000 per month. This system ensures that your rewards grow with your spending.

- Referral Bonuses: You can also earn rewards for referring others to sign up for the card, making it an appealing option for those who want to spread the word.

- Brand-Specific Bonuses: Enjoy four points per dollar on select brands, including Lyft, Four Seasons, Westin, and American Airlines.

4.2 Comparing to Airline-Specific Cards

For those loyal to specific travel brands, the X1 Plus Travel Card offers an attractive proposition. However, it’s essential to consider alternatives like airline-specific credit cards. For example, if you’re loyal to American Airlines, their co-branded credit card provides benefits like free checked bags, priority boarding, and the ability to earn American Airlines miles on spending. Miles are often valued higher than one cent per point, making it a competitive choice.

4.3 Insurances and Travel Protections

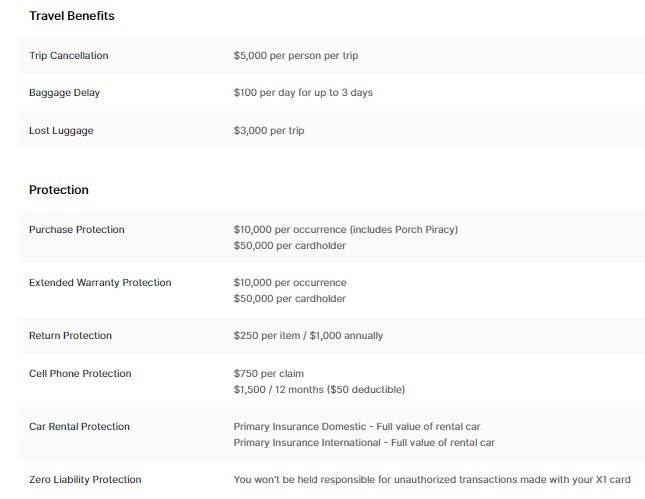

The X1 Plus Travel Card stands strong when it comes to insurances and travel protections:

- Trip Cancellation: Provides robust trip cancellation coverage, offering peace of mind for your travel plans.

- Luggage Delay and Lost Luggage Insurance: The card offers reimbursement rates that ensure you’re compensated adequately in case of luggage mishaps.

- Cell Phone Protection: Enjoy up to $750 per claim for cell phone protection, a valuable addition in today’s digital age.

- Primary Car Rental Protection: Renting a car? The X1 Plus Travel Card has you covered as it offers primary car rental protection.

5. Evaluating the X1 Plus Travel Card

As we near the end of our journey, it’s time to ponder a crucial question: is the X1 Plus Travel Card the right fit for you?

5.1 Unique Value Proposition

The X1 Plus Travel Card, with its $75 annual fee, offers complimentary airport lounge access primarily during flight delays. While generous, it may not suit all travelers’ needs.

For frequent travelers, alternatives like the American Express Hilton Honors Surpass Card provide ten free Priority Pass Lounge passes for a slightly higher $95 annual fee. Importantly, these passes don’t expire immediately after your flight, adding versatility. Although X1 plus travel card offers attractive options, also check best credit card for international travel.

5.2 A Dilemma of Purpose

One cannot ignore the question: who is the X1 Plus Travel Card designed for? The market positioning raises a few eyebrows. While some might appreciate lounge access for a fee, others may consider it an inconvenience.

6. A Vision for the Future

In an industry where competition is fierce, credit card companies constantly innovate. The X1 Credit Card family is no exception.

6.1 The Potential for Transfer Partners

One area where the X1 Plus Travel Card could become a game-changer is through the addition of transfer partners. If cardholders could transfer points to airline loyalty programs, like American Airlines, where points take on a higher value—especially for business-class bookings—this card would gain substantial appeal.

Conclusion

In the world of credit cards, the X1 Credit Card and its travel-focused counterpart, the X1 Plus Travel Card, offer a unique blend of innovation, rewards, and travel benefits. However, they may not be a one-size-fits-all solution. Your decision should align with your travel habits, priorities, and financial goals. Remember, credit cards are just one piece of the financial puzzle. Make informed decisions that align with your individual circumstances. Your journey to financial success begins with the right choices.

Frequently Asked Questions (FAQs)

How do I apply for the X1 Credit Card?

To apply for the X1 Credit Card or X1 Plus Travel Card, visit the official X1 Card website. You can typically apply online by providing your personal and financial information. Make sure to review the eligibility criteria and terms before applying.

What are the main differences between the X1 Credit Card and X1 Plus Travel Card?

The X1 Credit Card focuses on innovative features like free trial cards and instant rewards, while the X1 Plus Travel Card offers airport lounge access as its standout benefit. Additionally, the X1 Plus Travel Card has an annual fee and is tailored for travelers.

Can I use my X1 Credit Card internationally?

Yes, you can use the X1 Credit Card internationally wherever Visa is accepted. However, it’s essential to inform X1 Card of your travel plans to avoid any potential issues with international transactions.

Are there any foreign transaction fees associated with the X1 Credit Card?

The X1 Credit Card typically doesn’t charge foreign transaction fees. However, it’s advisable to check the card’s terms and conditions to confirm this, as policies may change over time.

Can I redeem X1 Credit Card points for travel or other rewards?

While the X1 Credit Card doesn’t provide traditional travel rewards like miles or points, you can redeem your points for statement credits, effectively reducing your outstanding balance. This offers flexibility in how you use your rewards to offset expenses.