Banking should be simple, accessible, and cost-effective. You should be able to manage your finances online without worrying about monthly service fees. However, in the quest to find the best banking options, you may stumble upon some of the worst banks in America. In this article, we will highlight three of these banks and explain why you might want to steer clear of them.

Chase Bank: Making Banking Complicated

Chase Bank is a well-known financial institution, but when it comes to their checking and savings accounts, it’s a hard pass for many customers. While they offer the convenience of no minimum deposit to open a checking account, they hit you with a monthly service fee of $12 for Total Checking, $4.95 for Secure Banking, and $25 (or $0 if you meet certain criteria) for Premier Plus Checking.

Avoiding these fees often means jumping through hoops like maintaining a minimum daily balance of $1,500 or making electronic deposits totaling $500 or more per month. This complexity can be frustrating for customers who prefer a straightforward banking experience.

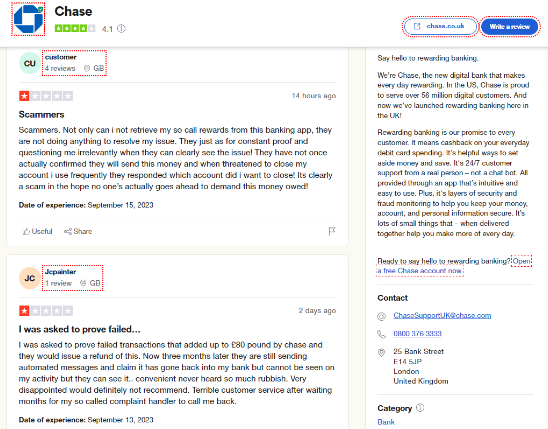

According to TrustPilot Review On Worst Banks in America Case Bank

Furthermore, Chase’s savings accounts offer a paltry 0.01% annual percentage yield (APY), making it an unattractive option for anyone looking to grow their savings. In essence, your money in a Chase savings account is practically hidden in the closet, earning next to nothing.

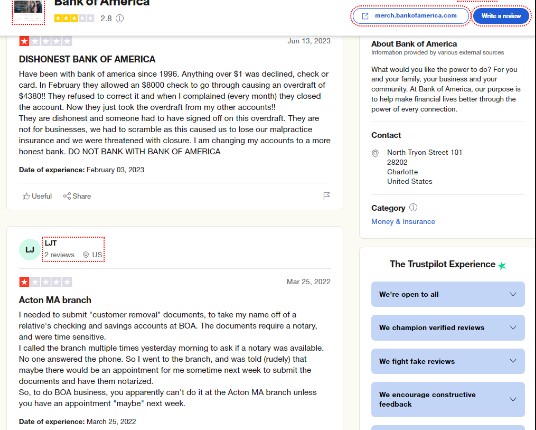

Bank of America: High Maintenance Banking

Bank of America offers multiple checking account options, but they come with their own set of requirements and fees. To avoid monthly maintenance fees that range from $4.95 to $25, you must meet certain criteria, such as maintaining a minimum daily balance or making qualifying direct deposits.

While some of these criteria may be attainable, they add unnecessary complexity to your banking routine. Savings accounts at Bank of America also provide a meager 0.01% APY, which is far from competitive.

According to TrustPilot Review On Worst Banks in America “Bank of America”

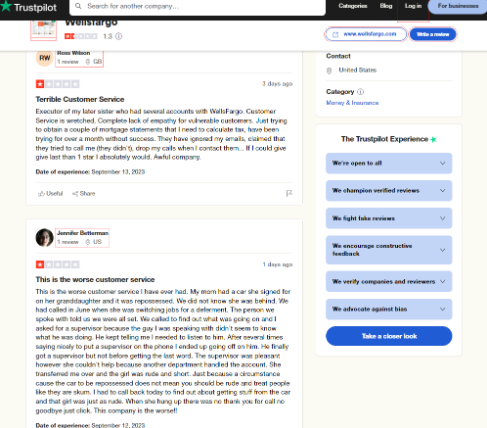

Wells Fargo: A History of Predatory Practices

Wells Fargo stands out as one of the most predatory banks in the United States. They charge monthly service fees for their checking accounts, ranging from $5 to $35. To avoid these fees, you must meet strict requirements, such as maintaining a minimum daily balance or having substantial linked balances. they also charge high interest on their wells fargo cards.

According to TrustPilot Review On Worst Banks in America “Wells Fargo”

Wells Fargo’s past is marred by unethical practices, including the unauthorized opening of millions of accounts without customer consent. This history raises serious concerns about their commitment to customers’ best interests.

Their savings accounts offer slightly better interest rates compared to Chase and Bank of America, but it’s still far from competitive, with an APY of 0.15%.

Better Banking Alternatives

If you’re looking for a bank that values simplicity, accessibility, and customer satisfaction, consider alternatives like Ally Bank. Ally offers high-yield savings accounts with no monthly maintenance fees, no minimum deposit requirements, and a competitive APY of 0.75%. They also provide user-friendly tools to help you manage your savings effectively.

Conclusion

your choice of bank should align with your financial goals and values. Avoiding the worst banks in America can save you from unnecessary fees and frustration. Consider banking with institutions like Ally that prioritize your financial well-being and offer transparent, customer-friendly options. Your money deserves to work harder for you, not for the bank’s profit margins.

Frequently Asked Questions

What is the difference between a checking account and a savings account?

A checking account is primarily used for everyday transactions like paying bills, making purchases, and withdrawing cash. It usually offers easy access to funds but typically earns little to no interest. A savings account, on the other hand, is designed for saving money over the long term. It often offers higher interest rates to help your savings grow.

How can I improve my credit score?

Improving your credit score involves managing your debts responsibly. Pay bills on time, keep credit card balances low, and avoid opening too many new credit accounts. Regularly review your credit report for errors and work on resolving any negative items.

What is the importance of an emergency fund?

An emergency fund is essential because it provides a financial safety net in case of unexpected expenses like medical bills, car repairs, or job loss. It helps you avoid going into debt during emergencies and provides peace of mind knowing you can cover unforeseen costs.

How can I create a budget and stick to it?

Creating a budget involves tracking your income and expenses to understand where your money goes. Start by listing all sources of income and categorize your expenses. Set realistic spending limits in each category and monitor your spending regularly. Staying disciplined and making adjustments as needed is key to sticking to your budget.

What is the best way to save for retirement?

Saving for retirement should start early and ideally include a combination of employer-sponsored retirement plans (like a 401(k) or 403(b)), individual retirement accounts (IRAs), and other investments. Contribute consistently, take advantage of employer matches, and consider diversifying your investments to help your retirement savings grow over time.