In today’s financial landscape, the concept of a credit card that doesn’t check your credit doesn’t charge any interest, and has no fees might sound too good to be true. In this comprehensive review, we will delve deep into the Tomo Credit Card and explore why you should approach this credit card company with caution. Before we begin, please take a moment to click the like button to support our content. Feel free to share your favorite tree in the comments below to appease the YouTube algorithms.

Tomo Credit Card: A Brief Introduction

Tomo Credit (website) has achieved significant milestones, including participation in the Barclays Accelerator Program powered by Techstars, raising over three million dollars in funding, and building a team of a dozen or so talented individuals. While Tomo Credit is a relatively new company, it has established a degree of credibility and infrastructure in the fintech space.

However, it’s important to note that Tomo Credit is not listed on the Better Business Bureau (BBB), a common platform for consumers to research companies. This absence from the BBB can be attributed to the company’s limited cardholder base due to its recent entry into the market. While this lack of presence on the BBB may be a concern for some, it is reasonable to expect it to improve over time.

The Unique Offering of Tomo Credit

The core offering of Tomo Credit is its credit card which stands out for several reasons:

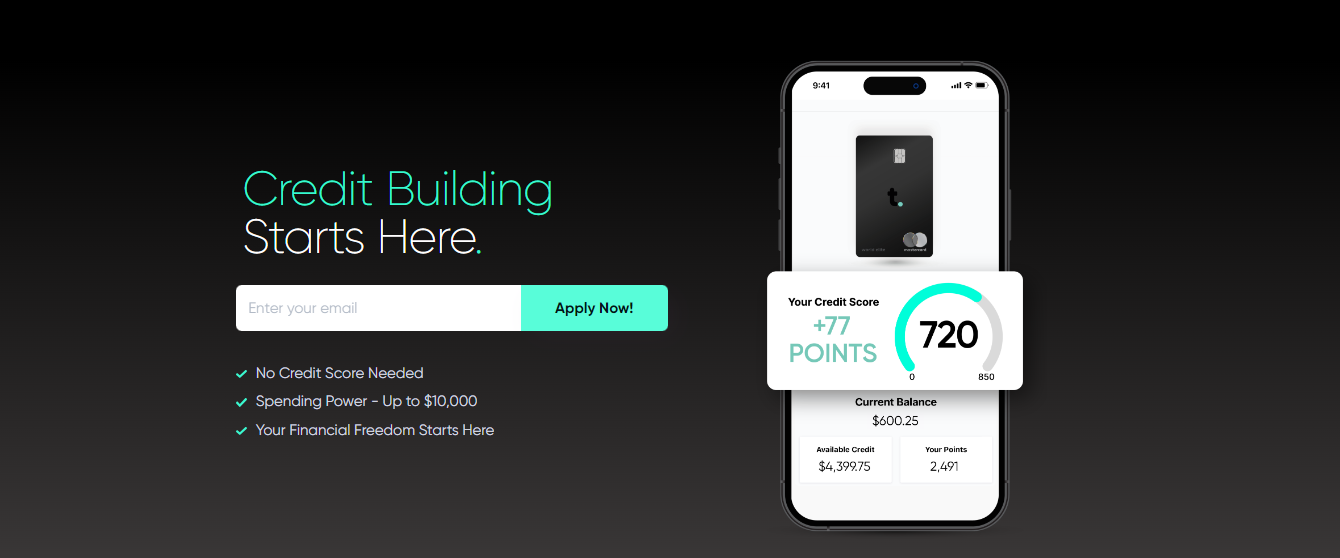

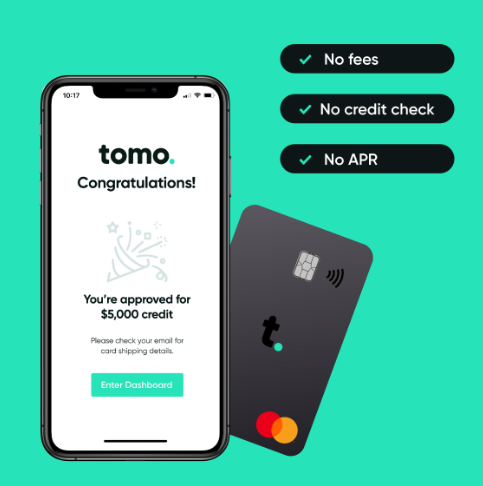

- No Credit Check: Tomo Credit does not perform a hard inquiry on your credit report when you apply for their card. This is a unique feature among credit cards, as most traditional card issuers rely heavily on credit history for approval.

- Zero Interest: Unlike most credit cards that charge significant interest rates ranging from 15% to 30%, Tomo Credit cardholders do not incur any interest charges. This aspect makes it an attractive option for those looking to avoid high-interest payments.

- No Fees: Tomo Credit does not impose annual fees, late fees, or any other hidden charges that are common with many credit cards.

- Cash Back Rewards: Cardholders have the opportunity to earn a certain percentage of cash back on their card purchases, enhancing the overall value of the card.

The absence of a credit check and the unique evaluation process used by Tomo Credit makes it a potential option for individuals with limited or no credit history. This sets it apart from secured credit cards that require a deposit to establish credit.

The Mechanics of Tomo Credit Card

The Tomo Credit card operates differently from traditional credit cards. It is technically classified as a charge card, similar to some American Express (Amex) cards, such as the Green Card, Gold Card, and Platinum Card. However, there are significant distinctions.

- No Balance Carryover: Unlike credit cards, charge cards like Tomo Credit require cardholders to pay off their balance in full every seven days. This automated payment system prevents cardholders from carrying a balance and incurring interest charges.

- No Late Fees: Tomo Credit does not charge late fees, thanks to its automated seven-day payment cycle. This is similar to a debit card with a delayed payment mechanism.

While the Tomo Credit card offers an appealing package, it is important to explore some of the potential drawbacks and concerns associated with the company’s business model. Are you facing challenges in your credit-rebuilding journey? Here a guide you through the best credit cards to rebuild credit.

The Concerns Surrounding Tomo Credit’s Business Model

Most credit card companies generate revenue through a combination of three primary sources: interest rates, fees, and swipe fees. However, Tomo Credit has chosen to eliminate two of these revenue streams—interest rates and fees. According to the Consumer Financial Protection Bureau (CFPB), interest charges account for a significant portion of credit card companies’ revenue.

Tomo Credit’s Revenue Stream

Tomo Credit primarily relies on swipe fees, also known as interchange fees, as its sole revenue source. These fees typically range from one percent to three percent, with Tomo Credit likely operating within this range. However, this limited revenue stream faces several challenges:

- Cash Back Rewards: Tomo Credit offers cash back rewards to its cardholders, ranging from one percent to potentially higher rates for those who refer others. This means that a significant portion of their interchange fee revenue is returned to cardholders as cash-back rewards.

- Relationship and Processing Fees: As a credit card company, Tomo Credit incurs relationship and processing fees, which can amount to around 15 percent of its remaining revenue after cash-back rewards.

- Losses and Fraud: Like any financial institution, Tomo Credit must account for potential losses due to unpaid balances and fraudulent activity, further reducing its revenue.

- Operating Costs: After accounting for cash-back rewards, fees, and potential losses, Tomo Credit has limited funds left for its operating expenses, including employee salaries, office space, infrastructure, and marketing.

The Profitability Challenge

Tomo Credit’s business model may face a profitability challenge. Their revenue stream relies heavily on a small percentage of interchange fees, which most credit card companies use as a supplementary revenue source rather than their primary one. Furthermore, Tomo Credit operates in San Francisco, where the cost of hiring highly skilled employees and maintaining office space is notably high.

The company’s ability to thrive depends on its ability to attract and retain high-income individuals with limited or no credit history, as they are likely to spend more on their credit cards. This specific target market is crucial to Tomo Credit’s success. However, there are concerns about the sustainability of this business model.

Potential Future Changes

Tomo Credit may need to make significant changes to its business model to ensure long-term profitability. While the company has raised over three million dollars in funding, the sustainability of its current model remains uncertain. Future changes could include exploring alternative revenue sources such as advertising or selling user data. Additionally, Tomo Credit might introduce supplementary product lines to bolster its profitability. If you have a startup plan you need a credit card for your business you get the best credit cards for your startup.

Potential Risks for Tomo Credit Cardholders

If you are considering applying for the Tomo Credit card, it’s essential to assess the potential risks and make an informed decision:

- Longevity Concerns: Tomo Credit’s future as a company is uncertain, which could impact the longevity of the card. If the company faces financial challenges, cardholders may find themselves with an inactive card.

- Ideal Customer Profile: The card is most advantageous for individuals with no or limited credit history who can spend a substantial amount on the card. If you already have an established credit history, the rewards may not be as appealing.

- Competition: Tomo Credit could face stiff competition from larger financial institutions targeting the same market. If major banks decide to pursue this niche, it could pose a significant challenge for Tomo Credit.

Conclusion

While the Tomo Credit card offers a unique and attractive package, potential cardholders should carefully consider the risks associated with the company’s business model and the sustainability of its offerings. If you fall within Tomo Credit’s ideal customer profile and are willing to accept the potential risks, it could be a valuable tool for establishing or rebuilding your credit.

Frequently Asked Questions (FAQs)

What Makes the Tomo Credit Card Different from Traditional Credit Cards?

The Tomo Credit Card stands out because it does not require a credit check, does not charge interest, and has no annual fees or late fees. It operates more like a charge card, requiring users to pay their balance in full every seven days.

How Does Tomo Credit Determine Creditworthiness Without a Credit Check?

Tomo Credit evaluates applicants based on a different set of metrics compared to traditional credit card companies. While most issuers rely heavily on credit reports and scores, Tomo Credit uses alternative criteria to assess creditworthiness.

Is the Tomo Credit Card a Good Option for People with No Credit History?

Yes, the Tomo Credit Card is designed to be accessible to individuals with limited or no credit history. It can serve as a valuable tool for those looking to establish credit for the first time.

What Are the Cash Back Rewards Offered by Tomo Credit?

Tomo Credit offers cash-back rewards to its cardholders. The cash-back rate can vary and may depend on factors such as referrals. It’s important to check the terms and conditions to understand the specific rewards offered.

What Are the Long-Term Prospects of Tomo Credit?

Tomo Credit’s long-term prospects are uncertain. The company’s business model relies heavily on interchange fees and cash-back rewards, which may pose challenges to long-term profitability. Potential cardholders should consider the risks associated with the company’s financial sustainability.