TAN Verification, TAN Application, TAN Documents, TAN Structure, Tax Account Number Verification: As everybody knows the fact that if someone wants to start their business, they have to pay a number of taxes. To pay tax, they have to maintain or register a Tax Account Number for any further proceedings. Let us tell you all that the full form of TAN refers to Tax Account Number which means that Tax Collection or Deduction Account Number. It is a type of ten-digit alphanumeric number that is governed by the Income Tax Department Office for all Indian citizens. This is for all citizens who are able to Deduct Tax at Source [TDS] or Collect Tax at Source [TCS]. So, here in this article, we will provide you full information related to the structure of a TAN, important documents required, and TAN verification processes with the help of name or number.

| Topic Name | TAN Verification Process, Structure, and Documents |

| Article Category | Framework of TAN Important Documents needed for TAN Application Process of TAN Verification Online Verification of TAN Through Name Verification of TAN Through Number Frequently Asked Questions |

Framework of TAN

Here we discuss the framework of a TAN. This TAN consists of a number of digits from which each one of digit has its own meaning. Let us tell you all that it consists of an alphanumeric number from which the first 4 numbers are alphabets after that next 5 numbers are numeric and the last number is an alphabet. Let us discuss the Framework of a TAN in the following points:

- The starting 3 alphabets of a TAN or tax collection, deduction Account Number shows the jurisdiction code.

- The fourth letter or alphabet shows the name of the TAN owner with their starting letter of the name.

- The owner of TAN can be any one of them such as any firm, company, or individual.

- And, the last letter of TAN can be a random one. For example, If someone has a TAN in a city of Bangalore has shown as like BLR A 23456 M

Also Read: PAN Card Offices or Centres in Bangalore

According to the Income Tax Act in the year 1961, below the rules & regulations of Section 203A has announced the fact that the making of a TAN has become an important task for all citizens of India who takes part in TAX deductors. They have to maintain or save their TAX number with all required documents. If anyone is not applying for a TAN, then their TDS or TCS payments are not acceptable by any banks. As well as they are not eligible for any kind of TDS Refund. Here is the list of documents are:

- Need Certificate of TCS or TDS

- Statement of TDS

- Statement of TCS

- Annual Information Return

- Payment Challan of TDS or TCS

- Along with all other mentioned below documents

According to the Income Tax Act below the section of 203 A, has announced the rule & regulations for all taxpayers that they must have to apply or register for the TAN i.e Tax collection or deduction number. It is important for all to get register for TAN if they are using any government tax or payments. But, if somehow a person fails to get register or apply according to the rules & regulations of Income Tax, then they have to pay a fine of Rs.10000/-.

Also Read: TAN Registration

Important Documents needed for TAN Application

Here, we will discuss all the important documents that are used to required while applying for a TAN application form. Let us tell you all that if you are applying for a TAN application offline, then you do not need to submit any of the documents. But, if you are applying for a TAN application online, then you have to sign an acknowledgment paper which is duly signed by an applicant during the successful submission of form and payment. And this signed acknowledgment must be sent to NSDL-TIN Facilitation offices or Centres. And, all center and office address will be given on the acknowledgment slip.

Some Important Points

- Let us tell you all that there is a need for only one TAN for every type of deductions, collections (interest, salary, property, and commission). It is important for all citizens to not to have any kind of different account for all types of tax deductions and collections. Along with this, the classification of TAN owners will remain the same for all types of payments. Let us take an example if someone purchases any property in their name then there is no need to have a company TAN. It is not that important. But, In fact, the company TAN is used in the purpose of various types of tax deposits or deduction, and the condition is only if you are purchasing any property in the name of the company.

- Every applicant should fill the correct information along with all important documents while applying for a TAN application.

Process of TAN Verification Online

Let us tell you all that the full form of a TAN is known as a Tax Deduction Account. Basically, it is for the identification of a particular person’s tax account. It also shows account details of Tax collection or deduction number. Generally, it consists of a ten-digit alphanumeric value. Out of this ten-digit alphanumeric code, starting four digits should be in an alphabet of capital letters, whereas the fifth and ninth digit should be numerical. After that, the tenth or last digit should be an alphabet of a capital letter. Let us take an example of a TAN number which is as follows PDES03028F. So, any applicant who is eligible for this TAN are eligible to deduct TDS from their number of payment option, and they must have TAN Card for further payments. Here we discuss the process of TAN verification through a name or number.

Here we will discuss the various steps of verification of a TAN Online. We will provide you full information related to the verification of TAN through Online services. Follow all given below steps very carefully, which was given as under:

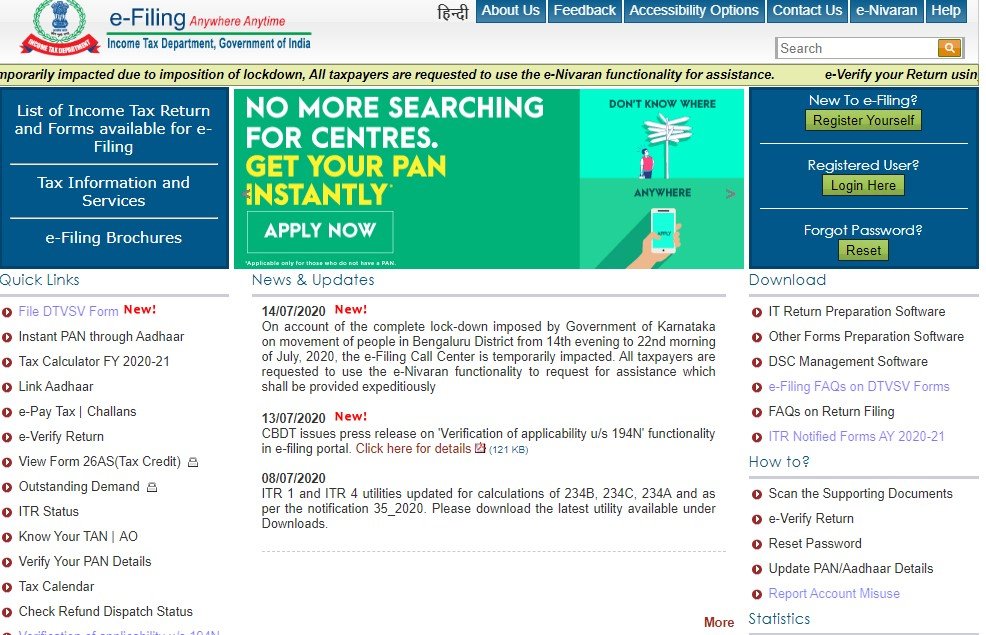

- For this, visit an official website of the Income Tax Department which is given as follows incometaxindiaefiling website.

- Now below the Services option, choose to know your TAN option.

- After clicking on the above-mentioned link, a new webpage will appear.

- Now start choosing the classification of Deductor from the drop-down menu. Classification is given as follows:

-

- Central, Local Authorities, State Government, Autonomous Bodies, and Statutory Bodies.

- Companies, Other Branches, Firm, BOI, AOP, AOP(Trust), and AJP.

- Individual or HUF that includes Business.

- Now start choosing an option for searching a TAN through number or name.

- After that, according to your choice, start entering an applicant name or a TAN number.

- Now, enter your already registered mobile number.

- After this, click on the continue button to get the result.

- In this manner, every applicant can verify a TAN with the help of an online facility.

Now, After this whole process, detail of TAN will appear on your computer screen. This will show you all information related to TAN number, category of the deductor, deductor name, permanent account number, range code, contact information, status, area code, type of AO, AO number, and address of AO with description.

Verification of TAN Through Name

Here we will discuss the various steps for verifying a TAN with the help of an applicant name. We will provide you a various number of steps that show the procedure of verification through a name. So, the basic steps are as follows:

- For this, visit an official website of the Income Tax Department which is given as follows incometaxindiaefiling website.

- The page will look like this.

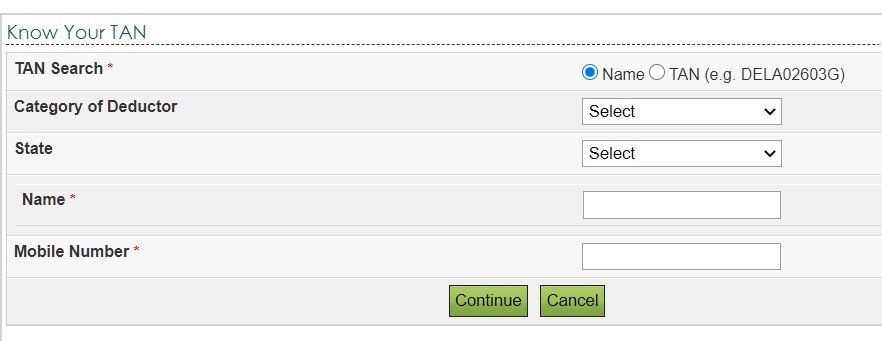

- Now, here tap on the link or button “Know your TAN”.

- After this, the page will look like this.

- Now, you have to first log in to your account by just entering your email ID and passcode.

- Now, search your TAN by just select the name option.

- Now, just choose your category from the deductor as shown in the drop-down menu.

- Now, select the state.

- After selection, now start to enter your name.

- Now, enter your submitted mobile number or ten-digit TAN number.

- After filling all this information, tap on the continue button provided there.

- After clicking on the continue button, there is a screen showing you verification of TAN through number.

- In this manner, you can verify your TAN anytime, anywhere.

Verification of TAN Through Number

Here we will discuss the various types of verification processes through a TAN number. We will provide you a various number of steps that show the procedure of verification through a TAN number. So, the basic steps are as follows:

- For this, visit an official website of the Income Tax Department which is given as follows incometaxindiaefiling website.

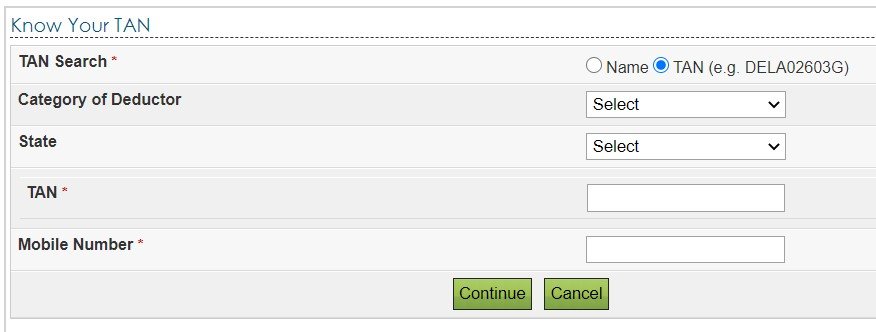

- Now, here tap on the link or button “Know your TAN”.

- Now, you have to first log in to your account by just entering your email ID and passcode.

- Now, search your TAN by just select the TAN number.

- Now, just choose your category from the deductor as shown in the drop-down menu.

- Now, select the state.

- After selection, now start to enter your TAN number.

- Now, enter your submitted mobile number or ten-digit TAN number.

- After filling all this information, tap on the continue button provided there.

- After clicking on the continue button, there is a screen showing you verification of TAN through number.

- In this manner, you can verify your TAN anytime, anywhere.

Now, After this whole verification process, Let us tell you all that a deductor has only one and only one Tax collection or deduction account number for only one class. If someone has more than one TAN, then it should be considered as illegal. If you want to verify a TAN, then you must have to register it first.

I hope you will understand this article very well and are ready to take benefit from it. If you are facing any problems related to the meaning of a TAN Card Form, TAN Structure, TAN Verification Process, and important documents then you may ask your queries in the given comment box.

Frequently Asked Questions

If I withdraw TDS without having a TAN, then what type of action should be taken from the government of India?

As you know that this TAN is important for all citizens of India. Whatever we can do related to TDS, there is a requirement of TAN. And, this number is used to communicate with all IT companies. Just in case, if somehow, you have not any type of TAN, then there will be a fine of Rs.10000/-. Not only this, but the banks also will not accept any type of TDS return or any payments from the client-side.

Should I checkup TAN of a particular person who withdraws TDS from given cash?

Yes, everyone can check the TAN information of a particular person. For this, you need to have their full name. With the help of a full name, it becomes good to verify or check TDS deduction. It has to be done legally.

Name the payment of mode that will be accepted while submitting the TAN Application Form?

Payment mode will be accepted through credit card, net banking, debit card, demand draft, and cheque.

How much fee should be paid for an application form of TAN?

The fee should be of Rs.62/-.

If I already have a PAN Card Number. Would It really require a TAN or just mention PAN number is enough?

If you have a PAN Card Number, then you need not be used PAN Number instead of TAN. Both of these documents are not similar. Both of them worked for different purposes. Along with this, TAN is usually for those people who just gather deducted tax with the help of an IT department. This PAN is used for every individual, and companies to just grant their taxes.

How would I obtain a TAN?

To obtain a TAN, you can apply for it online or offline. Fill a particular application form which is Form49B. It is available on the NSDL website. After filling submitted it by pay particular fees according to the government rules & regulations. Apply for it offline by just visiting TIN-FC Offices of Centre.