TAN Registration, Advantages of TAN Registration, Know your TAN: As we all knew the fact that for doing any type of transaction or doing some sort of business, how important for all to register a TAN. Let us tell you all that the full form of a TAN is the Tax Collection and Deduction Account Number. It is a type of ten-digit alphanumeric number that is governed by the Income Tax Department Office for all Indian citizens. This TAN is used by people as an identity of an individual or any tax collector or deductor. According to the Income Tax Act in the year 1961, section 203A, making a TAN is an important task for all people who submit TDS to the Income Tax Department office. According to this act, they recently have announced that if someone fails to have a TAN or their TAN number is incorrect, then there is a fine of Rs.10000/- while submitting TDS return. So, every citizen who is eligible to pay TDS, they must have a TAN number. So, here in this article, we will provide you full information related to the Know your TAN, important documents required, and TAN registration processes with the help of name or number.

| Topic Name | TAN Registration Process, Advantages, Know your TAN |

| Article Category | Mode of acquiring TAN Know Your TAN Online TAN Registration Process Result of Not having TAN Advantages of TAN Verification and Registration Frequently Asked Questions |

| TAN Verification Process | Click Here |

| TAN Form 49B | Click Here |

Basically, TAN Application is divided into two types namely Application for new TAN and Application for correction and change TAN. It is important for all applicants who need to collect or deduct tax based on the Income Tax Department. Every applicant can get an application form 49B from any TIN Facilitation Center to get apply for a TAN number. Every applicant can check their TAN application status by just following three methods namely TIN Call Centre, Acknowledgement Number, and SMS.

Mode of acquiring TAN

Here we discuss all the different modes of acquiring TAN. As we all are already aware of the fact that the Tax Deduction and Collection Number should be given to every citizen by the Income Tax Department as per the announced rules and regulations which were provided to you on various TIN Centres. Let us tell you all that this TAN facility should be suggested by the NSDL to all deductors. And, this TAN number is specified in all types of important documents. Now, we will tell you the fact that this TAN has two types of modes such as online and offline. This means people can apply for a TAN either of the two modes according to their choices.

- Offline Mode

For offline mode, everyone has to be download Form 49B. It is a type of application form which was filled for the allocation of Tax collection and deduction account number and gets submitted at the nearest NSDL TIN Facilitation Centers. Let us tell you all that everyone can download this form by just visiting an official website of NSDL or Income Tax Department. If you want to get a hard copy of this form, then you should have to visit at nearest TIN Facilitation Centers.

If you are living in Delhi and want to know the address of all nearest NSDL TIN Facilitation Centers then Click Here.

Let us tell you all that Form number INC-7 which was given below the sub-section[1] of section number 7 is mostly filled by numerous companies that are not registered below the Companies Act, in the year 2013 for the application form of tax collection or deduction account number.

- Online Mode

For online mode, all applicants can download his or her application form of TAN allotment by just visiting an NSDL TIN official website. After downloading an application form, fill all information very correctly. Everyone has to fill a proper residence address along with an email ID. It is important to mention a PAN number on an application form. If there is an old layout of the tax collection or deductor account number, still the need of a PAN number is required.

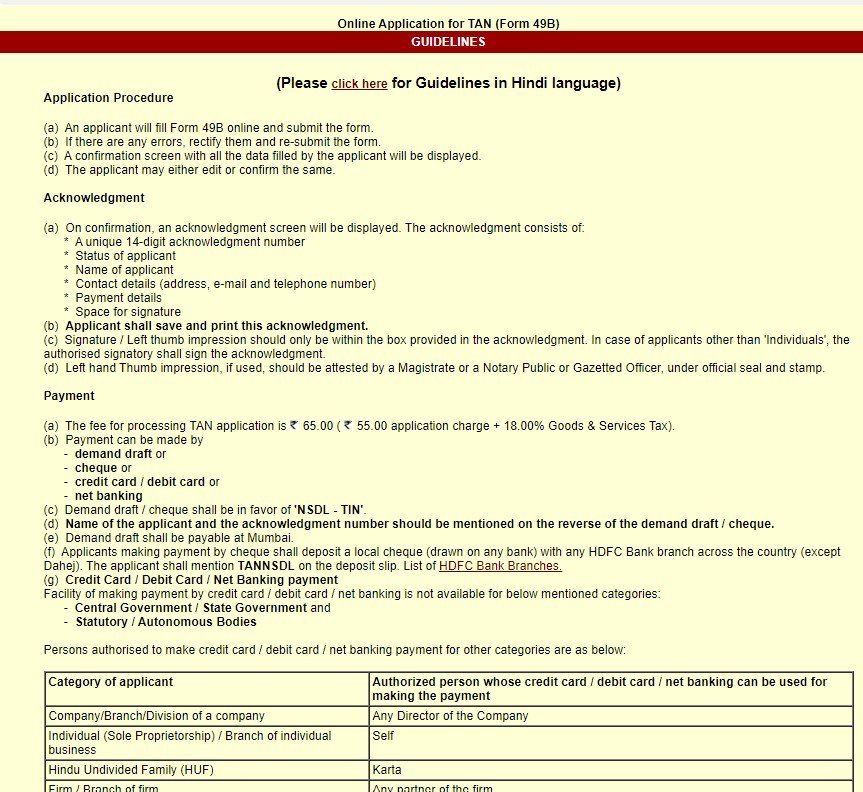

All applicants need to do a payment of an application form of Rs.63/- plus service tax. It is all your choice to select payment mode from Credit card, Debit card, Cheque, Demand Draft, and net banking. Let us tell you all that all Central government, Statutory, State government, and autonomous bodies can do their payment with the help of demand draft and cheque.

After payment, now you will get an acknowledgment number having fourteen digit number. Let us tell you all that on the given acknowledgment, generally, it includes applicant name, residence address, contact number, email ID, applicant status, and detail of payment. After getting an allotment number, this number must be sent to the NSDL office.

If you make a payment by credit card, net baking, and debit card, then your TAN will be reached at your address between five working days if you have done an online submission. Normally, it has to be done between 15 days. It is easy for all applicants to track the TAN application form online.

Also Read: Lost PAN Card

Know Your TAN

Here, we will discuss all the important points to get to know your TAN. When you get your TAN number earlier, but somehow you forgot it. So, now the government has started the online facility through which you can know your number easily with the help of an online facility. So, now let us tell you all that how would you search your TAN number using an online facility. For this, you have to visit the Income-tax department website. Here, you have to click on the link Know your TAN. Here are given some points that show how would you obtain:

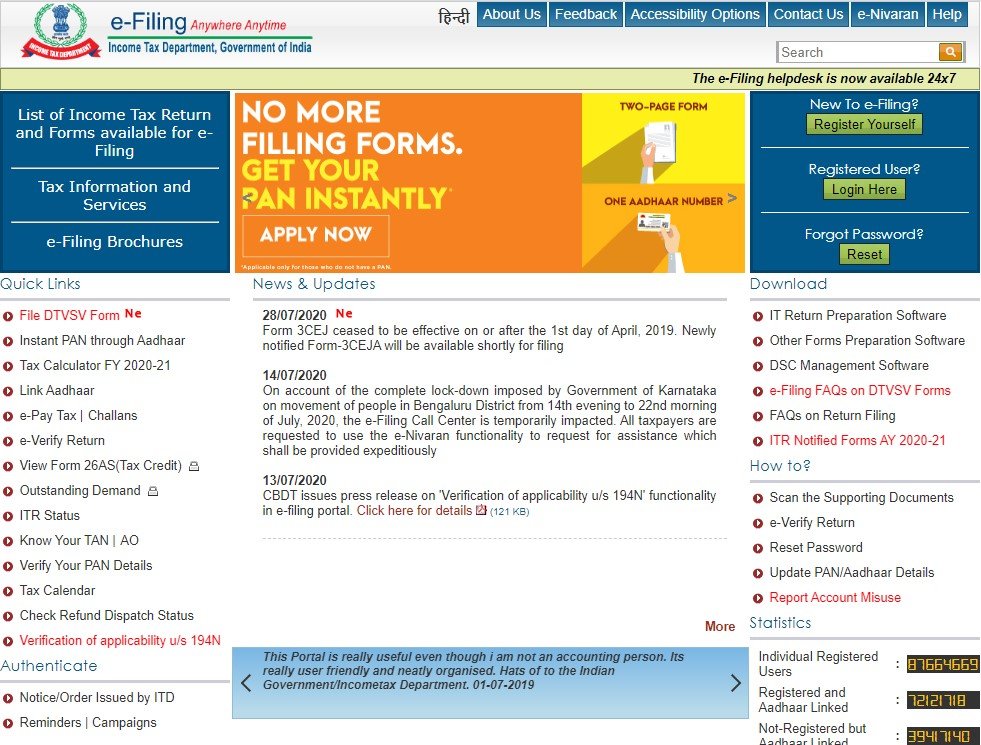

- Visit an official website of Income Tax which is given as incometaxindiaefiling

- The page will look like this.

- Now, click on the link Know your TAN as shown on the left-hand side of the webpage.

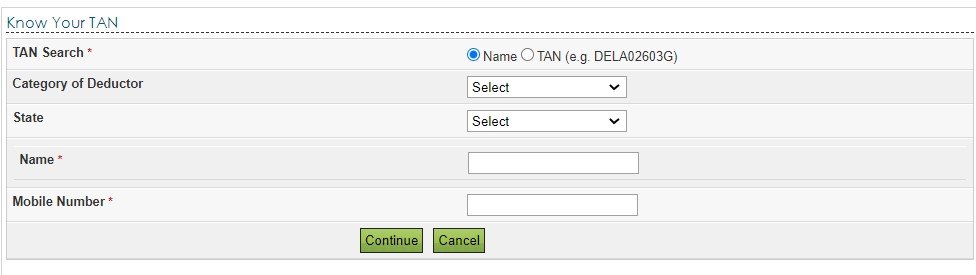

- The page will look like this.

- Now, it is your choice to select an option of TAN Search either by name or TAN number.

- After that, choose the Deductor category namely branch, individual, and company.

- Now select your state. After that enter your name and mobile number.

- Now, tap on the continue button.

- After this, the applicant TAN number would be sent to their mobile number as they mention at the time of form filling.

- In this manner, every applicant can recognize a TAN with the help of an online facility.

Check TAN Application Status by using TIN Call Centre Number

Here we discuss the following ways from which every applicant can check their TAN application status by using the TIN Call Centre number. For this, contact on 020-27218080 and asked all important information by the executive of a call center. By giving all the correct information, the present status of the TAN application is given it to you.

Check TAN Application Status by using SMS

Here we discuss the following ways from which every applicant can check their TAN application status by using SMS. Every citizen should track the TAN application status by just send an SMS. For this, type ‘NSDLTAN’ and send it on 57575 from your mobile number.

Online TAN Registration Process

Here we discuss the various steps of the TAN Registration process. This process is completely online. So, the steps of the online registration process of tax deduction or collection account number [TAN] is given as follows:

Online Apply For TAN Registration Process

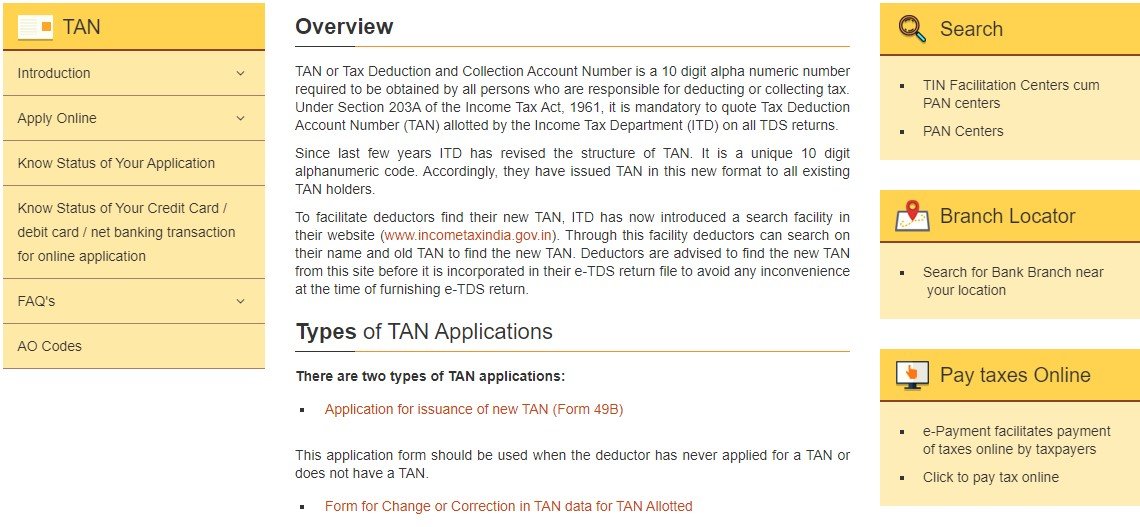

- First of all, visit an official website of NSDL which is given as follows tan services

- The page will look like this.

- Now here below the Apply Online tab, there is an option of New TAN, click on it.

- Here you will get all information related to the TAN such as basic guidelines about how to fill the form.

- The page will look like this.

- If you want to download an Online TAN Registration Form, then click on the given link which is as follows Download Form

- The page will look like this.

- Now, fill this form properly. The information asked in the form as PAN, applicant name, TAN, Deductor Information like name, category, and etc.

- Other information such as deductor communication address, email ID, and contact number.

- Include all necessary information on accepting regular statements.

- After this, tap on the given OK button, there is a confirmation message shown to you on your computer screen. Recheck all details and tap on confirm.

- After recheck, there is an acknowledgment number has been given to you. Save it or download this number and take a print out.

- So, now you will get your TIN below the TAN Registration Acknowledgement directly on your given email ID.

TAN Registration Process Confirmation

- Now, after online apply now it’s time to get a confirmation of your application form. For this, you will get another email from where you can find a link for confirmation.

- Now, tap on that particular link and fill TAN Registration Number and according to the instructions, provide full information about a User ID.

- Now, tap on check user ID availability. With the help of this link, you will get to know the availability of a particular user ID.

- If it is unavailable, then do this procedure again check user ID availability.

- If somehow it is available, then tap on the OK button for further process.

- In this way, you can make a confirmation process of TAN registration.

Password Allotment by NSDL-TIN

Now, for this process, there is another email you will have to receive. Now, this email is from the NSDL-TIN company having its user ID and password.

Important Consolidated FVU Request

- For this, you have to first visit an official website of NSDL website which is given as follows tan services

- Now, if some people don’t have their account, then they have to first register themselves and start login their accounts.

- Now, select and tap on the TAN Registration button.

- Now, start entering all information such as User ID and Password (which you will get during TAN registration) and after that tap on the OK button.

- For all first time users, the website may ask you for a change password.

- Now, set a new password and save it for future references.

- Now start login and tap on the link Consolidated FVU Request.

- Now here fill all important information as asked in the form.

- After completing this form, a new window will appear. Here, fill all the necessary details.

- Now, you will get your FVU consolidated file on your personal email ID. Let us tell you all that this type of file is protected under fifteen digit receipt number. When you open any zip file start to extract it out. This is similar to the FVU file. This is for the time period of the provisional receipt number. This file contains all entries in return. Again let us tell you all that this TDS file contains all entries of accepted returns.

Result of Not having TAN

Here we will discuss the fine of not having a TAN number. According to Section 272BB(1), if there is not given any TAN number to all respective TAN offices by an applicant or citizen then they need to pay a fine of Rs.10000/-. Somehow, if there is any wrong information, then there would be the same fine below Section 272BB. Except this, if you are facing such issues, then you need to check given below points that why did this happen:

- If someone has not any TCS or TDS return acceptable by any PAN or TIN Facilitation Centers.

- If there is not any bank who accepted challans to do payment as TCS or TDS.

Difference Between PAN or TAN

PAN means Permanent Account Number important for all to file their Income tax returns. Whereas, TAN means Tax Collection or Deduction Number is important for all who are eligible to gather TCS or withdraw TDS below the Income Tax Act as announced by the government of India.

TAN Jurisdiction Building Name

Here we will discuss the various steps to know an applicant TAN Jurisdiction Building Name by just following the all given below steps. Steps are:

- First, go to an official website of Income Tax which is given as incometaxindia

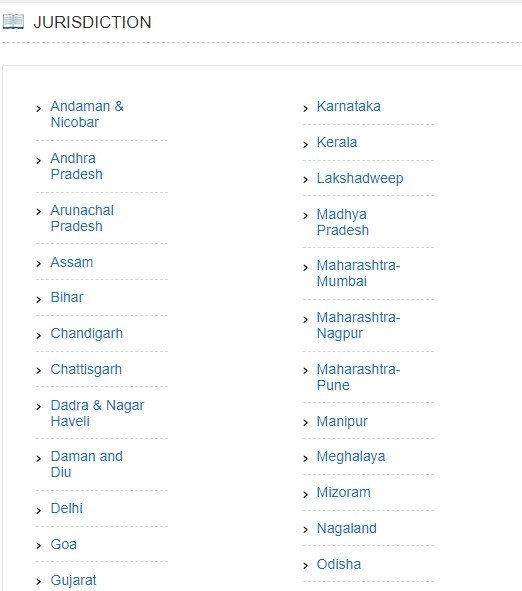

- The page will look like this.

- Now, here as you can see below the important links there is a jurisdiction option. Click on it.

- The page will look like this.

- Now, choose a state from here.

- After choosing, the PDF file is opened.

- The direct link of PDF file is given as Details of Delhi Jurisdiction

- In this PDF file, a long list of all building name will be shown to you.

- In this way, the applicant or citizen can check his or her TAN jurisdiction building name anytime or anywhere with the use of the Internet.

Advantages of TAN Verification and Registration

Here we will discuss the various necessary advantages of TAN Verification and Registration. As we know there are numerous ways of profit or benefits of using a TAN. Advantages are:

- From this TAN, all deductors should have fixed the authenticated login area.

- With the help of all data related to updating all effective information of TAN, all deductors received a communication signal from one and only the Income Tax Department as related to the Tax Deducted at Source [TDS] and even Tax collected at source [TCS].

- All deductors have the facility of download the recent Input File [FVU] for all the correction work and they can verify every status of challan online.

- All deductors should get a piece of a statement where it shows the tax deducted at source [TDS] status.

- According to the Section of 200A mentions that there should be an agreement of TDS [tax deducted at source] into TAN owner.

- All deductors should be able to download [TDS] tax deducted at the source very easily.

- So, this shows the advantages of the TAN verification and registration process. This type of process is very easy and you can easily understand.

I hope you will understand this article very well and are ready to take benefit from it. If you are facing any problems related to the meaning of a TAN Registration, how to apply Online for a TAN Registration Process, Important Documents, and its various advantages then you may ask your queries in the given comment box.

Frequently Asked Questions

Name all types of modes that are used to apply for obtaining a TAN Registration?

There are only two modes available such as online mode and offline mode. It is dependent on the user which mode they can be applied for a TAN Registration.

Can we make payment for the TAN Registration Application Form with the help of net banking?

Yes, we can do payment by using net banking, credit card, and debit card.

What is the processing fee for a TAN Registration Application Form?

The processing fee for a TAN Registration Application Form will be of Rs.63 plus service tax.