PMVVY, Pradhan Mantri Vaya Vandana Yojana, Online Apply, PMVVY Yojana 2021, Prime Minister Vaya Vandana Scheme: As we know, that the Indian government was started the scheme or yojana for all senior citizens on 04.05.2017 named as Pradhan Mantri Vaya Vandana Scheme. It is a type of pension yojana begun by the government. In this yojana, every older person whose age is sixty years or more prefers an annual pension and monthly pension according to their choices. For a monthly pension, you will receive an interest rate of 8% for ten years. For the annual pension scheme, you will receive an interest rate of 8.3% for ten years. Below PMVVY Scheme, every older people should receive a reasonable rate of interest on their investment. This article will discuss everything related to the Prime Minister Vaya Vandana Yojana 2021, eligibility conditions, documents required, essential points, the process to apply online, benefits, objectives, and other information. So, please read our article until the end.

| Topic Name | [PMVVY Scheme] Pradhan Mantri Vaya Vandana Yojana 2021 |

| Article Category | Pradhan Mantri Vaya Vandana Scheme Pradhan Mantri Vaya Vandana Yojana: New update PM Vaya Vandana Yojana 2021 Vaya Vandana Scheme 2021 PM Vaya Vandana Yojana Surrender Value Important Points of PMVVY Scheme 2021 PM Vaya Vandana Yojana Online Apply Frequently Asked Questions |

| State Name | Central |

| Official Website | Click Here |

Pradhan Mantri Vaya Vandana Scheme

PMVVY is a type of pension or security plan. It is a type of yojana officially managed by India’s government and run by the LIC company. Earlier, the total or maximum amount to invest below this yojana was seven and a half lakh, which now increased to fifteen lakh rupees. Not only the investment, but it also increases the deadline date, which is from 03 May 2018 to 31 March 2021. Every citizen must check all details before applying for a particular scheme. Here, we will ready to provide you with full information related to the PMVVY 2021. Kindly read our article carefully.

Also Read: WB Joy Bangla Yojana

Overview of PMVVY Scheme 2021

| Name of Article | Pradhan Mantri Vaya Vandana Yojana |

| Started By | Life Insurance Corporation of India |

| Beneficiaries | Indian Citizens |

| Objective | To Provide all information related to the PMVVY 2021 |

| Official Website | Click Here |

| Year | 2020 |

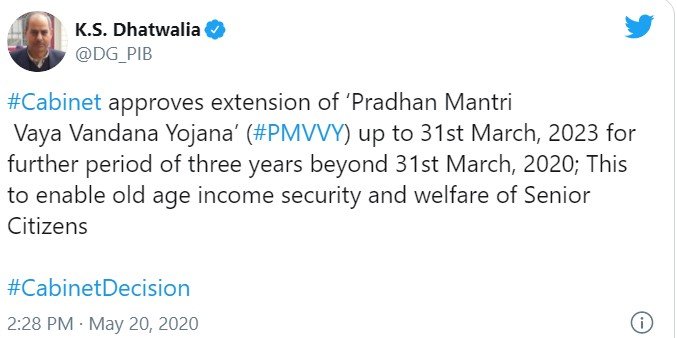

Pradhan Mantri Vaya Vandana Yojana: New Update

Here we will discuss the new update of the PMVVY Scheme. Let’s inform you all that the Union Cabinet has announced to increase the last date of investment below this yojana, which is from 31.03.2020 to 31.03.2023. As everybody knows, the LIC (Life Insurance Corporation) stated that the main aim is to provide a pension to all senior person (sixty years or more). In this scheme, every applicant has to give a minimum fixed annuity based on the return of the subscription or purchase price. In this yojana, senior people should invest Rs.1,56,658/- to get a minimum pension of Rs.120000/- every year and invest of Rs.1,62,162/- to get a minimum pension of Rs.1000/- for every month.

Prime Minister Vaya Vandana Yojana: Objective

Here we will discuss the objective of Pradhanmantri Vaya Vandana Yojana so, as we knew that this yojana would benefit for all old age people in our country. The primary aim or purpose of starting this yojana is to give pension to all old age people. This scheme will be given to them with the help of the paid interest on the investment made by them. With this great initiative, every senior person in our country will feel safe and not depend on others during old age. Through this scheme, every senior person has become financially independent.

Also Read: YSR Pension Scheme

PM Vaya Vandana Yojana 2021

As we all know, this scheme is a type of pension scheme, where all senior people should invest around fifteen lakh rupees. In this yojana, the total limit of investment would always be different from one family to another, such as if from one family, both husband and wife can invest Rs.15 – 15 lakhs separately, they will get the bonus in investment. Below this scheme, there is a law from the pensioner side: to have the right to get the amount of interest as a pension.

Let’s inform you all that below PM Vaya Vandana Yojana, the pension scheme will be ranging from 1000 to 10,000 rupees. It is known that financial help as a pension will be a guarantee from the government with a fixed annual return of 8% for around ten years below this pension scheme. The investment limit has increased with a confirmation that senior people have a minimum of ten thousand rupees every month, with a minimum pension of one thousand every month. The basic point is that you will receive the amount of interest in the form of an annuity. It means that if you have deposit fifteen lakh rupees at an 8% rate of interest, then you will get one lakh twenty thousand rupees interest in one year. This amount will be paid monthly as a 10-10 thousand rupees, by every quarter as 30000-30000 rupees. And by twice a year of 60000-60000 rupees and lastly by once a year of 120000 rupees.

PMVVY Application Form

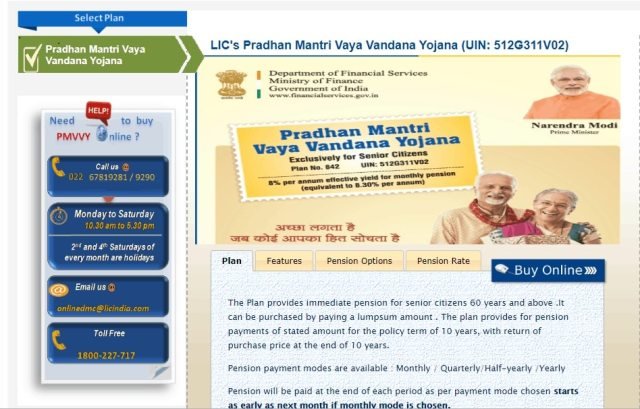

Here we will tell you the basic information of the PMVVY application form. Let’s inform you that every person should receive their first instalment of pension after one year, three months, six months, or one month after deposit the amount. It depends on the choice of the option you opt or choose. In this PMVVY Scheme 2021, every interested candidate who wants to apply for this scheme can apply either online or offline according to their choices. If you wish to apply for this scheme online, visit a LIC website, register online, and buy a policy. On the other hand, if you want to apply for this scheme offline, you may visit the LIC branch centre and avail the benefit of PM Vaya Vandana Yojana 2021.

New Update

Let’s inform you all that this policy scheme is applicable for ten years. Below this scheme, you can sell a policy by 31 March 2021 with the secure payment made at the rate of 7.40% per annum. In this PM Vaya Vandana Yojana, the pensioner can opt quarterly, monthly, half-yearly, or yearly pension schemes during the purchase time. Let’s inform you that the maximum amount of pension should be about Rs.9250/- every month. Every eligible candidate should receive a pension of Rs.27,750/- every quarter, Rs.111000/- every year, and Rs.55500/- every half year. As the time of the scheme will extend, the government has to make a few amendments to it. In this Vaya Vandana Yojana, the minimum amount of pension (annual) of One thousand rupees has been giving to every candidate. The minimum amount of investment has made up to One lakh sixty-two thousand one-sixty-two rupees would amend.

Vaya Vandana Scheme 2021

If somehow senior person leaves this scheme or yojana in the middle of exits, it has informed you all that there is an option of withdrawing his money before the scheme’s maturity period. If the pensioner has some severe illness, they will be able to receive their money back for treatment. Let’s inform you all that if pensioners want to get back their money for treatment, they will get 98% of the amount deposited. Every pensioner will take a loan after three years of the amount deposited below PM Vaya Vandana Yojana 2021. In this government yojana, you will take a loan up to 75% of the deposited amount. Every quarter, there is a fixed rate of interest. For this, the pensioner has to pay an interest every six months until you pay back the total loan amount.

Pradhan Mantri Vaya Vandana Yojana Interest Rates

| Option of Pension | Fixed Interest Rate |

| Quarterly | 7.45% |

| Half-yearly | 7.52% |

| Monthly | 7.40% |

| Yearly | 7.60% |

Vaya Vandana Yojana Payment

Here we will tell you the payment method below the Pradhan Mantri Vaya Vandana Yojana. Let’s inform you all that every pensioner should be able to pay the payment below this scheme monthly, quarterly, yearly, or half-yearly. Everyone you should pay by using the following online methods such as NEFT, Aadhaar Enabled Payment System.

Pension Options

Here we will provide you with the information to get the pension from LIC company. The options are as follows:

- Monthly

- Quarter

- Half-yearly

- Annual basis according to their wish.

- The amount of pension will be paid by through NEFT or Aadhaar enabled payment system.

Pradhan Mantri Vaya Vandana Yojana 2021: Maturity benefits

Here we will provide you with the various maturity benefits below Pradhan Mantri Vaya Vandana Yojana 2021. The steps are as follows:

- After the policy tenure period of ten years, the pensioner will get the deposited amount and pension if they were alive.

- If the pensioner dies, the total deposited amount will return to the nominee within the policy tenure period.

- If somehow the pensioner commits suicide, then the deposited amount will get refunded.

PM Vaya Vandana Yojana Surrender Value

If somehow, any person wants to quit PM Vaya Vandana Yojana and cannot pay any amount. Or, he or she needs money for some personal reason. In that case, 98% of the total amount returned. If you are not delighted with the rules & regulations, or you say the policy’s terms & conditions. In that case, you may return it by following the requirements as if you buy policy offline within fifteen days or you buy online within thirty days; you may return.

Every pensioner will be able to get the loan below Pradhan Mantri Vaya Vandana Yojana. This work was done after the completion of the policy of three years. Below this scheme, you will be able to get 75% of the total amount paid. The real interest rate below this loan scheme was charged at 10%.

Important Points of PMVVY Scheme 2021

Here we will discuss some of the important points related to the PMVVY Scheme 2021. The steps are as follows:

- For PMVVY Scheme, the minimum age of every senior person would be 60 years or plus. The maximum age limit is not given at all.

- The policy tenure is of ten years. The minimum pension scheme would be of Rs.1000/- per month, Rs.3000/-, Rs.6000/- for half-yearly, Rs.12000/- per year. The maximum amount of Rs.30,000/- for quarterly, Rs.60,000/- for half-yearly, and Rs.1,20000/- per year.

- In this Pradhan Mantri Vaya Vandana Yojana 2021, the total maximum amount would be Rs.15 lakhs that a senior person would invest.

- The time of the policy term is of ten years.

- In this PMVVY Yojana, they provide income security to all old age senior people of the country.

- Below this scheme or yojana, you would not be able to give any GST.

Important Documents

Here we will discuss the required documents needed during the registration of this yojana or scheme. The papers are as follows:

- A citizen must be a resident of India.

- Aadhaar Card

- Applicant PAN Card

- Mobile Number

- Applicant Bank account details

- Passport size photo

Pension Rates Examples [PMVVY scheme]

Here we will tell you the examples of pension rates for buy Rs.1000 below the different mode of payment:

- Half-yearly: Rs.81.30/- per annum

- Monthly: Rs.80/- per annum

- Yearly: Rs.83/- per annum

- Quarterly: Rs.80.50/- per annum

All the above Pension rates are given without knowing the age group of the citizen.

Also Read: Prime Minister Research Fellowship

PM Vaya Vandana Yojana Online Apply

Here we will provide you with the steps to apply online for PM Vaya Vandana Yojana Online. All interested applicants ready to apply for this scheme can apply for it either online or offline. The steps are as follows:

- For this, visit the official website of Life Insurance Corporation, which is as follows Click Here.

- The page will look like this.

- Now, tap on the registration link. An application form will appear on your computer or laptop screen.

- Now, fill all asked information given on the application form such as Aadhaar Card number, applicant name, address, etc.

- After successfully submit all details, now upload all required documents.

- Tap on the submit button.

- In this manner, you will be able to apply for this scheme online.

Key Points

| Policy Term | 10 Years | |

| Mode of Pension Scheme | Monthly, Quarterly, half-yearly and annually (in rupees) | |

| Price of Purchase | Rs.1,50,000/- Monthly

Rs.1,49,068/- Quarterly Rs.1,47,601/- Half-yearly Rs.1,44,578/- Yearly |

Rs.15,00,000/- Monthly

Rs.14,90,683/- Quarterly Rs.14,76,015/- Half-yearly Rs.14,45,783/- Yearly |

| Age | 60 years (completed) | No Limit |

| Pension amount | Rs.1,000/- Monthly

Rs.3,000/- Quarterly Rs.6,000/- Half-yearly Rs.12,000/- Yearly |

Rs.10,000/- Monthly

Rs.30,000/- Quarterly Rs.60,000/- Half-yearly Rs.1,20,000/- Yearly |

Application Process [Offline]

Here we will discuss the necessary procedure to apply offline for this PMVVY yojana. For this, every eligible applicant or candidate must visit the nearest LIC Branch. After that, take all the required documents while visiting the centre and submitting it to the branch office.

Now, the LIC agent will apply for this scheme. They verify all documents. After the completion of verification, they will use for this policy scheme.

I hope you will understand this article very well and are ready to take advantage of it. Suppose you face any problems related to the Prime Minister Vaya Vandana Yojana 2021, eligibility conditions, documents required, essential points, the process to apply online, benefits, objectives. In that case, you may ask your queries in the given comment box.

Frequently Asked Questions

Name all important documents that are needed to apply for this Pradhan Mantri Vaya Vandana Yojana?

Important Documents are as follows A citizen must be a resident of India, Aadhaar Card, Applicant PAN Card, Mobile Number, Applicant Bank account details, and Passport size photo.

Is this scheme will be available for all state senior citizen people?

Yes, this PMVVY scheme has been announcing by the Central Government, which applies to all states in our country.

Name all modes of the Pension Scheme below PM Vaya Vandana Yojana 2021?

All modes are as follows: Monthly, Quarterly, half-yearly, and annually (in rupees).