If you’re in need of a credit boost and are looking for a credit-building solution without a credit check, Kovo Credit might be the answer you’ve been searching for. In this comprehensive Kovo Credit review, we’ll delve into the ins and outs of this platform, its features, and its pros and cons to help you make an informed decision regarding whether it’s the suitable option for you.

What is Kovo Credit?

Kovo Credit is a credit builder platform designed to help individuals improve their credit scores. It achieves this by offering a unique opportunity to make purchases through their platform, which are then reported to the credit bureaus. This process allows you to receive a retail installment loan of up to $240 without the need for a credit check, making it a more accessible option for those with poor or no credit history.

But Kovo Credit offers more than just credit builder loans. It provides a range of valuable online courses designed to empower users in various aspects of their lives. From enhancing interview skills and boosting self-confidence to gaining knowledge in entrepreneurship and stress management, Kovo’s courses provide practical tools and strategies to support personal and professional growth. Moreover, they offer courses on personal branding, Google Sheets, and programming, ensuring there’s something for everyone.

The primary goal of Kovo Credit is to empower individuals to take control of their finances and achieve their financial goals. By using Kovo to make timely payments and demonstrate responsible financial behavior, users can potentially qualify for low-interest rate loans and further enhance their creditworthiness.

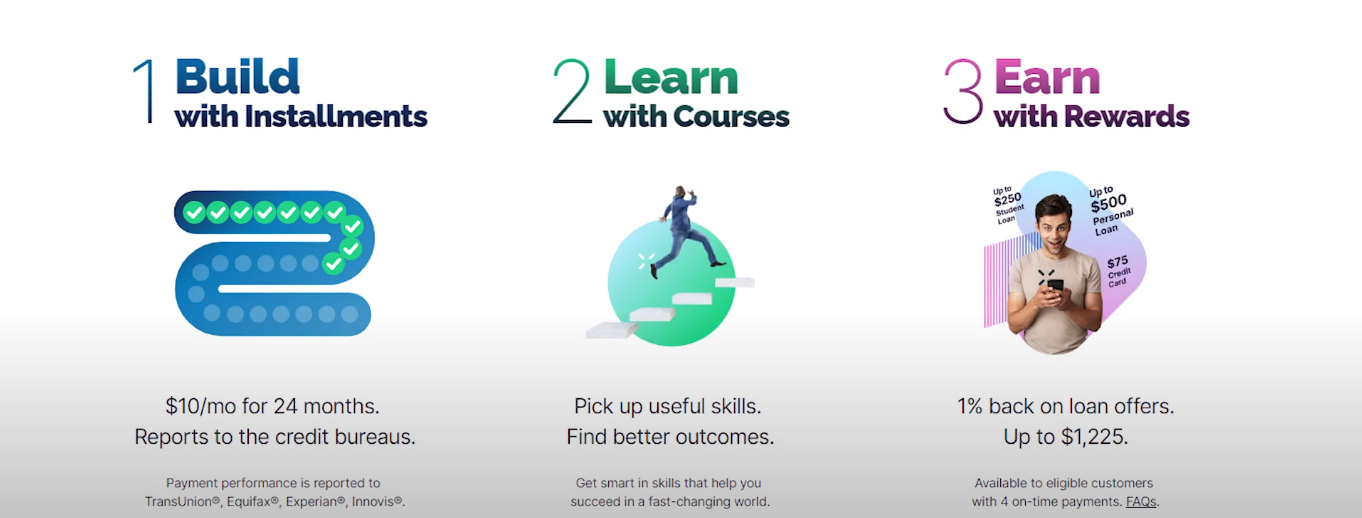

The Components of Kovo Credit

Kovo Credit comprises three main components: retail installment loans, online courses, and rewards. Let’s break down each of these:

1. Retail Installment Loans

Kovo Credit offers retail installment loans that allow you to borrow money to pay for their courses. You can repay this loan through small, manageable monthly payments. The significant advantage is that your payment history is reported to credit bureaus, positively impacting your credit score. This makes Kovo Credit a valuable tool for building or rebuilding your credit.

2. Online Courses

Kovo Credit doesn’t stop at just loans. They offer an array of online courses that cover essential aspects of personal finance and money management. These courses are designed to educate users on better financial management, ultimately leading to improved financial situations. Moreover, if you find the courses unsatisfactory, Kovo Credit offers free refunds within 30 days. Simply reach out to their support team.

3. Rewards

Kovo Credit goes the extra mile by rewarding users who open a loan or credit card offer from select future lenders and credit card issuers. These offers encompass a variety of loan products and credit cards, and collectively, they can earn you up to $1,225 in gift cards.

The Benefits of Using Kovo Credit

Kovo Credit offers several significant advantages:

No Credit Check Required

One of the standout features of Kovo Credit is that there is no credit check required for approval. This means that anyone can sign up and start building their credit, regardless of their current credit history. Plus, approval is instant, so you can access the platform and begin improving your financial health right away.

No Fees or Interest Charges

Kovo Credit stands out by not charging any fees or interest associated with using their platform. Users can borrow money at a zero percent APR, making it an affordable option for managing their finances. Furthermore, Kovo Credit offers a unique opportunity for users to earn one percent on loans through their Lending program, providing an additional avenue to strengthen their financial standing.

Earning Rewards

Users have the opportunity to earn rewards through Kovo Credit’s partnership with lenders and credit card issuers. These rewards can include gift cards, adding extra value to your credit-building journey.

Valuable Courses

Kovo Credit offers a diverse range of online courses that cover personal finance, money management, self-improvement, and professional development. These courses provide practical tools and strategies to support your growth in various aspects of life. Whether you’re looking to improve your skills or explore new horizons, Kovo’s courses can be immensely beneficial.

30-Day Refund Policy

Kovo Credit offers a 30-day refund policy for their courses. If you’re not satisfied with a course for any reason, you can request a free refund by reaching out to their support team.

Potential Drawbacks of Kovo Credit

While Kovo Credit offers several benefits, it’s essential to consider some potential drawbacks:

Loan Amount Limit

Kovo Credit caps the loan amount at $240. While this amount may be sufficient for some users, it may not meet the needs of those looking to make larger purchases or investments. The loan provided by Kovo can only be used to purchase their online courses, limiting the options for using the loan for other products or services.

Not a Quick Fix

It’s crucial to understand that Kovo Credit is not a quick solution for dramatically improving your credit score. Building a solid credit history takes time, and Kovo Credit is just one tool in the process. While the platform can help, it does not guarantee a rapid increase in your credit score.

Who Can Benefit from Kovo Credit?

Kovo Credit can benefit various groups of individuals:

Thin Credit Profiles or No Credit History

If you have a thin credit profile or no credit history at all, Kovo Credit can be an excellent starting point to establish your credit history. The platform’s accessibility and lack of a credit check make it easy for individuals in this situation to begin building credit.

Credit Rebuilders

For those looking to rebuild their credit after financial setbacks, Kovo Credit can be a valuable tool. By demonstrating responsible borrowing habits and making timely payments, users can show the credit bureaus their commitment to improving their credit standing.

Personal and Professional Development Seekers

If you value personal and professional development, Kovo’s wide range of courses may be appealing. Whether you want to enhance your skills, improve your knowledge, or explore new career opportunities, Kovo’s courses can help you grow and advance.

Comparing Kovo Credit to Other Credit Builders

To make an informed decision, it’s important to compare Kovo Credit to other popular credit-building platforms. Let’s take a look at how it stacks up against Kikfoff, Credit Strong, and Self:

Kovo vs. Kikoff

Both Kovo and Kikoff offer credit-building services that report to major credit bureaus. Kovo offers a two-year plan, which is advantageous if you’re looking to build a longer credit history. Kikoff, on the other hand, provides a standard monthly option. In terms of costs, Kovo charges $10 per month, while Kikoff charges just $5 for their credit account. Keep in mind that the long-term benefits of a strong credit score far outweigh the cost of building credit. The choice between Kovo and Kikoff depends on your preferences and goals.

Kovo vs. Credit Strong

Kovo and Credit Strong have different approaches to credit building. Kovo offers credit builder loans with a set loan amount and monthly payments. In contrast, Credit Strong provides a similar service but at a higher monthly payment and cost. With Credit Strong, your monthly payments contribute to building savings rather than purchasing courses. While Credit Strong’s terms are longer and payments higher, it can help you build a stronger credit profile.

Kovo vs. Self

Self is one of the most well-known credit builders in the industry. When it comes to credit builder loans, Kovo Credit starts at a lower amount ($240) compared to Self’s $520. However, Kovo does not charge administrative fees or finance charges, potentially making it a more affordable option. Both lenders allow for early loan payments without penalties and report payments to major credit bureaus. With Self, your money is locked into a savings account, which you can access once the loan is paid off, minus any fees.

Conclusion

Kovo Credit offers a comprehensive solution for individuals looking to build or rebuild their credit while gaining access to valuable courses and potential rewards on their offical website. With its accessibility, no credit check requirement, and instant approval, it can be an excellent choice for those with thin or no credit profiles. However, users should be aware of its limitations, such as the capped loan amount and the fact that it’s not a quick fix for improving credit scores. To determine if Kovo Credit is the right fit for your financial goals, carefully weigh its benefits and drawbacks against your specific needs and preferences.

Frequently Asked Questions

How does Kovo Credit help improve my credit score?

Kovo Credit helps improve your credit score by offering retail installment loans that allow you to make small monthly payments. These payments are reported to the credit bureaus, helping boost your credit score as you demonstrate responsible financial behavior.

Is there a credit check required for Kovo Credit approval?

No, one of the standout features of Kovo Credit is that there is no credit check required for approval. This makes it accessible to individuals with poor or no credit history.

What types of courses does Kovo Credit offer, and how can they benefit me?

Kovo Credit provides a variety of online courses, covering topics from personal finance and money management to self-improvement and professional development. These courses can empower you with practical tools and knowledge to enhance your financial and personal well-being.

Are there any fees associated with Kovo Credit?

Kovo Credit does not charge any fees or interest associated with using their platform, making it an affordable option for managing your finances.

How can I access rewards with Kovo Credit, and what are the benefits?

Kovo Credit offers rewards when you open a loan or credit card offer from select future lenders and credit card issuers. These rewards can include gift cards, allowing you to potentially earn up to $1,225. It’s an added incentive for using the platform to improve your financial standing.