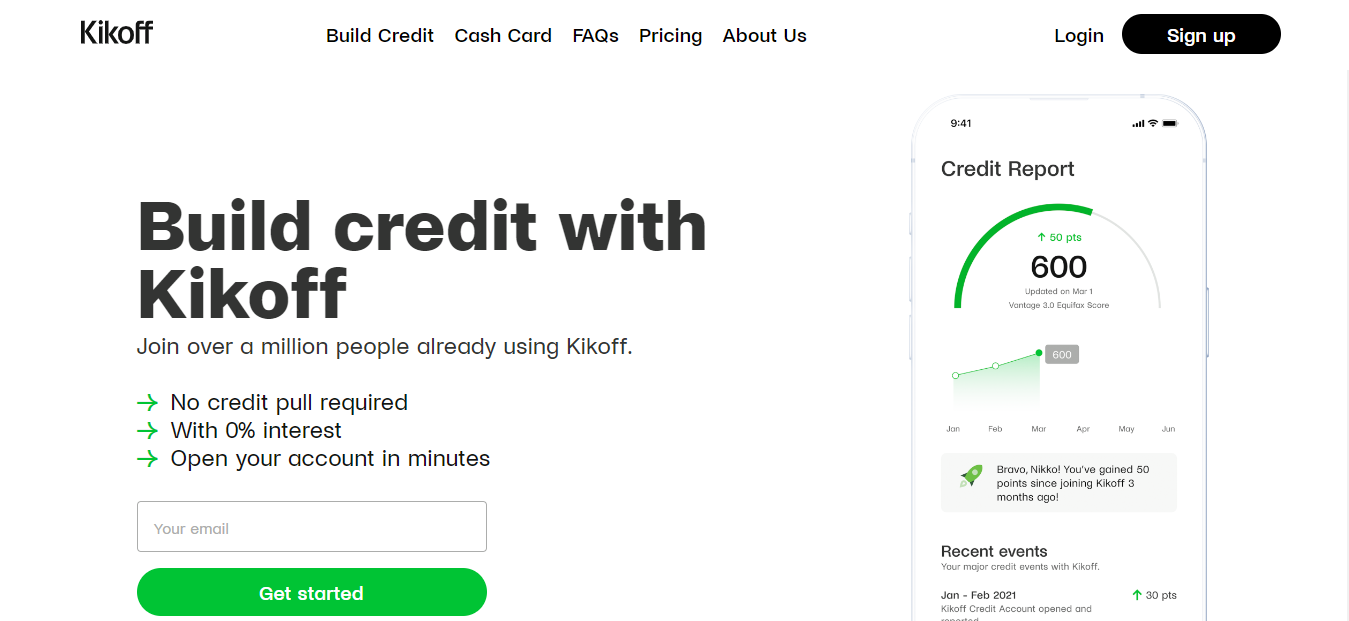

Are you looking to boost your credit score without the hassles of credit checks and hidden fees? Kikoff Credit Builder might just be the solution you’ve been waiting for. In this comprehensive guide, we’ll break down everything you need to know about Kikoff and how it can help you access a 750 credit line. Let’s dive right in!

What is Kikoff Credit Builder?

Kikoff is a fintech company headquartered in San Francisco, offering a range of financial products designed to help individuals build and rebuild their credit. The core offerings of Kikoff include:

- Revolving Credit Account: This is your gateway to a 750 credit line with zero interest and no credit check. You can open an account within minutes, all starting at just $5 per month.

- Credit Builder Loan: If you’re unfamiliar with credit builder loans, they are designed to assist individuals with little to no credit history in establishing or improving their credit score. With Kikoff, you can start this process after a year of using their service, adding just $10 per month. At the end of the year, Kikoff returns the $120 you’ve invested, helping you create a small emergency fund and boost your credit score.

- Credit Plus Cash Card: Arrange your paycheck to go into your Kikoff account, and you can access the Kikoff Cash Card, similar to a MasterCard that functions like a debit card. You can only spend what’s in your account, plus you gain access to your paychecks two days earlier than with a regular bank account. Additionally, there’s a $200 sign-up bonus after three months of normal use.

How to Get Started with Kikoff

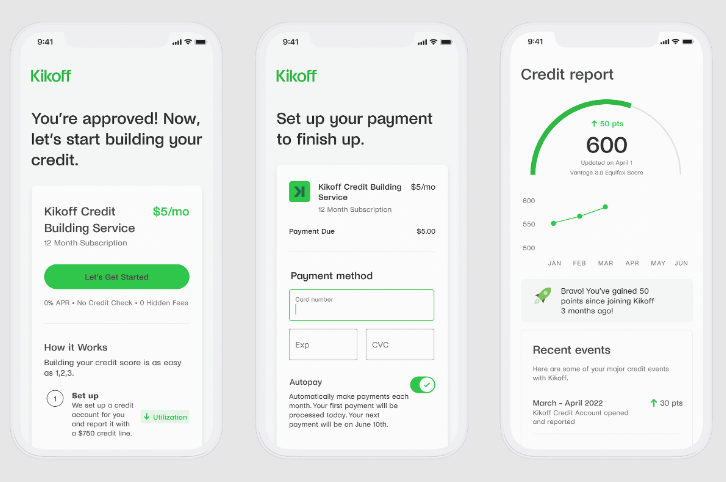

Getting started with Kikoff is straightforward:

- Sign Up: You can sign up via the Kikoff website or download their app from the App Store or Google Play Store.

- Provide Necessary Information: Enter your email address, personal information, and social security number. Providing your social security number is essential for reporting credit information to the credit bureaus.

- Approval: Approval typically takes just a few seconds.

- Purchase an Item: To have Kikoff report to the credit bureaus, you’ll need to buy an item from their store. Most products range from $10 to $20, focusing on personal finance and wellness topics.

- Link Your Bank Account: After your purchase, link your bank account and make monthly payments until the item is paid off.

The Benefits of Kikoff Credit Builder

Pros:

- No Credit Check: Kikoff does not perform a hard inquiry on your credit report during the application process, protecting your credit score.

- Easy Approval: Nearly anyone can qualify for Kikoff’s services.

- No Interest or Fees: You won’t encounter any interest charges or hidden fees while using Kikoff’s credit line.

- Variety of Credit Lines: Kikoff offers both revolving and installment credit lines, allowing you to diversify your credit profile.

- Reports to All Three Credit Bureaus: Kikoff consistently reports to all major credit bureaus, ensuring your credit score benefits from your responsible credit behavior.

Cons:

- Limited Product Selection: Kikoff’s product offering is currently limited, with most items costing between $10 to $20. However, they plan to expand their product lineup in the future.

- Not Available in All States: Kikoff is not available in Delaware.

- Restricted Credit Line Use: The 750 credit line can only be used to purchase products from Kikoff, limiting its versatility compared to other credit-building options.

- Credit Reporting: While Kikoff reports to all three credit bureaus, you need a specific combination of products for this to happen. Otherwise, it only reports to two.

Comparing Kikoff to Other Credit Building Tools

Kikoff vs. Kovo Credit Strong

- Credit Amounts: Kikoff offers a higher credit line of $750, while Kovo offers a lower loan amount of $240.

- Credit Reporting: Kikoff reports to all three major credit bureaus but requires a specific combination of accounts. Kovo, on the other hand, reports to all three bureaus regardless of the accounts you have.

- Use of Funds: Both Kikoff and Kovo restrict the use of funds to their respective platforms.

- Cost: Kovo charges $10 per month, while Kikoff starts at just $5 per month. Kikoff also offers a credit builder loan that can be more comparable to Kovo.

Kikoff vs. Credit Strong

- Credit Building Approach: Credit Strong offers a revolving line of credit that reports a minimum of $500 to the credit bureaus. Kikoff takes a more diverse approach with a range of credit products.

- Cost: Credit Strong charges an annual fee of $99, which is comparable to Kikoff’s monthly costs when broken down.

- Credit Reporting: Credit Strong reports to all three credit bureaus, providing an advantage in this regard.

Kikoff vs. Secured Credit Card

- Credit Limit: Kikoff provides a fixed $750 line of credit, while a secured credit card’s limit is determined by your initial deposit.

- Cost: Kikoff has no interest or fees, whereas secured credit cards can come with annual fees and interest charges.

- Flexibility: Secured credit cards can be used anywhere they are accepted, offering greater spending flexibility.

- Upgrade Path: Secured credit cards may offer the opportunity to upgrade to an unsecured card, which Kikoff does not provide.

Conclusion

Kikoff is an excellent choice for those looking to enhance their credit history without the burden of interest charges, fees, or credit checks. With easy approval, consistent reporting to all three major credit bureaus, and a user-friendly approach, Kikoff offers a convenient and affordable way to build or rebuild your credit.

Ready to take the next step in your credit-building journey? Give Kikoff Credit Builder a try and unlock the power of a 750 credit line today!

Frequently Asked Questions (FAQs)

What is Kikoff Credit Builder?

Kikoff Credit Builder is a financial service offered by Kikoff, a fintech company based in San Francisco. It provides individuals with the opportunity to build or rebuild their credit history by offering a range of financial products, including a revolving credit account, a credit builder loan, and a credit plus cash card.

How does Kikoff Credit Builder work?

Kikoff Credit Builder works by giving users access to a 750 credit line with no credit check and zero interest. Users can open an account for as low as $5 per month. They can also opt for a premium service, which provides a $2,500 credit line with a monthly credit report from all three credit bureaus for $20 per month. Users can use this credit line to purchase products from Kikoff’s store, similar to a retail credit card.

Does Kikoff Credit Builder charge interest or fees?

No, Kikoff Credit Builder does not charge any interest or fees on outstanding balances. This sets it apart from traditional credit cards and many other credit-building options.

How do I apply for Kikoff Credit Builder?

The application process for Kikoff Credit Builder is simple. You can sign up on the Kikoff website or download their app from the App Store or Google Play Store. You’ll need to provide your email address, personal information, and social security number. Approval typically takes just a few seconds.

How does the Credit Builder Loan work with Kikoff?

The Credit Builder Loan with Kikoff is an option that becomes available after you’ve been using their service for a year. You can set up auto or manual transfers from your bank account to contribute $10 each month to the loan. At the end of the year, Kikoff returns the $120 you’ve contributed. This can help you create an emergency fund and improve your credit score.

Does Kikoff Credit Builder report to credit bureaus?

Yes, Kikoff Credit Builder consistently reports to all three major credit bureaus. This means that your positive credit behavior will reflect on your credit reports, potentially improving your credit score.

Is Kikoff Credit Builder available in all states?

Kikoff Credit Builder is available in 49 states, covering about 99% of the U.S. population. The only state not covered is Delaware.

What are the benefits of Kikoff Credit Builder?

Some of the benefits of Kikoff Credit Builder include:

- No credit check during the application process.

- Easy approval process.

- No interest or fees.

- Variety of credit lines, including revolving and installment.

- Consistent reporting to all three credit bureaus.

Are there any downsides to using Kikoff Credit Builder?

While Kikoff Credit Builder offers many advantages, there are a few potential downsides, such as:

- Limited product selection in their store.

- Availability limited to 49 states (excluding Delaware).

- The 750 credit line can only be used to purchase products from Kikoff’s store.

- Specific combinations of products are required for reporting to all three credit bureaus.

How does Kikoff Credit Builder compare to other credit-building tools?

Kikoff Credit Builder offers unique advantages, such as no interest or fees, easy approval, and diverse credit lines. However, its product selection is limited, and it’s not available in all states. When comparing it to other tools like Kovo Credit Strong, secured credit cards, or credit builder loans, consider factors like credit limits, costs, and reporting to credit bureaus to determine the best fit for your needs.