Starting or running an LLC in 2024? It’s time to explore the world of business credit. Whether you’re a new LLC owner or an experienced business person, leveraging Other People’s Money (OPM) is a crucial step in scaling your business. One of the most effective ways to achieve this is by obtaining business credit. In this comprehensive guide, we’ll show you how to get business credit for your LLC in the fastest way possible while understanding the key rules and strategies for leveraging business credit effectively. bad credit

What is Business Credit?

Business credit refers to your company’s ability to borrow money, and it plays a pivotal role in the growth and sustainability of your LLC. Similar to personal credit scores, businesses have credit scores too. These scores help creditors, lenders, vendors, and suppliers evaluate your company’s creditworthiness.

Why Bussiness Credit Matters?

Business credit matters for a variety of reasons, and its importance can significantly impact a company’s operations, growth potential, and financial stability. Here’s why business credit is crucial:

1. Access to Capital When You Need It

Unforeseen circumstances can strike at any time. Having access to credit, whether through loans, lines of credit, or credit cards, can be a lifeline during challenging times. For instance, if you need to secure a substantial loan to expand your inventory, having good business credit can make all the difference in securing the funding you need.

2. Vendor and Supplier Flexibility

Good business credit can earn you favorable payment terms with vendors and suppliers. Instead of requiring immediate payment upon delivery, they may extend your payment terms to 30 or even 45 days. This flexibility can significantly improve your cash flow and reduce financial stress.

3. Lower Interest Rates

When borrowing money for your LLC, lower interest rates mean less costly debt. Maintaining good business credit can help you secure loans and credit cards with lower interest rates, ultimately saving you money in the long run.

The Phases of Establishing Business Credit

To successfully establish business credit for your LLC, you should understand the phases involved:

Phase 1: Establishing Business Credit

The first phase emphasizes the importance of building business credit for your company. You never know when you’ll need to borrow money to seize opportunities or weather unexpected challenges.

For instance, imagine you run a clothing business, and your hot-selling product needs a substantial inventory boost. With business bad credit, securing a loan might be challenging, potentially causing your business to miss out on growth opportunities.

Phase 2: Utilizing Business Credit

In the second phase, you’ll explore the diverse applications of business credit. It’s not just about obtaining loans and credit cards. Business credit can influence insurance premiums, attract investors, and even help you qualify for government contracts.

If you’re planning to take your company public or seek investors to fuel growth, having a strong business credit profile can increase your chances of attracting investment.

How to Get Business Credit?

Now, let’s dive into the practical steps to for how to ger business credit for your LLC:

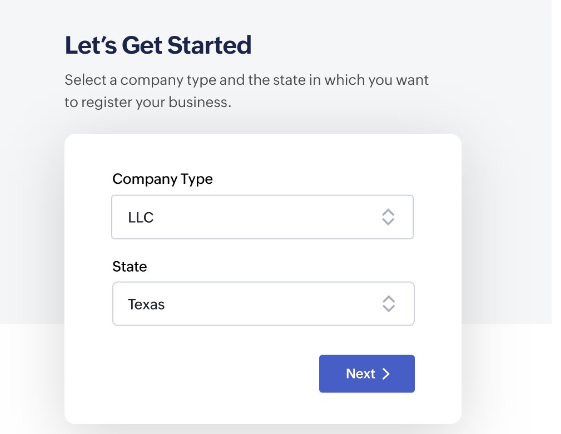

Step 1: Register Your LLC

If you haven’t already done so, register your LLC with your state. Proper registration is the foundation for establishing business credit.

Step 2: Get an EIN

Apply for an Employer Identification Number (EIN) from the IRS. An EIN serves as your business’s social security number, separating your personal and business finances.

Step 3: Open a Business Bank Account

After obtaining an EIN, establish a dedicated business bank account. This enhances your business’s credibility and separates personal and business finances.

Step 4: Obtain a Dedicated Business Phone Number

Having a dedicated business phone number displayed on your website, social media profiles, and directories enhances your professional image.

Key Business Credit Reporting Agencies

Just as with personal credit, business credit is reported by several agencies. Some of the main business credit reporting agencies include:

- Experian

- Equifax

- Dun & Bradstreet

- CreditSafe

Differences Between Business and Personal Credit Scores

While business and personal credit scores share similarities in factors considered, there are crucial differences:

- Business credit scores range from 0 to 100, with higher scores indicating lower credit risk.

- Personal credit scores range from 300 to 850, with higher scores representing better creditworthiness.

- Business credit scores are more public and can be checked by anyone, while personal credit scores are more private and require authorization.

- Factors affecting business credit scores include payment history, age of credit history, debt usage, industry risk, and company size. Personal credit scores consider factors such as payment history, amount of debt, new credit, credit mix, and average length of credit history.

How Long Does Data Remain on a Business Credit Report?

Understanding how long data remains on your business credit report is crucial:

- Trade data: 3 years

- Judgment data: 6 years and 9 months

- Bankruptcies: Up to 9 years and 9 months

- Tax liens: 6 years and 9 months

- Collections: 6 years and 9 months

- Uniform Commercial Filings: 5 years

- Bank, government, and leasing data: 3 years

Preventing negative entries and maintaining a clean credit history are essential for your business credit score.

Frequently Asked Questions

Q1. What’s the Difference Between Personal and Business Credit Scores?

Personal credit scores are tied to individuals and range from 300 to 850, while business credit scores are tied to companies and typically range from 0 to 100. Personal credit scores reflect an individual’s creditworthiness, while business credit scores assess a company’s credit risk.

Q2. How Can I Improve My Business Credit Score Quickly?

To boost your business credit score, make timely payments to vendors, maintain a low credit utilization rate, and apply for a business credit card. Ensure that your vendors report your payments to credit bureaus and regularly monitor your credit score for accuracy.

Q3. Is It Possible to Get Business Credit with Bad Personal Credit?

Yes, it’s possible to establish business credit even if you have bad personal credit. By following the steps outlined in this guide, you can build a positive business credit history that’s separate from your personal credit.

Q4. Are There Any Free Resources for Checking My Business Credit Score?

While there are paid services for checking your business credit score, some credit bureaus offer limited free access to your business credit report. You can access these reports periodically to keep an eye on your business credit profile.

Q5. What Role Does Business Credit Play in Attracting Investors?

Investors often consider a company’s business credit when evaluating potential investments. A strong business credit profile can increase your credibility and make your business more attractive to investors looking for stable and reliable opportunities for their capital.