If you’re looking to improve your credit score and gain access to financial opportunities, the Home Depot Credit Card could be your answer. In this article, we’ll delve into the benefits, application process, and tips for securing this credit card. By the end, you’ll be equipped with the knowledge to make an informed decision on whether this card is right for you.

What is the Home Depot Credit Card?

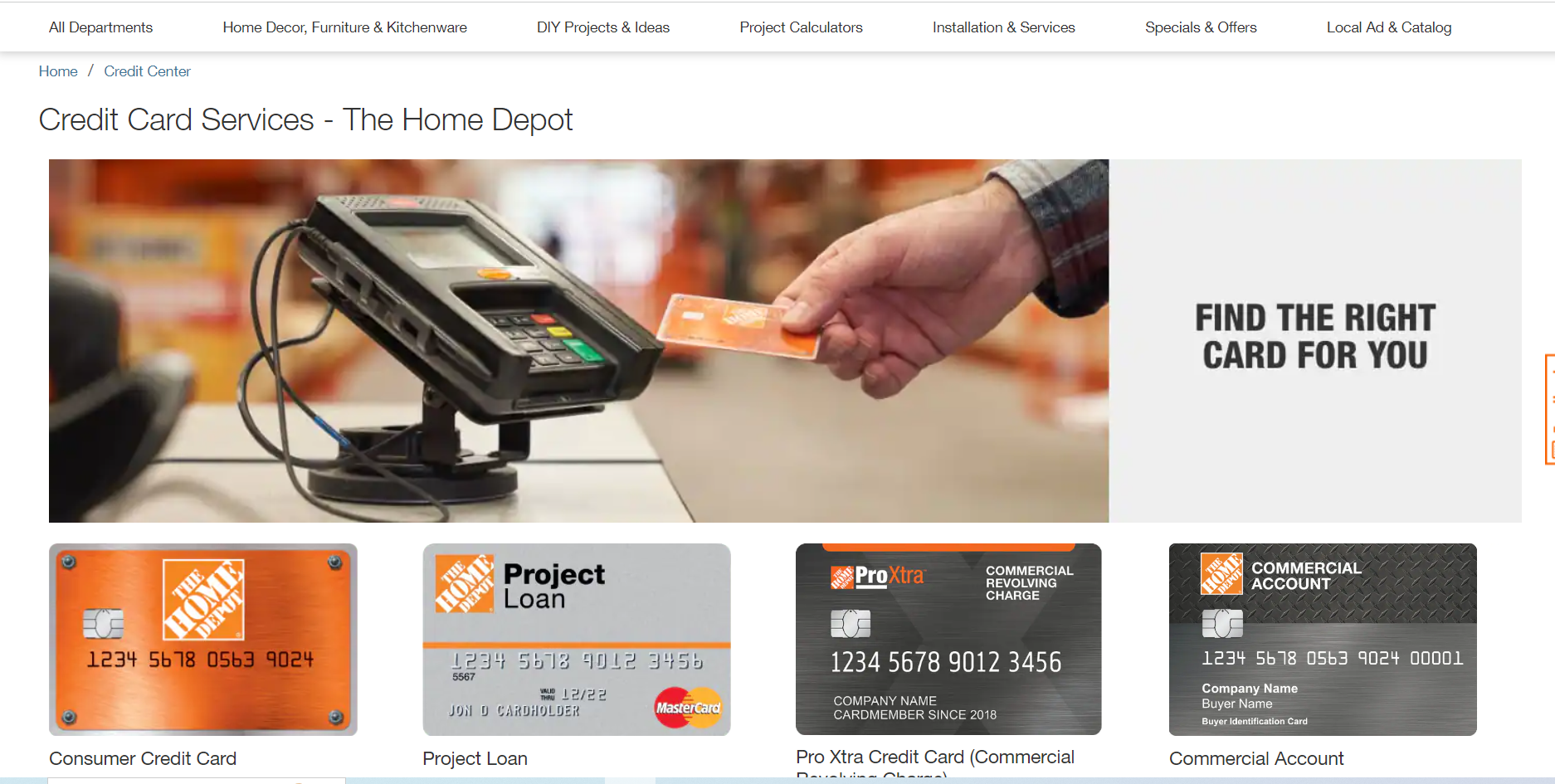

The Home Depot credit card offers four types: the Consumer Credit Card, the Project Loan Card, the Pro Extra Card, and the Commercial Account Card. While each card serves different purposes, this article will focus on the Consumer Credit Card, which can be a valuable tool for building credit.

Credit Score Requirements

To qualify for the Home Depot Consumer Credit Card, having a credit score of at least 620 is recommended. While some individuals with scores as low as 610 have been approved, it’s wise to aim for a minimum of 620 to increase your chances of approval.

Credit Bureau Inquiries

When you apply for the Home Depot Consumer Credit Card, the company primarily pulls information from Experian and TransUnion, with a heavy emphasis on Experian (about 70%) and the remainder from TransUnion. Equifax is not typically used for their credit checks, so ensure your Experian and TransUnion reports are in good standing.

No Annual Fees

As of the time of writing this article, the Home Depot Consumer Credit Card does not charge an annual fee. However, it’s essential to stay updated on their policies as they can change over time.

Overview of Home Depot Credit Cards

The Home Depot Consumer Credit Card:

Purpose: This card is primarily designed for individual consumers who frequently shop at Home Depot and want to finance their home improvement purchases.

Key Features:

-

- No Annual Fee: There is no annual fee associated with this card.

- Deferred Interest Promotions: Cardholders can benefit from special financing options on eligible purchases. These promotions often include deferred interest, which means you won’t pay interest if you pay off the balance within a specified period (e.g., 6, 12, or 24 months).

- Regular APR: If you do not take advantage of deferred interest offers and carry a balance, there is a variable APR associated with this card.

The Home Depot Project Loan Card:

Purpose: This card is designed for larger home improvement projects, such as renovations or remodels, where you need a substantial line of credit.

Key Features:

-

-

- Fixed Monthly Payments: Instead of revolving credit, you’ll make fixed monthly payments with a set interest rate for the life of the loan.

- No Annual Fee: Like the Consumer Credit Card, this card does not have an annual fee.

- Credit Limit: The credit limit is typically higher than that of the Consumer Credit Card, making it suitable for more extensive projects.

-

The Home Depot Commercial Revolving Charge Card:

Purpose: This card is designed for contractors, businesses, and professionals who frequently shop at Home Depot for their commercial needs.

Key Features:

-

-

- Business-Focused: It’s meant for business use and provides expense tracking tools.

- No Annual Fee: There is typically no annual fee associated with this card.

- Flexible Payment Terms: You have the option to pay your balance in full each month or carry a balance over time, depending on your needs.

- Rewards Program: Depending on your volume of purchases, you may be eligible for the Home Depot Pro Xtra loyalty program, which offers benefits like volume pricing, exclusive discounts, and more.

-

The Home Depot Commercial Account Card:

Purpose: Similar to the Commercial Revolving Charge Card, this card is designed for commercial or business use but with a different payment structure.

Key Features:

- Net Terms: With this card, you can enjoy extended payment terms, making it suitable for businesses with cash flow considerations.

- No Annual Fee: Like the other Home Depot cards, there is typically no annual fee.

- Expense Management: It provides tools for tracking and managing business expenses.

-

-

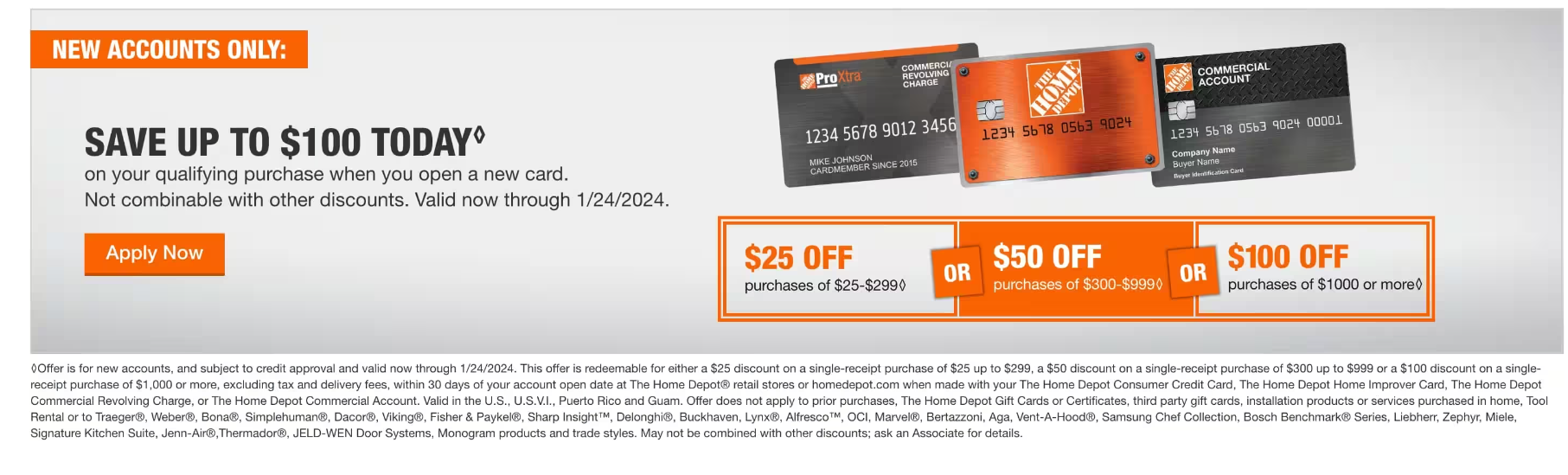

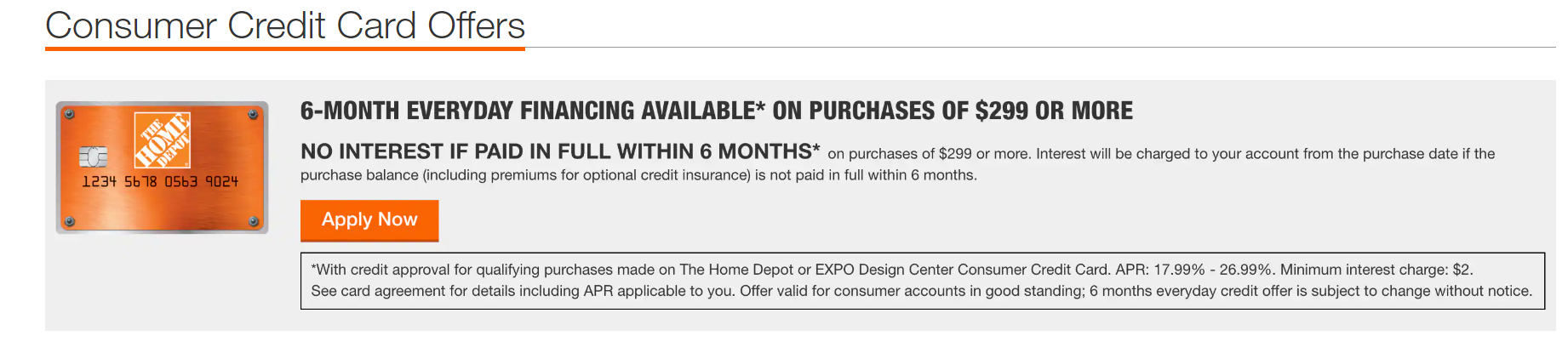

Flexible Financing

One of the notable features of this card, similar to American Express credit cards, is the flexibility it offers in financing. You can benefit from six months of financing on purchases of $299 or more, and during special promotions, you can even enjoy up to 24 months of financing. This can be especially advantageous during holidays and events such as Christmas, Thanksgiving, Labor Day, Fourth of July, and Mother’s Day.

Zero Liability

The Home Depot Consumer Credit Card provides zero liability protection on unauthorized charges, ensuring your peace of mind when using the card.

Building Credit Responsibly

While this card is accessible to individuals with lower credit scores, it’s crucial to use it responsibly to improve your credit. Make on-time payments and keep your credit utilization low to see significant improvements in your credit score over time.

Take Action to Improve Your Credit

With reasonable credit score requirements, no annual fees, and opportunities for savings and financing, it’s a practical choice for many individuals. Remember, improving your credit score is a journey that requires effort and responsibility. Take advantage of this opportunity to enhance your financial well-being and secure a brighter financial future for yourself and your family.

Conclusion

The Home Depot Credit Card offers a valuable opportunity for individuals looking to improve their credit scores and access financing options for their home improvement projects. With its reasonable credit score requirements, no annual fees, and special promotions, it can be a helpful tool on your journey to better credit. To make the most of this card, ensure you make timely payments, keep your credit utilization low, and use it wisely. By doing so, you can see significant improvements in your credit score over time. So, don’t hesitate to take action. Apply for the Home Depot Consumer Credit Card today.

Frequently Asked Questions

What credit score do I need to qualify for the Home Depot Consumer Credit Card?

To increase your chances of approval, it’s recommended to have a credit score of at least 620. However, some individuals with scores as low as 610 have been approved. Aim for a minimum of 620 to be on the safe side.

Which credit bureaus does Home Depot check when I apply for the card?

Home Depot primarily pulls credit information from Experian and TransUnion. Experian is given more weight in their credit evaluation process, with approximately 70% of the information coming from Experian and the remaining 30% from TransUnion. Equifax is typically not used for their credit checks.

Are there any annual fees associated with the Home Depot Consumer Credit Card?

As of the time of writing, there are no annual fees associated with the Home Depot Consumer Credit Card. However, it’s important to stay updated on their policies as they can change over time.

What benefits does the Home Depot Consumer Credit Card offer for financing purchases?

The card provides flexible financing options, including six months of financing on purchases of $299 or more. During special promotions, you can enjoy even longer financing terms, such as up to 24 months. These promotions often coincide with holidays and events like Christmas, Thanksgiving, Labor Day, Fourth of July, and Mother’s Day.

How can I use the Home Depot Consumer Credit Card to improve my credit score?

To improve your credit score with this card, use it responsibly. Make sure to make on-time payments and keep your credit utilization low. By doing so, you can see significant improvements in your credit score over time, helping you qualify for better financial opportunities in the future.