Welcome to a groundbreaking journey, where traditional credit cards meet the dynamic world of cryptocurrency. Are you ready to embark on a financial odyssey that will redefine how you earn, spend, and invest? In this comprehensive guide, we unveil the extraordinary potential of the Gemini Credit Card, a financial instrument backed by the visionary Winklevoss twins. Join us as we unlock the power of crypto rewards, navigate the fee landscape, and explore the allure of metal cards. Discover why the Gemini Credit Card could be the ultimate financial tool you’ve been waiting for. Let’s dive into the future, where possibilities are boundless!

What Is the Gemini Credit Card?

The Gemini Credit Card is a Mastercard issued by Web Bank and is touted as the only crypto card that deposits your crypto rewards instantly. This means that as soon as you make a payment for a qualifying purchase, you will receive a notification that your crypto rewards have been sent directly to your account.

The card is available in three different colors: black, silver, or rose gold, and all cards are made of metal. Notably, Gemini has chosen not to display card numbers on the physical card for added security. Instead, your name will be the only information on the back of the card. You can access your card number through the Gemini mobile app or website when needed.

Who Should Consider the Gemini Credit Card?

This card caters to both crypto enthusiasts and those new to the world of cryptocurrency. It offers a straightforward and secure way to earn crypto rewards by simply making everyday purchases. Whether you want to grow your existing crypto holdings or start building your crypto portfolio from scratch, the Gemini Credit Card makes it easy.

Keep in mind that when you apply for this credit card, Gemini will perform a credit check to determine your eligibility. Fortunately, this check won’t impact your credit score. Plus, using the card can contribute positively to your credit history.

Crypto Rewards – A Closer Look

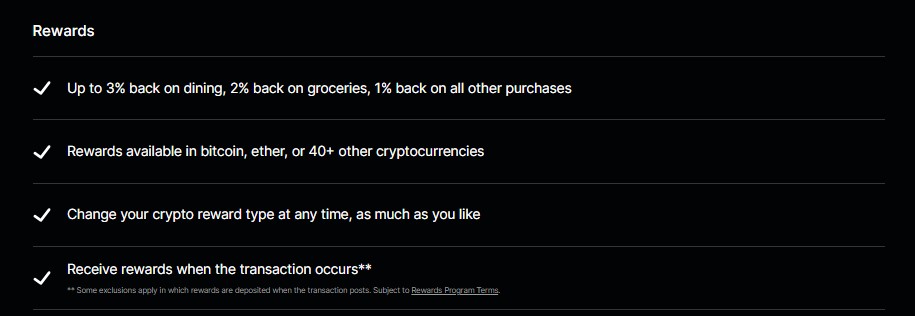

At the heart of the Gemini credit card is its crypto rewards program. This program allows cardholders to earn rewards in the form of cryptocurrencies, including the immensely popular Bitcoin and over 50 other digital currencies. Here’s a more detailed breakdown of how these rewards work:

- Dining Rewards: Enjoy a robust 3% cashback rate on dining expenses. Whether you’re dining out or ordering in, you’ll earn rewards on your culinary adventures.

- Supermarket Bonanza: One of the standout features of this card is its 2% cashback rate on supermarket purchases. Importantly, there are no spending limits, allowing you to earn this cashback rate without any restrictions.

- Everything Else: For all other purchases, you’ll still receive a respectable 1% cashback rate. While it may not be the highest in the market, it adds up over time.

- Immediate Redemption: A key advantage of the Gemini credit card is the immediate redemption of rewards. When you make a purchase, your rewards are credited to your account instantly. There’s no need to wait for your monthly statement, ensuring you benefit from crypto market fluctuations.

- Comparing to Other Cards: While the Gemini card offers competitive rates, other credit cards may provide higher cashback rates, especially for non-category spending. If you’re a credit card enthusiast looking to maximize your earnings, you might want to consider other options. However, if you’re keen on seamless integration of crypto rewards into your spending habits, the Gemini card has a unique appeal.

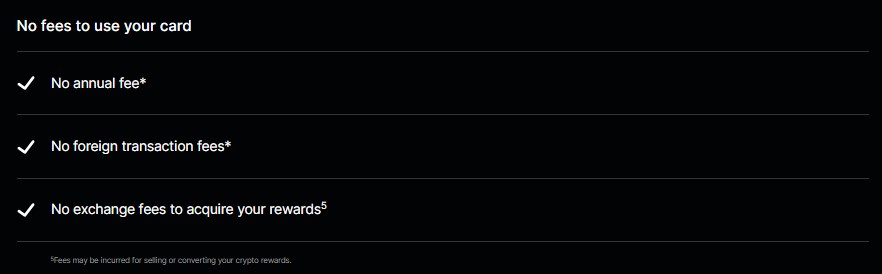

Fee Structure

Understanding the fees associated with any credit card is crucial to making an informed decision. Here’s a detailed look at the fee structure of the Gemini credit card:

- No Annual Fee: You can enjoy the benefits of this card without worrying about an annual fee.

- No Foreign Transaction Fees: For travelers, this is a significant advantage.For making purchases in foreign currencies, there are no additional fees.

- No Exchange Fees for Rewards: Gemini recognizes that exchange fees on crypto rewards would diminish their value, so they’ve eliminated this potential cost.

- Cash Advance Fee: Should you ever need a cash advance, expect to pay a fee of $10 or three percent of the advance amount, whichever is greater. However, it’s important to note that cash advances are generally not recommended due to high costs.

- Late Payment Fee: If you miss a payment, the late payment fee is a reasonable $20, which is lower than some other credit cards.

- Return Payment Fee: If a payment is returned, you’ll incur a $35 fee. It’s advisable to avoid returned payments to prevent this charge.

- Card Replacement Fee: In the unlikely event that you need to replace your card multiple times within a 12-month period, there’s a $20 fee for the third card replacement and subsequent replacements. Most users are unlikely to encounter this fee.

How to Obtain the Gemini Credit Card

Now that you have a thorough understanding of what the Gemini credit card offers, let’s explore how to obtain one for yourself.

Step 1: Sign Up for Gemini

To embark on your journey to securing the Gemini credit card, the first step is to sign up for an account on the Gemini cryptocurrency exchange. You can do this by visiting their website or downloading the Gemini app from your preferred app store.

Step 2: Verification and Approval

Once you’ve signed up, you’ll need to complete the necessary verification process. This typically involves providing identification and other required documents to verify your identity. Gemini will review your information, and upon approval, you’ll have access to their platform.

Step 3: Fund Your Gemini Account

Before you can apply for the Gemini credit card, you’ll need to fund your Gemini account. This involves depositing funds into your Gemini wallet. You can do this via bank transfer or by purchasing cryptocurrencies through the exchange. Also visit to see conversion of coins on crypto.com.

Step 4: Apply for the Gemini Credit Card

With funds in your Gemini account, you’re now ready to apply for the Gemini credit card. Keep an eye on your account or your email for notifications regarding card availability. Once you receive an invitation to apply for the card, follow the provided instructions to complete your application.

Step 5: Enjoy the Benefits

Upon approval, you’ll receive your very own Gemini credit card. Activate it, and you’re ready to start earning crypto rewards on your everyday purchases. Whether you’re dining out, grocery shopping, or making any other purchases, you’ll see your rewards accumulate immediately.

The Allure of Metal Cards

Visually, the Gemini credit card stands out. Crafted from metal, these cards exude an aura of sophistication. The three available colors—black, platinum, and rose gold—add a touch of luxury to your wallet. Interestingly, each color is associated with a crypto luminary, emphasizing the card’s connection to the world of digital currencies.

Tax Considerations

As you explore the world of crypto rewards, it’s natural to wonder about the tax implications. Fortunately, the IRS treats credit card rewards as rebates, which means you won’t be taxed on the crypto you receive when you earn rewards. Instead, you’ll pay taxes on any gains when you decide to sell the crypto. This tax treatment adds an appealing layer of simplicity to managing your rewards. You can also avoid taxes legally, visit the given link for more information.

Conclusion

The Gemini credit card opens up new possibilities for crypto enthusiasts and credit card aficionados alike. Whether it’s the immediate redemption of rewards, the allure of metal cards, or the potential for crypto gains, this card has a lot to offer. Keep in mind that your choice of credit card should align with your financial goals, spending habits, and your level of interest in cryptocurrencies. The Gemini credit card is a fascinating addition to the credit card landscape, offering a unique blend of financial rewards and crypto opportunities. As the financial world continues to evolve, it’s worth exploring how this card could fit into your financial strategy.

Frequently Asked Questions (FAQs)

What Is the Gemini Credit Card?

The Gemini Credit Card is a financial product that combines traditional credit card features with cryptocurrency rewards. It allows you to earn rewards in the form of various cryptocurrencies, including Bitcoin, as you make everyday purchases.

How Can I Apply for the Gemini Credit Card?

To apply for the Gemini Credit Card, you need to sign up for a Gemini cryptocurrency exchange account, complete the verification process, fund your account, and await an invitation to apply for the card. Once invited, follow the provided instructions to complete your application.

What Are the Key Benefits of the Gemini Credit Card?

The Gemini Credit Card offers several benefits, including crypto rewards with immediate redemption, a fee structure that minimizes costs, and the visual appeal of metal cards. It also simplifies taxes on rewards by treating them as rebates rather than taxable income.

Are There Any Fees Associated with the Gemini Credit Card?

While the Gemini Credit Card has no annual fee and no foreign transaction fees, it does have fees for cash advances, late payments, return payments, and card replacements. These fees are standard for many credit cards and are outlined in the card’s fee structure.

Is the Gemini Credit Card Right for Everyone?

The suitability of the Gemini Credit Card depends on individual preferences and financial goals. It’s an excellent choice for those interested in seamlessly integrating crypto rewards into their spending habits. However, serious credit card enthusiasts may consider other options to maximize cashback earnings.