Are you in search of the ideal personal debt consolidation loan? Look no further. In this article, we will explore the best personal loans for consolidating your debts and provide you with valuable insights to make an informed decision. Debt consolidation can be a powerful tool to help you manage your finances more efficiently, but not all loans are created equal. Let’s delve into the key factors to consider when selecting the best personal loan for your debt consolidation needs.

What Are the Best Personal Debt Consolidation Loans?

When you’re on a mission to find the best personal debt consolidation loan, it’s essential to navigate the sea of options wisely. Not all loans are created equal, and selecting the right one can make a significant difference in your financial journey. To simplify your search, here are some best personal debt consolidation loans- Light Stream, Up Start, Lending Club, Happy Money and so on. Also try No credit check loan. Now, let’s take a closer look at the six crucial characteristics you should consider when evaluating these loans.

1. Origination Percentage: Minimize Hidden Costs

Origination fees can significantly impact the total cost of your loan. These fees, typically ranging from 1% to 12% of the loan amount, are deducted before you receive the funds. For example, if you borrow $10,000 with a 5% origination fee, you’ll receive only $9,500. Understanding and comparing origination fees is crucial to selecting the best personal debt consolidation loan.

2. Low Interest Rates: Maximize Savings

When seeking the ideal personal debt consolidation loan, securing low interest rates is paramount. These favorable rates empower you to merge various high-interest debts into a single, cost-effective loan. The result? Substantial long-term savings and a streamlined approach to repaying your debts. By accessing a loan with a lower interest rate, you not only reduce the overall financial burden but also gain the financial freedom to make manageable monthly payments. Say goodbye to the stress of juggling multiple high-interest obligations and hello to a brighter financial future.

3. Credit Score Safeguard: Soft vs. Hard Credit Checks

Understanding the impact of credit checks on your score is crucial when searching for the perfect personal debt consolidation loan, you can improved your credit score. While some lenders perform soft credit pulls during rate inquiries, leaving your credit score untouched, others opt for hard credit pulls when you’re ready to finalize your loan application. These hard pulls may temporarily affect your credit score. To safeguard your creditworthiness, it’s wise to lean towards lenders who utilize soft credit checks during rate assessments. This approach enables you to explore your options without fear of unnecessary credit score fluctuations, ensuring a smoother debt consolidation journey.

4. Asset Protection: The Value of Unsecured Personal Loans

When contemplating a personal debt consolidation loan, understanding loan security is pivotal. In the realm of personal loans, two primary categories exist: secured loan and unsecured loan. Unsecured loans, the preferred choice for many, do not require collateral such as your car or home. While secured loans may tempt with lower interest rates, they expose your assets to risk in case of repayment failure.

Opting for the best personal loans means choosing the unsecured path, guaranteeing the safety of your valuable assets. With these loans, your financial well-being remains shielded, as non-payment won’t result in the forfeiture of your cherished possessions. Embrace the freedom and peace of mind that unsecured loans offer on your journey to financial consolidation.

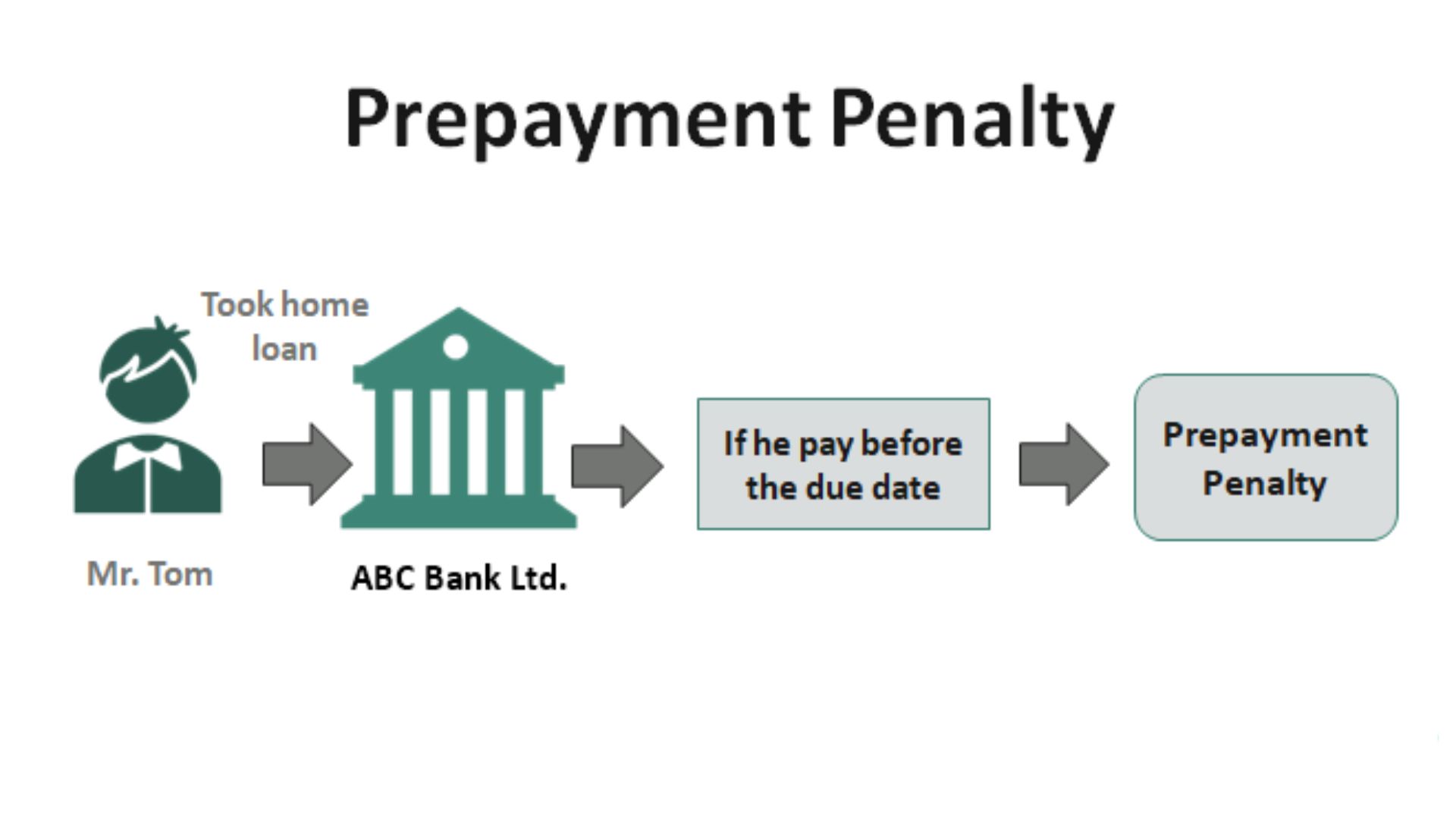

5. Embracing Financial Freedom: Prepayment Penalty-Free Loans

When embarking on the journey of debt consolidation, opt for a lender that offers the invaluable perk of no prepayment penalties. This feature empowers you with unmatched financial flexibility, enabling you to pay off your loan ahead of schedule without facing additional fees or charges.

The absence of prepayment penalties is a powerful tool in your arsenal, allowing you to accelerate your debt repayment strategy and potentially save a substantial sum in interest charges over time. By choosing a loan that encourages early repayment, you’re not just consolidating your debts; you’re embracing financial freedom and taking control of your fiscal future with confidence.

6. Informed Choices: Assessing Lender Credibility Through Reviews

Choosing the right lender for your debt consolidation journey hinges on thorough research. As you embark on this financial quest, it’s essential to delve into reviews and ratings on trusted platforms like the Better Business Bureau (BBB). Positive reviews serve as a beacon, illuminating the path to reputable lenders who offer quality service and prioritize customer satisfaction.

However, don’t limit your exploration to only the positive side of the spectrum. Reading negative reviews can be equally enlightening, providing insights into potential pitfalls and challenges that other borrowers have encountered. By balancing your research between both positive and negative experiences, you’ll be well-prepared to make an informed decision, ensuring a smoother and more successful debt consolidation process.

Should You Get a Personal Loan for Debt Consolidation?

Ultimately, the decision to get a personal debt consolidation loan is yours to make. Compare rates from different lenders and determine what suits your financial situation best. The key consideration should be whether a personal loan will help you get out of debt more affordably, easily, and quickly. Carefully evaluate your options and choose the path that aligns with your financial goals.

Conclusion

Finding the best personal debt consolidation loan is a pivotal step towards regaining control of your financial future. By considering essential factors like origination fees, low interest rates, credit checks, loan security, prepayment penalties, and lender reputation, you can make a well-informed choice that aligns with your financial goals.

Debt consolidation loan offers a pathway to simplicity, allowing you to merge high-interest debts into a single, manageable loan. This not only reduces the financial burden but also paves the way for a more organized and efficient repayment process. It’s a powerful tool for achieving financial freedom.

Frequently Asked Questions (FAQs)

What Is a Debt Consolidation Loan?

A debt consolidation loan is a financial tool that allows you to combine multiple high-interest debts, such as credit card balances or personal loans, into a single loan with a potentially lower interest rate. This simplifies your finances by consolidating your debts into one manageable monthly payment.

How Does Debt Consolidation Work?

Debt consolidation works by taking out a new loan to pay off your existing debts. You then make monthly payments on the consolidation loan, often at a lower interest rate than your previous debts. This can reduce your overall interest costs and help you pay off your debts faster.

What Are the Benefits of Debt Consolidation?

The key benefits of debt consolidation include potentially lower interest rates, simplified finances, and a clear path to debt repayment. It can also help improve your credit score if you make consistent, on-time payments.

Are There Different Types of Debt Consolidation Loans?

Yes, there are various types of debt consolidation loans, including unsecured personal loans, secured loans (backed by collateral like your home), and balance transfer credit cards. The type you choose depends on your financial situation and creditworthiness.

Is Debt Consolidation Right for Me?

Whether debt consolidation is right for you depends on your individual circumstances. It can be a helpful solution if you have multiple high-interest debts and struggle to manage them. However, it’s essential to assess your ability to make loan payments and avoid accumulating more debt. Seeking guidance from a financial advisor or a specialist in debt consolidation can offer you tailored and personalized advice.