In the world of credit cards, where rewards and cashback reign supreme, the choice between Citi Custom Cash vs Amex Blue Cash Preferred is a pivotal one. These two cards, each with its own unique set of features and benefits, have garnered the attention of savvy consumers seeking to optimize their spending. In this comprehensive comparison, we will dissect every aspect of these cards, from sign-up bonuses and annual fees to cashback multipliers, to help you navigate the complex landscape of credit card rewards. By the end of this article, you’ll be equipped with the knowledge needed to make an informed decision based on your financial goals and spending preferences.

Sign-up Bonuses and Annual Fees

Discover how these factors impact the value of the Citi Custom Cash and American Express Blue Cash Preferred cards and determine which one aligns with your financial goals.

Citi Custom Cash Card

Let’s start by examining the sign-up bonuses and annual fees of Citi Custom Cash Card.

- Sign-up Bonus: The Citi Custom Cash card offers a $200 cashback bonus after spending $750 in the first three months of account opening. This is a solid incentive for new cardholders looking to kickstart their cashback earnings.

- Annual Fee: One of the standout features of the Citi Custom Cash card is its lack of an annual fee. This no-annual-fee structure is a welcome relief for those seeking to maximize their cashback without the burden of recurring fees.

American Express Blue Cash Preferred Card

Now, let’s take a closer look at the American Express Blue Cash Preferred card’s sign-up bonus and annual fees.

- Sign-up Bonus: The American Express Blue Cash Preferred card offers a higher sign-up bonus of $300 cashback, but there’s a catch—you need to spend $3,000 in purchases within the first six months to qualify. This bonus may be more attractive to those with higher spending habits.

- Annual Fee: Unlike the Citi Custom Cash card, the American Express Blue Cash Preferred card has an annual fee. However, it offers an introductory annual fee of $0 for the first year, and then it’s $95 annually. It’s important to note that this annual fee can be offset if you use the card for Equinox+ purchases, as it provides a $120 Equinox+ credit divided into 10 monthly credits over the year.

Cashback Multipliers

The heart of any rewards credit card lies in its cashback multipliers. Here, we’ll break down the cashback rates for both cards and see how they stack up against each other.

Citi Custom Cash Card

The Citi Custom Cash card is designed for simplicity and versatility when it comes to cashback. It offers:

- 5% cashback on your top eligible spending category each billing cycle (up to $500 spent).

- 1% cashback on all other purchases.

- Eligible spending categories include grocery stores, streaming services, gas, transit, travel, and select others.

This unique approach of automatically rewarding the category where you spend the most each month without any user intervention makes the Citi Custom Cash card a convenient choice for those who prefer a straightforward rewards structure.

American Express Blue Cash Preferred Card

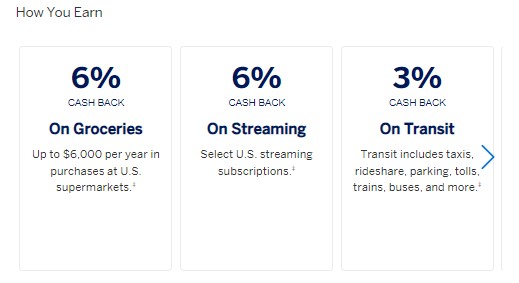

The American Express Blue Cash Preferred card offers a more detailed breakdown of cashback multipliers:

- 6% cashback on groceries (up to $6,000 per year).

- 6% cashback on streaming services.

- 3% cashback on transit.

- 2% cashback on gas.

- 1% cashback on all other purchases.

This card excels in providing substantial cashback rates in several spending categories. However, it’s essential to consider the annual fee when evaluating its overall value. Explore other American Express credit cards.

Why the Citi Custom Cash Card Shines

To illustrate the strengths of the Citi Custom Cash card, let’s delve deeper into a real-life example, focusing on the grocery spending category:

Groceries Example with the Citi Custom Cash Card:

If you spend $500 per month on groceries, you’ll earn $25 in cashback each month and $300 in cashback over a year.

Comparing with American Express Blue Cash Preferred (Groceries Only):

- Spending the same $500 per month on groceries with the Blue Cash Preferred card would earn you $30 per month and $360 per year.

- However, you need to subtract the $95 annual fee, which leaves you with $265 of total cashback.

In this example, the Citi Custom Cash card outperforms the Blue Cash Preferred card, offering $35 more in cashback over a year. It’s important to note that this comparison focuses solely on the grocery category, aligning with the intended use of the Citi Custom Cash card. Here is list of best credit card for groceries.

Combining Cards for Maximum Value

To maximize your cashback potential, you can adopt a strategy that combines both cards. Let’s examine another real-life example, taking into account various spending categories:

- Monthly expenses: $150 on groceries, $40 on streaming services, $150 on gas, and $150 on transit.

American Express Blue Cash Preferred:

- You’d earn $9 in cashback for groceries, $2.40 for streaming services, $4.50 for gas, and $4.50 for transit, totaling $20.40 per month or $244.80 per year. After deducting the $95 annual fee, your take-home value is $149.80 per year.

Citi Custom Cash + Citi Double Cash (Assuming 2% cashback):

- With the Citi Custom Cash card focusing on groceries (earning $7.50 cashback) and the Citi Double Cash card covering the other categories (earning $6.80 cashback), you’d get a total of $14.30 in cashback each month or $171.60 per year.

In this scenario, using a combination of the Citi Custom Cash and Citi Double Cash cards proves to be more lucrative than relying solely on the American Express Blue Cash Preferred card.

Evaluating the Cards in Depth

While the Citi Custom Cash card offers substantial value, it’s essential to consider your individual financial situation and spending habits when choosing the right card. The American Express Blue Cash Preferred card still has merits, especially for covering various high-value spending categories like groceries, streaming services, gas, and transit.

The Blue Cash Preferred Card’s Annual Fee and Grocery Spending Cap

- One notable drawback of the Blue Cash Preferred card is its annual fee, which can offset some of the cashback benefits.

- Additionally, the card has a spending cap of $6,000 per year for groceries. If you spend more than $500 per month in groceries, this card may not be the most advantageous option.

Consider the American Express Gold Card for Higher Grocery Spending

If you consistently spend more than $500 per month on groceries, you might want to explore alternatives like the American Express Gold Card. It offers four times the membership rewards points on groceries, up to 25,000 points per year. These points can be converted to cashback or used for other valuable redemptions.

Conclusion

Both the Citi Custom Cash and American Express Blue Cash Preferred cards have their strengths and are excellent choices for specific situations. However, choosing the right card depends on your unique financial circumstances and spending patterns. Take the time to evaluate your spending patterns and use this information to make an informed decision about which card will help you maximize your cashback earnings.

Frequently Asked Questions (FAQs)

Which card is better for everyday spending?

If you’re looking for a straightforward card with no annual fee and automatic cashback, the Citi Custom Cash card is a solid choice. However, if you spend heavily in categories like groceries and streaming services, the American Express Blue Cash Preferred card might offer more value despite its annual fee.

Can I use both cards together to maximize rewards?

Yes, using both cards strategically can be a smart move. The Citi Custom Cash card’s focus on one category and the American Express Blue Cash Preferred card’s strong multipliers in various categories allow you to tailor your card usage to your spending patterns.

What other factors should I consider when choosing a credit card?

In addition to cashback rates and annual fees, consider factors like your credit score, redemption options, additional card benefits (such as travel insurance or purchase protection), and the card issuer’s customer service when making your decision.

Are there alternatives to these cards with similar benefits?

Yes, there are many credit cards on the market, and new ones are introduced regularly. You may want to explore alternatives like the Discover it Card, Chase Freedom Flex Card, or other cashback or rewards cards that align with your spending habits and goals.

How do I decide which card is right for me?

To determine the best card for your needs, assess your typical monthly spending across different categories, including groceries, gas, streaming services, and transit. Calculate how much cashback each card would provide based on your spending, considering annual fees if applicable. The card that offers the most value based on your spending patterns is likely the right choice for you.