ATM Card Safety Tips, Debit Card Fraud, Prevent Debit Card Fraud at ATM, Bank Alert: As we all know, that how much important for all of us to have an ATM Card. Along with that, it is highly essential to know the necessary information about ATM Fraud. So, all of us need to prevent our Debit Card Fraud at several ATM. This article will discuss everything related to the essential safety tips to avoid Debit Card Fraud, eight ATM Card Safety Tips, and much more information. Interested applicants should read this article very carefully. Those people who want to keep safe their ATM Card should read this article.

Eight Rules for ATM Card Safety

Here we provide you with some of the basic eight rules to keep your ATM Debit Card Safe. These are as follows:

- Always Check Bank Account Statements

As we know, several types of fraud will happen from the ATM Card. So, we should make a habit always to recheck our bank account statements online or offline. This recheck work is most important for all of us to get prevented ATM fraud. Do this recheck daily, once in a week, thrice, or according to your choice. But, must check your bank statements.

- Secure PIN Number

PIN means Personal Identification Number. It plays a vital role in ATM Card Fraud. If someone knows your PIN Number, then there is a high chance to easily hack your ATM Debit Card. But, the condition is that if they get your ATM Debit Card and know your PIN Number, then only they can do ATM Fraud. Always remember that never give your PIN Number to anyone. Never write this PIN anywhere, either wallet or purse. Never use PIN Number at the gas pump. Out of these, use a debit card in the credit card mode that provides you with additional liability protection, as per the bank rules & regulations. To get protected yourself from any fraud, use the credit card purchase function.

Also Read: Children Education Allowance

- Avoid the use of Debit Card Online

All of us need to use only a credit card online. Like we see that many customers are not using their debit Card Online; they use Credit cards for online transactions. This is because the fraud in credit card takes more time to get the process, and thus, the chances of fraud become less, and you can save your ATM Credit Card from scam. According to the Federal Reserve Bank of San Francisco, let’s inform you all that they tell a security symbol of fraud ATM as a padlock or not broken key. These symbols will show encrypted information as a safer side. So, everyone needs to use only a Credit Card at ATM as it is highly secured than Debit Card.

- Always use ATM at Bank

ATM (Automated teller machines) is the machine from where we can debit cash from our bank accounts. As we know, India becomes digital, so the government has started several ATMs at different locations or places. Let’s inform you that ATMs are situated in subway stations, banks, stores, airports, and many other places with no risk of fraud or theft. Some areas have a skimming device attached to the ATM by the thief that stores Debit Card data. This thing will happen in any bank, but they can’t do so due to the proper cameras. The other places have less security; then only thieves were trying to do this action.

- Never use any public internet access for financial transactions

As we can see, there are a high number of cases of ATM fraud. So, everyone needs to avoid any public internet connection for online transactions. If for some cases, if you are using any wireless access, then make sure that access would be a password-protected signal. Because all password-protection internet connections will be safe for all types of bank transactions, you can pay bills, check bank accounts, shop, etc. In this way, there are fewer chances for hackers to hack that particular bank account. They cannot capture your bank account details or password.

- Directly Report Problems

Whenever you feel something wrong happens in your bank ATM Card, then directly report all of your problems to the bank concerned authorities. Some of the cases are if you would steal your debit or credit cards or missing those cards, then also you have to report all unauthorized transactions directly. It will be very beneficial for all of us to report problems.

- To file a police report

When you get to know that your Debit Card is robbed, then you may contact the nearest police station or keep the copy of the police report. Because of this police report, you have some proof against the charges.

Also Read: PMRF

- Generate Security Profile

Always keep your ATM secured by just using the different security questions. There are several security questions, such as your mother maiden name, pet name. It makes an easy task for all of us to secure our ATM account. And, all answers to particular questions would not be the same. So, it is always good for everyone to secure their Bank ATM by using security questions.

Illegal Charges on Debit Card

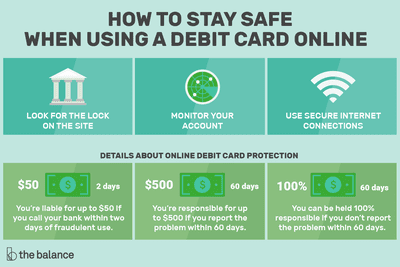

Like we all know the fact that there are illegal charges on Debit Card would be possible. As per the National Consumer Law Center, if somehow any citizen Debit Card has consisted of illegal charges on it without having been stolen or lost, then they can protect it by reporting charges between 60 days of the statement. It depends upon the customer to report the loss of their Debit Card between two weekdays.

Let’s inform you all that the total limit of their loss would be around $50. Other than that they will get a loss of $500. Suppose any customer takes months to inform the bank. In that case, they will not recover their money as we can see that several banks have improved their Debit Card security issues according to the rules as mentioned earlier and should not consider citizen responsibility in the fraud charges.

I hope you will understand this article very well and are ready to take advantage of it. Suppose you face any problems related to the essential safety tips to avoid Debit Card Fraud, eight ATM Card Safety Tips. In that case, you may ask your queries in the given comment box.

Frequently Asked Questions

How can we secure our Debit or Credit Card from ATM fraud?

We can secure our Debit or Credit Card from ATM fraud by following given steps such as by not using any public internet connection, use ATM at a bank, avoid using Debit Card service online.

Why should we not use our Debit Card Online?

Always use Credit card service online by avoiding any fraud as Credit card security will be significantly higher than Debit Card service online. Credit card uses a security symbol from getting any fraud.

Is ATM at Bank is highly secure than other ATM places?

Yes, it is true. Bank ATM is highly secured than others because of the camera security options or many other benefits.