In the dynamic landscape of retail credit cards, the Sephora credit card has swiftly risen as a prominent and compelling player. This in-depth guide is your passport to a comprehensive exploration of the Sephora credit card, leaving no stone unturned. From its distinctive and alluring features to the intricate details hidden in the fine print, we will provide you with an extensive understanding of what this credit card entails. Whether you’re an avid beauty aficionado constantly on the hunt for the latest cosmetic treasures or a discerning shopper looking to maximize your purchasing power, this article acts as your indispensable guide, unveiling the concealed intricacies and advantages of Sephora’s credit card offerings.

Overview of Sephora Credit Cards

Sephora, the beauty retail giant, has introduced three distinct credit cards to cater to its diverse customer base. Each card is designed to cater to different needs, and they all have one enticing feature in common: a generous 15% off your first purchase upon approval. But let’s delve deeper into the specifics of these cards:

- Sephora Store Credit Card: This is the entry-level card, tailor-made for dedicated Sephora shoppers. It can be used exclusively for in-store or online Sephora purchases.

- Sephora Visa Card: The next step up the ladder, the Sephora Visa Card comes with a minimum credit limit requirement of $5,000, earning you a Visa Signature Card if approved. Alongside the benefits shared with the store card, this version allows you to earn 1% cash back on all other outside purchases and offers a $20 Sephora credit reward after spending $500 on non-Sephora purchases.

-

Sephora Visa Signature Card: This elite card caters to big spenders, offering additional perks like enhanced auto rental coverage, roadside dispatch assistance, and more. The specifics of these benefits may vary depending on whether you have a Visa or Visa Signature card, so be sure to check your benefits guide.

Deciphering the Fine Print

It’s crucial to scrutinize the fine print when considering any credit card, and the Sephora credit cards are no exception. Here are some key details you need to be aware of:

Reward Dollars

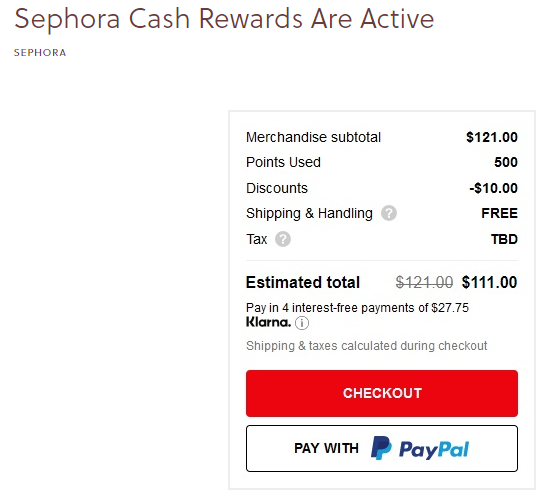

Reward dollars are the lifeblood of the Sephora credit card experience. These points are earned when you make purchases – 4% back at Sephora and 1% everywhere else if you hold the Visa Card. However, it’s important to know that these reward dollars have an expiration date of 18 months from the date they’re posted to your account. So, be sure to redeem them within this timeframe.

Redemption Threshold

To redeem your reward dollars, you need to accumulate a minimum of 125 reward dollars, equivalent to a $5 credit. However, this credit also comes with a 90-day expiration period. Once your reward dollars are posted to your account, you have three months to put them to good use, or they vanish.

Stacking Reward Dollars

If you have over $5 in credit card rewards and want to stack them, you can only do so in-store, not online. However, if your purchase exceeds the amount of your credit card rewards, you must use your Sephora credit card to cover the remaining balance.

Limitations and Exclusions

Unfortunately, there are limitations to what you can do with your credit card rewards. They cannot be redeemed for gift cards, and purchases made at Sephora stores located inside JC Penney do not qualify for rewards, earning 4 percent on purchases, or allowing redemption of credit card rewards.

Eligibility Requirements for a Sephora Credit Card

-

Age Requirement: You must be at least 18 years old to apply for a Sephora credit card.

- Legal Residency: You must be a legal resident of the country where Sephora offers its credit card. In most cases, this is the United States.

- Creditworthiness: Your credit history and credit score will play a significant role in the approval process. Sephora, like other credit card issuers, will review your credit history to determine your creditworthiness for that always maintain a good credit score, if you have a bad credit core then you have to fix your bad credit score.

- Income: You typically need to have a source of income to be eligible for a credit card. This income can come from employment, self-employment, or other sources. Credit card issuers want to ensure that you have the means to repay your credit card balance because credit card companies always want to know about your financial stability.

- Not Having an Existing Sephora Credit Card: If you already have a Sephora credit card, you may not be eligible for another one of the same type. However, you might be eligible for different types of Sephora credit cards if they offer multiple options.

- Compliance with Sephora’s Terms and Conditions: You’ll need to agree to and comply with Sephora’s terms and conditions, including their policies on credit card usage, fees, and other rules.

- Legal Capacity: You must have the legal capacity to enter into a credit card agreement, meaning you’re not incapacitated or under legal guardianship.

It’s important to note that the specific eligibility requirements can change over time, and they may vary based on the type of Sephora credit card being offered.

How to Apply for a Sephora Credit Card

Step 1: Visit the Sephora Website

To begin the application process for a Sephora Credit Card, the first step is to visit the official website of Sephora. You can access the website through your web browser on your computer or mobile device.

Step 2: Explore Sephora Credit Card Options

Once you’re on the Sephora website, navigate to the section related to Sephora Credit Cards. You may find this under the “Sephora Credit Card” or “Beauty Insider” tab. Take some time to explore the different credit card options available, including the store credit card and the Visa credit card. Understand the benefits and features of each to decide which one suits your needs.

Step 3: Start the Application

After selecting the Sephora credit card that interests you the most, you can initiate the application process by clicking on the “Apply Now” or “Get Started” button. This button is typically prominently displayed on the Sephora Credit Card page.

Step 4: Complete the Application Form

You will be directed to an application form. Here, you’ll need to provide various pieces of information. These typically include your name, contact details, social security number, income, and employment information. Be sure to fill out all the required fields accurately and truthfully.

Step 5: Review Terms and Conditions

Before submitting your application, take the time to review the terms and conditions associated with the Sephora Credit Card. It’s important to understand the interest rates, fees, and any other relevant policies. Make sure you agree to these terms.

Step 6: Submit the Application

Once you’ve carefully filled out the application form and are in agreement with the terms and conditions, submit your application. The processing time for the application may vary, but you’ll typically receive a response within a few minutes.

Step 7: Await Approval

After submitting your application, Sephora will review your application and credit history. If your application is approved, you will receive your new Sephora Credit Card in the mail within a few weeks. If your application is declined, Sephora will notify you of the decision.

Step 8: Activate Your Card

Upon receiving your Sephora Credit Card in the mail, you’ll need to activate it. This is often done by calling a provided phone number or by going online and following the activation instructions.

Step 9: Start Using Your Sephora Credit Card

Once activated, you’re all set to start using your Sephora Credit Card. You can use it to make purchases both at Sephora stores and online. Take advantage of the benefits and rewards that come with your new card, such as discounts, cashback, and exclusive offers.

Is the Sephora Credit Card Right for You?

The Sephora credit cards may seem like a fantastic choice for beauty aficionados, but they might not be the best fit for everyone. These cards are most suitable for frequent Sephora shoppers who spend a significant amount each month. If you don’t fall into this category, here are a couple of alternatives worth considering:

U.S. Bank Cash Plus Card

This card offers a $150 welcome bonus after spending $500 on purchases within the first three months of account opening, far surpassing the $20 credit card rewards from Sephora. The U.S. Bank Cash Plus Card allows you to choose your own 5% cashback categories, and it includes department stores, like JC Penney, which earn 5% cashback on up to $2,000 in qualifying purchases every quarter. Plus, there’s no annual fee.

Chase Freedom Card

The Chase Freedom Card provides 5% cash back on select rotating categories each quarter that you activate. Rotating categories often include drugstores and department stores, aligning with the brands you’d find at Sephora. Along with a $150 sign-up bonus and no annual fee, the Chase Freedom Card also earns Chase Ultimate Rewards, which can be redeemed for cashback, travel, or shopping.

Additionally, Chase offers a cashback shopping portal that frequently offers 4% or more cashback on Sephora purchases.

Conclusion

The Sephora credit cards may hold allure for makeup mavens, but their true value depends on your shopping habits. Remember, the devil is in the details, so it’s essential to understand the fine print. While the Sephora credit cards have their merits, there are alternative credit card options that may better suit your spending patterns and offer more substantial rewards.

So, whether you’re a Sephora superfan or simply a savvy shopper, use this guide to make an informed decision about the Sephora credit card that’s right for you. Happy shopping!

Frequently Asked Questions (FAQs)

How do I apply for a Sephora credit card?

You can apply for a Sephora credit card online through Sephora’s official website. Simply visit their credit card page, fill out the application form, and follow the instructions provided.

What are the benefits of having a Sephora credit card?

Sephora credit cards offer various benefits, including a 15% discount on your first purchase, 4% cashback on Sephora purchases (in-store or online), and additional rewards for the Visa card, such as a $20 Sephora credit reward after spending a certain amount on non-Sephora purchases. The specific benefits can vary based on the type of Sephora credit card you qualify for.

What is the minimum credit score required to be approved for a Sephora credit card?

Sephora, like other credit card issuers, considers your credit history and credit score during the application process. While they don’t specify a minimum credit score, having a good or excellent credit score (typically 670 or higher) will increase your chances of approval.

How do Sephora credit card rewards work?

Sephora credit cardholders earn reward dollars, which are equivalent to points, when making purchases. You can accumulate reward dollars and redeem them for Sephora store credit. Remember that these reward dollars have expiration dates, so it’s essential to use them within a specified timeframe.

Can I use my Sephora credit card at Sephora stores inside JC Penney?

No, purchases made at Sephora stores located inside JC Penney do not qualify for rewards or the benefits offered by Sephora credit cards. The rewards and discounts are typically applicable only at standalone Sephora stores or on the Sephora website.