In this article, we’re about to delve deep into the world of Mercury Insurance. Well, the reason is quite simple – it’s been making some waves in the insurance industry. In fact, it recently earned the top spot in JD Power’s Insurance Digital Experience Study, ranking number one for its exceptional customer experience. Impressive, right?

But before we get carried away with the accolades, let’s take a closer look at this Insurance. We’ve done some extensive research, and the results are a bit intriguing. While JD Power sings their praises, other aspects of the company leave something to be desired.

Mercury Insurance’s Journey

Mercury Insurance has been around for about six decades, starting its insurance journey in 1962. Founder George Joseph had a clear vision: to offer affordable insurance without compromising customer satisfaction. Over the years, the company has grown significantly and now boasts 9,400 agents and a vast network.

Their average annual premium for combined home and auto policies hovers around $1,558, according to Bankrate. Combining these two policies might make sense, as both are individually average, but together, they offer some intriguing perks.

Expanding Horizons

Initially focused on California, Mercury Insurance has since expanded to 10 different states. They aim to continue growing their presence across the nation. Notably, in 2019, they were recognized as one of America’s best midsize employers to work for. Happy employees often equate to better service, which is great news for policyholders.

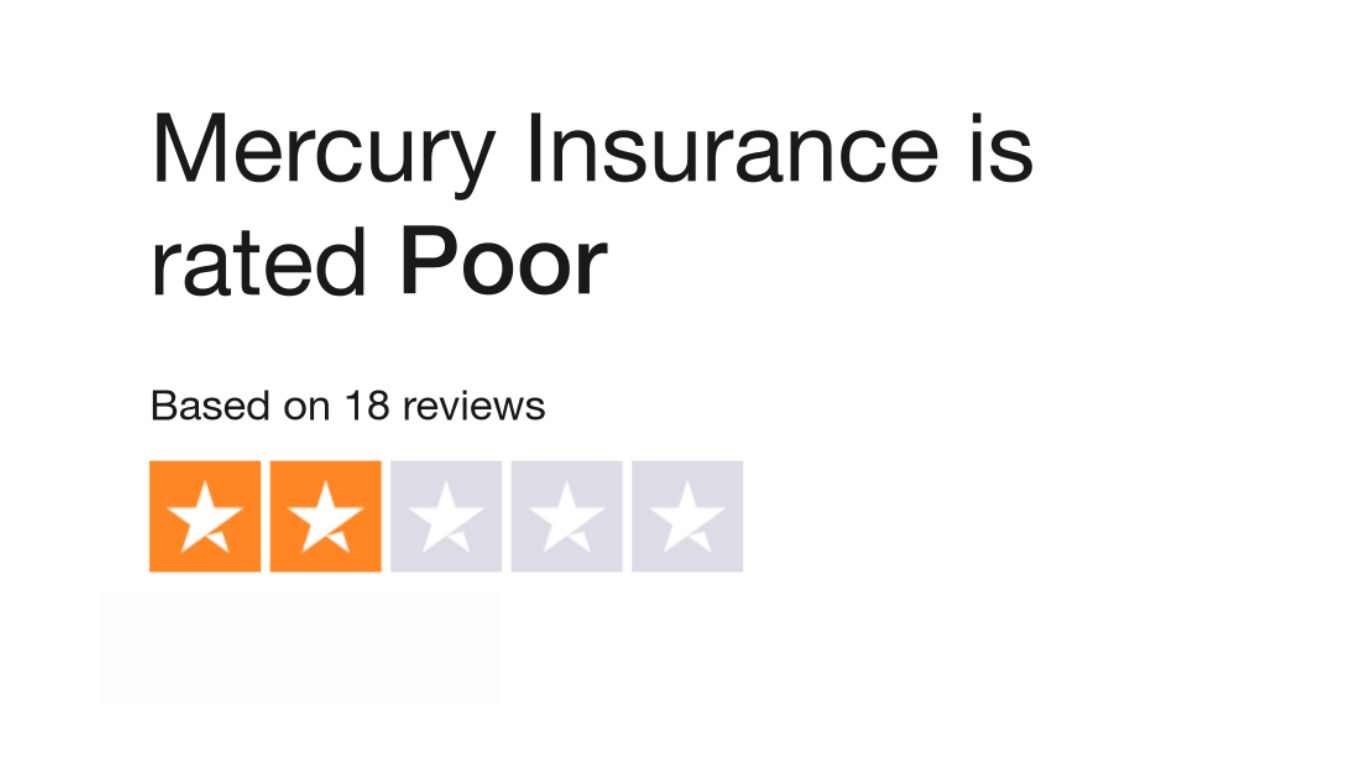

A Closer Look at Reviews

The online reviews. A quick Google search reveals a mixed bag. Companies with hundreds or thousands of reviews often rate Mercury Insurance with three stars or less, and sometimes even as low as one or two stars. Complaints are prevalent.

Auto Insurance Discounts

Mercury Insurance website offers some standard auto insurance discounts, including anti-theft features, auto-pay, e-signatures, good driver, good student, multi-car, multi-policy, and paid-in-full discounts. While these aren’t groundbreaking, they’re par for the course in the auto insurance industry. Also, get the cheapest car insurance options.

Premium Home Coverage

Mercury Insurance tries to stand out in the home insurance space by offering premium-level policies. These include extra features like enhanced towing, OEM replacement parts, and cashback options. If you want comprehensive coverage and top-tier service, this might be appealing.

Explore Other Options

Before making a decision, consider exploring other options like Cover Insurance. Our channel sponsor allows you to compare quotes from over 30 different insurance companies, including Mercury Insurance. Plus, if you and a friend both buy a policy, you’ll each receive a $50 Amazon gift card.

The Pros and Cons

Let’s break down the pros and cons of Mercury Insurance:

Pros:

- Competitive rates

- Mechanical breakdown protection

- Ride-share coverage

Cons:

- Below-average customer service

- No online claims filing

- Limited coverage options and discounts

- Must purchase a policy through an agent

- Available in only 11 states

Ratings and Accolades

Mercury Insurance receives varying ratings from different sources. For instance:

- WalletHub: 2.2 out of 5

- JD Power: 3.9 out of 5

- NAIC: 3.363 (higher than usual complaints)

- Better Business Bureau: A+

- Moody’s: A2

Pricing Insights

Pricing-wise, Mercury Insurance seems competitive, with rates ranging from $140 per month for 18-year-olds to $57 per month for 65-year-olds. Keep in mind that these figures vary based on factors like age and driving history. But, it’s worth noting that their rates for 21-year-olds appear unusually low.

Cybersecurity Coverage

One unique feature offered by this insurance is cybersecurity coverage. In today’s digital age, this could be a game-changer. They provide coverage in case you fall victim to a cyberattack, offering peace of mind in an increasingly connected world.

Mercury Insurance is a company with both commendable qualities and some puzzling aspects. The stark contrast between glowing reviews and critical opinions is something to consider. As you navigate the world of insurance, take the time to compare and assess your options carefully.

Conclusion

Exploring the world of Mercury Insurance reveals a complex landscape of both accolades and concerns. While they’ve earned recognition for their customer experience, other aspects of the company raise questions. As you consider this Insurance for your needs, it’s essential to weigh the pros and cons carefully. Remember, insurance choices should align with your specific requirements and priorities.

Frequently Asked Questions (FAQs)

Is Mercury Insurance a reputable company?

Mercury Insurance has received mixed reviews, with ratings varying from source to source. Some customers have praised their service, while others have expressed concerns. It’s crucial to research and consider your specific needs when evaluating their reputation.

What makes Mercury Insurance stand out in the market?

Mercury Insurance offers competitive rates, mechanical breakdown protection, and ride-share coverage, making them an attractive option for some policyholders. Their unique cybersecurity coverage for homes is also worth noting.

Should I choose Mercury Insurance based on JD Power’s ranking alone?

While JD Power’s ranking is a positive indicator, it’s essential to conduct thorough research beyond this single source. Consider your preferences, and requirements, and consult multiple reviews and ratings to make an informed decision.

What are the drawbacks of Mercury Insurance?

Mercury Insurance has faced criticism for below-average customer service, limited coverage options, and average discounts. It’s essential to weigh these drawbacks against the company’s strengths before making a decision.

Are there alternatives to Mercury Insurance worth exploring?

Yes, there are plenty of alternatives to Mercury Insurance in the insurance market. Consider exploring other reputable companies and comparing quotes to ensure you find the policy that best suits your needs and budget. Remember to look for coverage that aligns with your unique circumstances.