Have you ever dreamt of diving into the realm of decentralized finance (DeFi)? If VVS Finance has caught your eye, then you’re in the right place! We’re about to embark on a journey that will shine a light on every corner of this platform. From acquiring the famous Crypto.com Coin (CRO) to maximizing your returns through farming and mining, let’s start this adventure together.

What is VVS Finance?

VVS-Finance stands as a beacon in the DeFi landscape, offering users a platform to participate in liquidity pools, farming, and mining to reap rewards. As the crypto world evolves, VVS-Finance is steadily making its mark. But how does it compare to other platforms? Why, let’s find out!

Acquiring Crypto.com Coin (CRO)

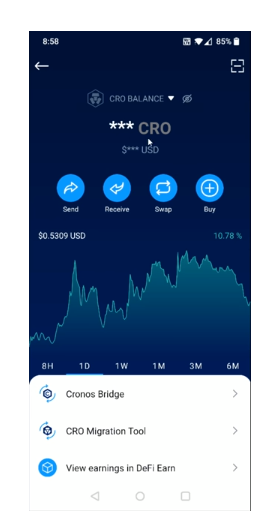

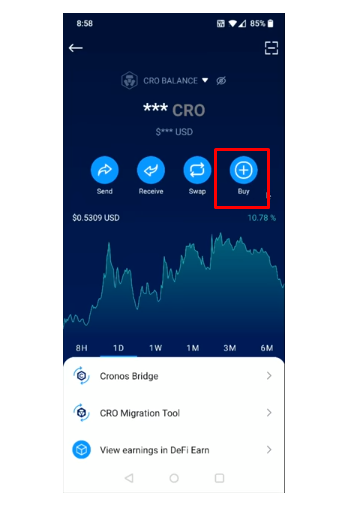

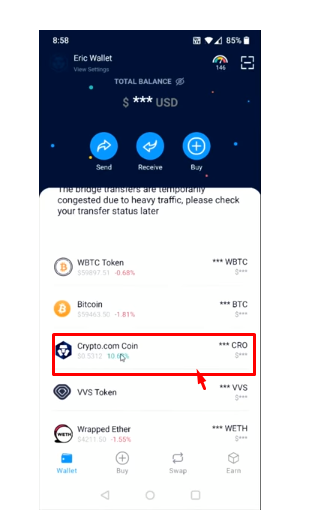

Before you can dive into VVS-Finance, you’ll need some Crypto.com Coin (CRO) in your wallet. Here’s how you can acquire it:

- Crypto.com App: You can purchase CRO directly within the DeFi wallet. By clicking on the “Buy” option, you can link your DeFi wallet to the Crypto.com app and make the purchase.

- External Wallet: Alternatively, you can receive CRO from an external wallet.

- Transfer: Purchase CRO within the Crypto.com app and transfer it to your DeFi wallet.

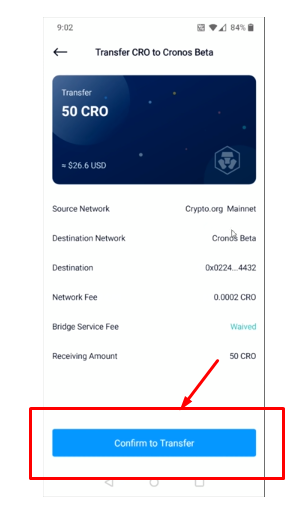

Transferring CRO to Chronos

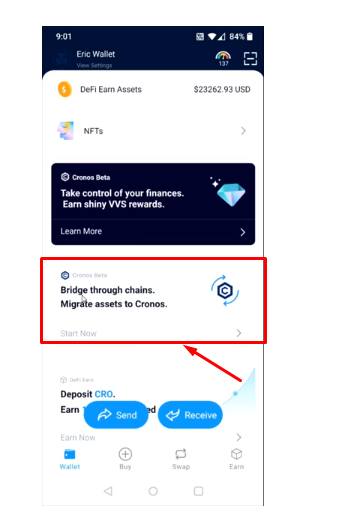

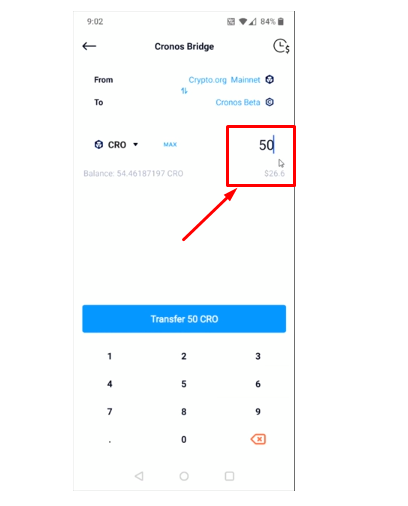

Once you have CRO in your DeFi wallet, you’ll need to transfer it to Chronos to use it in VVS-Finance. Follow these steps:

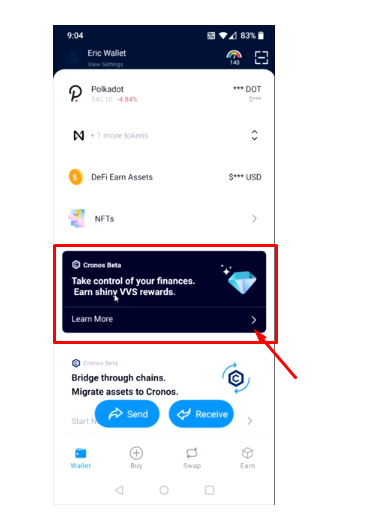

- Scroll down in the DeFi wallet until you find the option that says “Bridge through Chain – Migrate Assets to Chronos.”

- Enter the number of CRO coins you want to transfer (it’s a good practice to keep some for gas fees).

- Confirm the transfer. You’ll notice the network fee is minimal.

- After a short processing time, your CRO will be available on Chronos.

Navigating to VVS Finance

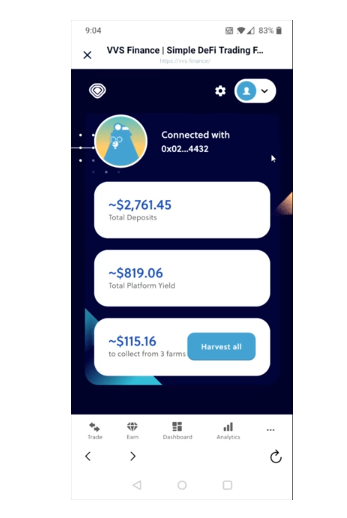

Now that you have CRO on Chronos, it’s time to explore VVS-Finance:

- Open your DeFi wallet and click on the “VVS Finance” area.

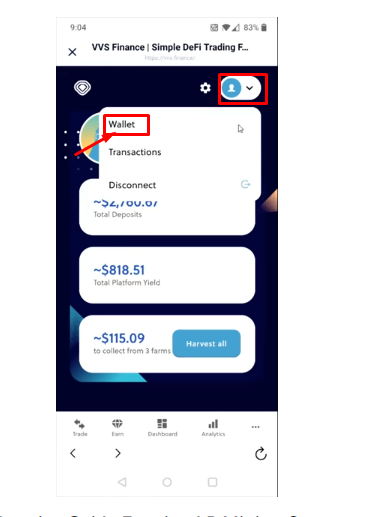

- To check your CRO balance, click on your profile image in the upper right-hand corner, then select “Wallet.”

Farming in VVS Finance

In VVS-Finance, you can participate in farming by staking a combination of CRO and other tokens in liquidity pools to earn VVS rewards. Here’s how:

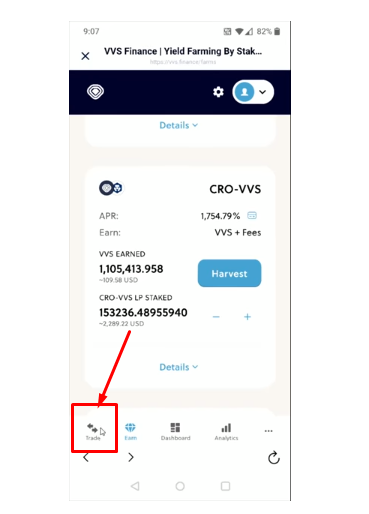

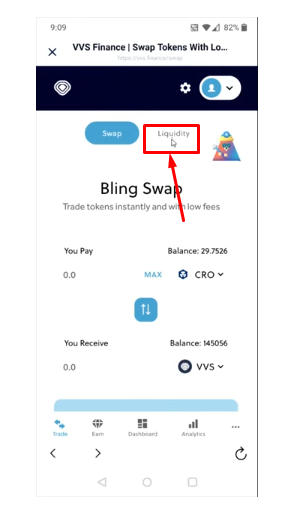

- Click the “Trade” option in the bottom left-hand corner.

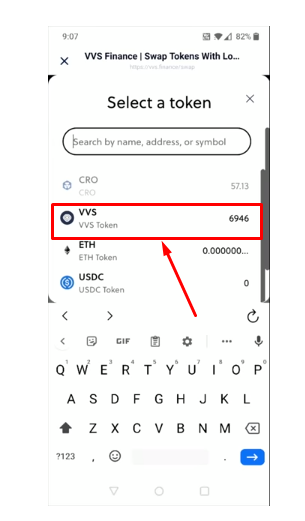

- Select the token you want to stake (e.g., CRO).

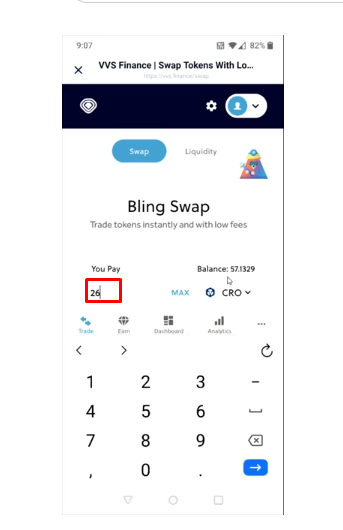

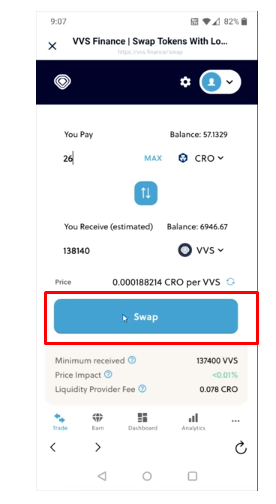

- Transfer a portion of your CRO to another token (e.g., VVS) to create a balanced pair. Keep some CRO for gas fees.

- Confirm the swap.

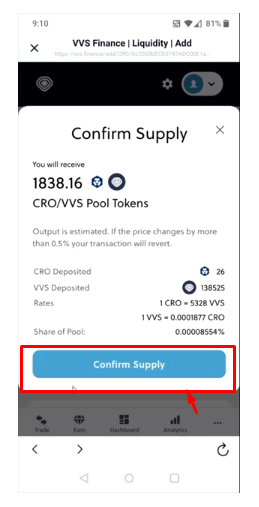

- Go to “Liquidity” and select the tokens you want to provide liquidity for (e.g., CRO and VVS).

- Confirm the supply.

- Your liquidity is now added to the pool, and you’ll start earning rewards.

Mining in VVS Finance

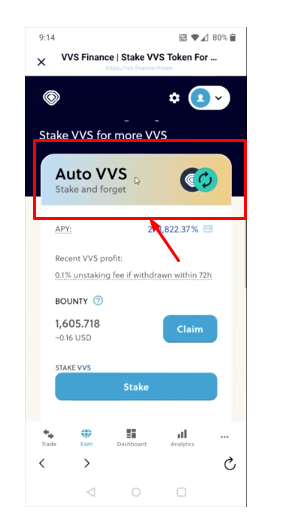

If you prefer holding onto your VVS tokens, you can stake them in the mines to earn rewards automatically. Here’s how:

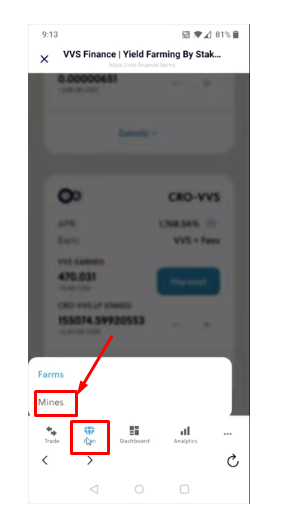

- Navigate to the “Earn” section and click on “Mines.”

- Choose the auto-mine option for hands-free rewards. If you prefer manual control, select the manual mining option.

With this tutorial, you’re equipped to explore VVS-Finance confidently. Remember to stay informed about changes in liquidity pool options and always assess the associated risks. Happy farming and mining in VVS-Finance! If you want to know how to transfer your crypto coins from Crypto.com to Binance.

Frequently Asked Questions

Q1. What is VVS-Finance?

VVS-Finance is a decentralized finance (DeFi) platform that allows users to participate in liquidity pools, farming, and mining to earn rewards.

Q2. How do I acquire Crypto.com Coin (CRO)?

You can acquire CRO by purchasing it within the DeFi wallet, receiving it from an external wallet, or transferring it from the Crypto.com app.

Q3. What are liquidity pools in VVS-Finance?

Liquidity pools involve staking a combination of tokens (e.g., CRO and VVS) to provide liquidity for the platform. In return, users earn rewards based on the pool’s performance.

Q4. What is the difference between farming and mining in VVS-Finance?

Farming involves staking tokens in liquidity pools, while mining entails holding VVS tokens in dedicated pools. Both methods allow users to earn rewards.

Q5. Are there risks involved in VVS-Finance?

Yes, there are risks associated with DeFi platforms, including impermanent loss, smart contract vulnerabilities, and market volatility. It’s crucial to understand these risks before participating.

Conclusion

Unlocking the potential of VVS Finance can be an exciting venture in the world of cryptocurrencies. This step-by-step tutorial has guided you through acquiring Crypto.com Coin (CRO), transferring it to Chronos, and navigating VVS-Finance to participate in farming and mining. However, it’s essential to exercise caution and stay informed about the evolving landscape of liquidity pools and cryptocurrencies.