Have you ever found yourself worried about the potential losses with sudden market fluctuations? If you’re using Robinhood, there’s a tool that can provide a safety net for your investments. But how exactly does it work, and how can you set it up to ensure you’re taking full advantage of its protective features?

Dive in as we unravel the mechanics of how to set stop loss on Robinhood, a game-changer for mindful investors like you.”If you want to protect your investments by setting up a stop loss, you’ve come to the right place. Let’s walk you through the process of setting a stop loss on Robinhood, ensuring your stocks are automatically sold when they reach a specified price level.

What is the Stop Loss Feature?

A stop-loss order is a feature provided by most trading platforms, including Robinhood, that allows an investor to set a predetermined price at which a stock (or other financial instrument) will be automatically sold. Its primary purpose is to limit an investor’s potential losses.

The primary reason investors use stop-loss orders is to prevent large losses in volatile markets. For instance, if you’ve bought a stock at $100 and set a stop-loss order at $90, your potential loss is capped at 10% (minus any potential difference between the stop price and the actual sale price).

How to Set Stop Loss on Robinhood?

Protecting your investments is paramount in the volatile world of stock trading. If you use Robinhood, one of the best tools at your disposal is the stop loss order. Let’s check the steps to set up a stop loss, ensuring you limit potential downturns on your investments.

1. Find Your Desired Stock

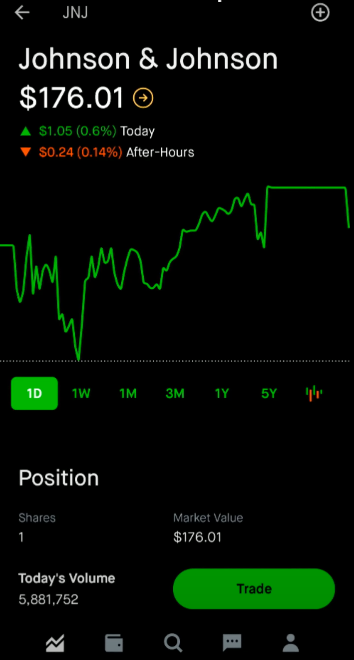

Begin by launching the Robinhood app and navigating to the home page. Continue scrolling downward until you find the stock for which you intend to establish a stop loss. Let’s use “Johnson & Johnson” as our example.

2. Access the Trade Menu

Tap on the stock you’ve selected (in this case, Johnson & Johnson). Now, you’ll want to click on “Trade,” which is typically found in the asset’s menu.

3. Select the Sell Option

Once you’re on the trading screen, look for the “Sell” button and give it a tap.

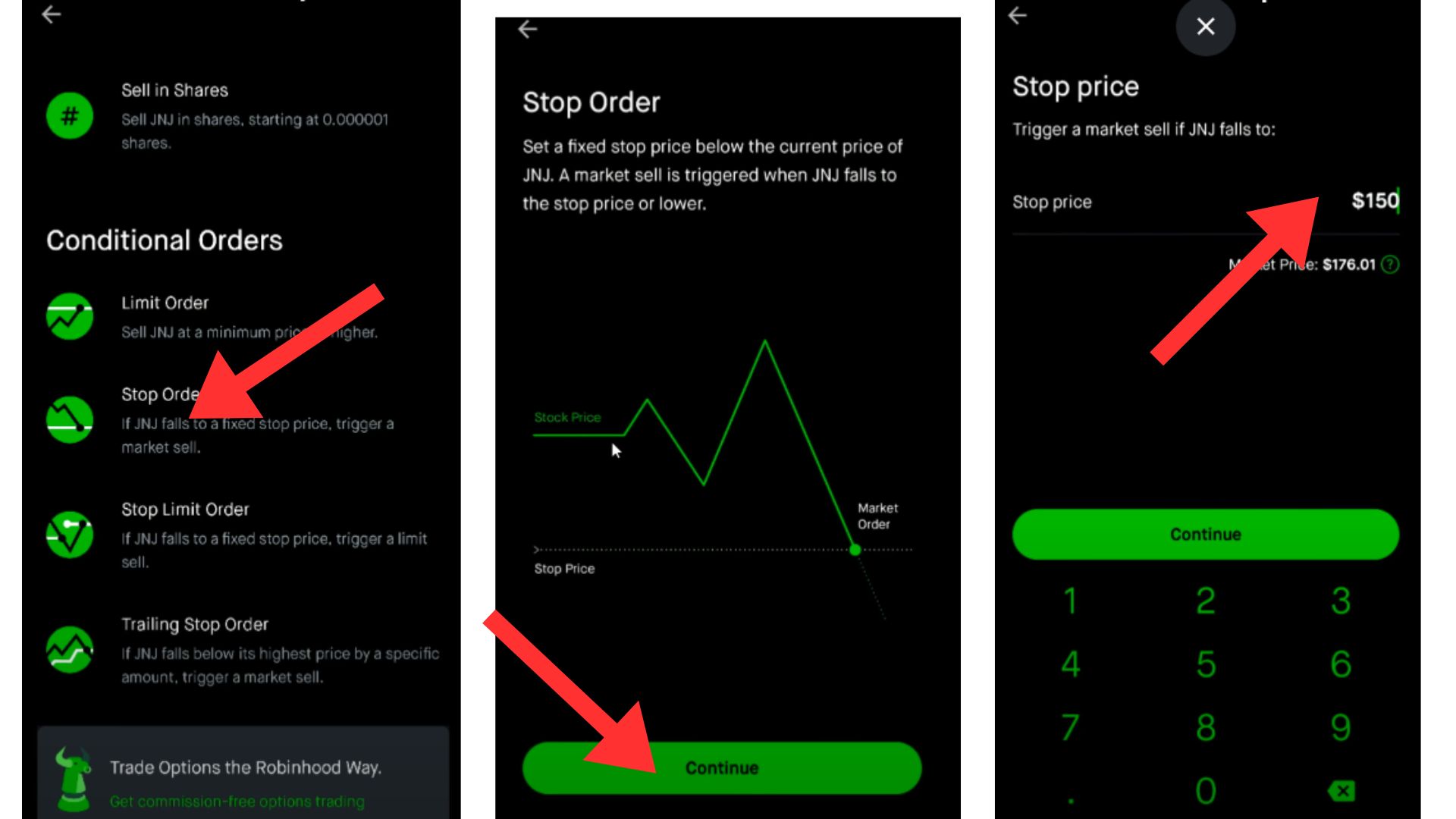

4. Configure Your Stop Loss

In the upper right-hand corner of the screen, you’ll see a dollar sign with a dropdown arrow. Click on it to reveal several options. Scroll down until you find “Conditional Orders,” and within that section, locate “Stop Order.” This is where you set up your stop loss.

Here’s a brief overview of what to do:

- Stock Price: The current market price of the asset.

- Stop Price: Set the price at which you want your stock to automatically sell. Ensure it’s below the current market price to trigger the sell order.

Click “Continue” to proceed.

5. Set a Time Frame

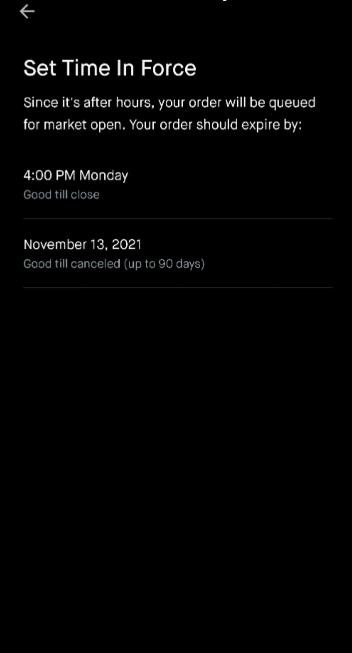

You have several options for setting the duration of your stop loss:

- One Trading Day: The stop loss will be active for a single trading day.

- Good Till Closed (GTC): The stop loss remains active until you manually choose to cancel it.

- Good Until Canceled (Up to 90 Days): Opt for this choice to maintain your stop loss order’s effectiveness for a maximum of 90 days.

Select your preferred time frame.

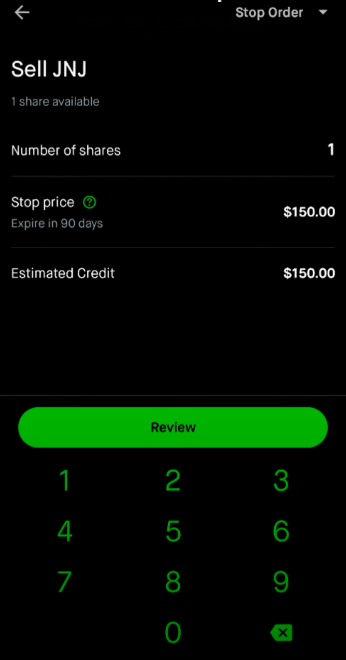

6. Specify the Number of Shares

Enter the number of shares for which you want to set the stop loss. Make sure it matches your current holdings.

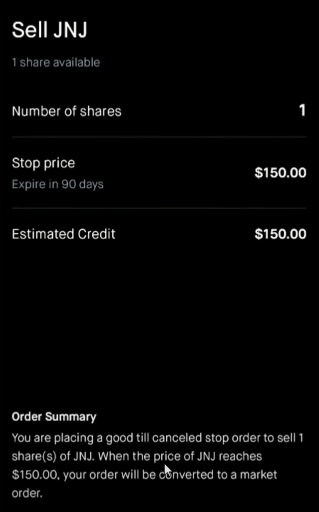

7. Review Your Order

Review the order summary that appears on the screen. It will confirm that you are placing a “Good Till Canceled” stop order to sell the specified number of shares when the price reaches your defined stop price.

8. Submit Your Stop-Loss Order

If everything appears correct and you are prepared to proceed, simply swipe up from the bottom to submit your stop-loss order.

Congratulations! You’ve successfully set up a stop loss on Robinhood to protect your investments. Now, if the stock price falls to your predetermined stop price, your order will automatically trigger a market sell, helping you limit potential losses. You can also take information about How To Use Robinhood App. It is useful information and a complete guide.

Frequently Asked Questions

Q1. What is a Stop Loss Order on Robinhood?

A stop loss order on Robinhood is an automated instruction to sell a specific stock when its price falls to a predetermined level. It’s a risk management tool that helps you limit potential losses in your investments.

Q2. Is There a Fee for Placing a Stop Loss Order on Robinhood?

No, Robinhood does not impose any fees for placing or executing stop loss orders. However, be aware of potential market order execution risks, which can lead to slight variations in the sell price.

Q3. Can I Modify or Cancel a Stop Loss Order on Robinhood?

Yes, you can modify or cancel a stop loss order on Robinhood as long as it hasn’t been triggered. Simply navigate to the order in your portfolio and make the necessary changes or cancel it altogether.

Q4. What Happens When My Stop Loss Order Is Triggered?

When your stop loss order is triggered, Robinhood will automatically convert it into a market order, and your shares will be sold at the prevailing market price. Keep in mind that the executed price might slightly differ from your stop price in volatile markets.

Q5. How Often Should I Review and Adjust My Stop Loss Orders?

The frequency of reviewing and adjusting your stop loss orders depends on your investment strategy and risk tolerance. Some investors check and update their stop loss orders regularly, while others do so periodically or when significant market events occur. Finding the right balance that aligns with your financial objectives and risk tolerance is crucial.

Conclusion

setting a stop loss on Robinhood application is a crucial step in managing your investments and mitigating potential losses. By following the easy-to-follow steps outlined in this guide, you can safeguard your portfolio and make more informed decisions. Remember to stay informed about market trends and explore additional resources to enhance your investment strategy. Happy investing!