Children Education Allowance, 7th CPC, 7th Pay Commission for Central Government Employee, Tax Benefits: The Central Government has started Children Education Allowance for all of its employees. Let’s inform you all that in our India, all Government employees are paying for the school and hostel expenses of their children. All of the facility will give below the Children Education Allowance [CEA]. There are several updates, features, and allowances for an academic wage below the CEA. It is a type of funding that is usually giving to all govt. An employee for the proper education and hostel facilities of their children. Along with that, it is essential to know that the total amount given below CEA for all differently-abled student is double than that of the average student. Here in this article, we will discuss everything related to the Children Education Allowance, 7th Pay Commission for all employees, benefit, etc. Interested applicants should read this article very carefully.

according to the scheme, the following rates were given to students:

| Name | Allowance | Details |

| Amount of Education | Rs.1,500 p.m | As Dearness Allowance [DA] getting higher, CEA will also be getting higher. |

| Subsidy of Hostel | Rs.4,500 p.m | As Dearness Allowance [DA] getting higher, then hotel subsidy will also be getting higher. |

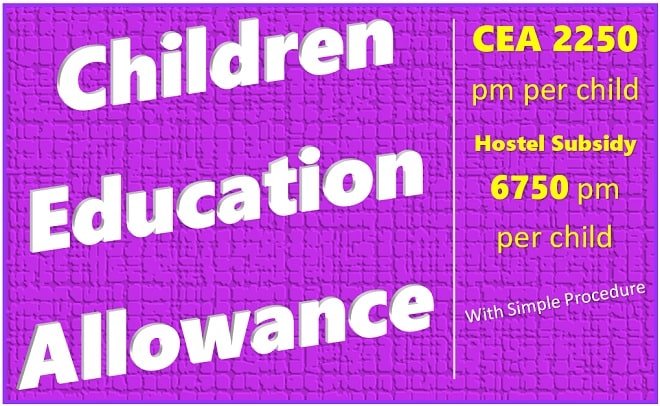

However, many people want to increase the process of reimbursement, scope, rates of allowances. Now, it shows that CEA will do according to the education cost. So, the refund will be as follows:

| Name | Allowance | Details |

| Amount of Education | Rs.2,250 p.m | As Dearness Allowance [DA] getting higher, CEA will also be getting higher. |

| Subsidy of Hostel | Rs.6,750 p.m | As Dearness Allowance [DA] getting higher, then hotel subsidy will also be getting higher. |

According to the government, recently CEA amount will give to all class 12 students. Government make sure that they will hike the availability of this scheme to postgraduate and graduate students. So, this is not acceptable as a type of studies at the level of graduate.

Also Read: One Time Grant For Media Personality Scheme

Process of Simplification

Let’s inform you all that the process of reimbursement has become one of the most critical factors from the years ago. There have been several cases where it becomes so essential for all of us. So, we must improve the reimbursement following several suggestions. Another factor behind this reimbursement is that disorientation of vouchers. By facing all of these issues, it has advised that the year-end will do the process of refund or when the education or academic year ends.

It is required to issue the reimbursement certificate from the head of the school principal. It shows the year of admission to your child. Not only this, it is essential for all to have the certificate for getting hotel subsidy. It is also getting issue from the head of your school principal. The low amount of allowance will give to the parent.

Let’s inform you all that the CEA scheme has become the most significant support to all 7th Pay Commission employees as they were getting this scheme for their children education. Recently, it is giving to only two children of an employee having studied in a recognized college or school.

Tax Benefits Claim procedure on Children Educational Expenses

Here we will discuss the different ways to claim tax benefit for all children educational expenses. For this, everyone has to defer the issued receipt from the particular institution at the employer financial year. This type of declaration should be done according to the Form 12BB before deliver the investment proof till the year-end. All self-employed employees will be able to claim this deduction of tax below the VI-A schedule from submitting the fees.

Also Read: PM eVIDYA

Important Note: Everyone of you should know the fact that tuition fees and education allowances are two different things, and can be claimed differently for getting the benefit of tax. The Children Education Allowance is a tax-exempt below the section of 10(14), and tuition fees is a tax-deductible below the area of 80C (IT Act) (1961).

Tax Dispensation on Education and Hostel Expenditure

In our country India, like we all know the fact that all people who are working on the salary basis should get Children Education Allowances in their salary only and are admit to claiming the tax exemption on following:

Children Education Allowance: In this Allowance, every employee will get a fixed allowance of education from the employer that is tax-exempt of near about Rs. 100/- p.m for per child. The maximum child is only two.

Hostel Expenditure Allowance: In this Allowance, hostel fees will be paid from tax up to three thousand rupees p.m per child. The maximum child is only two.

Tuition Fee Payment Deduction

Not only Children Education Allowance, but every government employee has also claimed for the tax deduction of the tuition fee. This payment will be made through the child education expense of the commercial year for only two children.

Let’s inform you all that the tuition fee should pay during the admission time to a college, university, or school of India for the intention of full-time education claim of tax deduction below the section of 80C. The main advantage of the tax deduction on the payment of tuition fee should make available to all self-employed or salaried employees.

Remember that, below the provisions of section 80C, the benefit of tax deduction should seeing on a very high investment like PPF, life insurance premium, EPF, etc. It also includes the tuition fees along with the limit of cumulative of Rs. 1.5 Lakh.

I hope you will understand this article very well and are ready to take advantage of it. Suppose you face any problems related to the Children Education Allowance, 7th Pay Commission for all employees, benefit. In that case, you may ask your queries in the given comment box.

Frequently Asked Questions

Is this Children Education Allowance will provide to only Central Government Employees?

Yes, it is for only Government employees to get the benefit of Children Education Allowance.

Can we get the Tax Dispensation on both hostel and education allowances below this Government Scheme?

Yes, you will be able to get the Tax Dispensation on both hostel and education allowance below this Government Scheme.

How many rupees will give every month below the Education and Hostel Allowances?

On Children Education Allowance, every employee will get a fixed allowance of education from the employer that is tax-exempt of near about Rs. 100/- p.m for per child. On the other hand, In Hostel Allowances, hostel fees will be paid from tax up to three thousand rupees p.m per child.